The market lost over three percent and snapped a four-week winning streak in the week ended January 21 amid weak global cues and continued selling by foreign institutional investors (FIIs).

In the last week, BSE Sensex shed 2,185.85 points (3.57 percent) to end at 59,037.18, while the Nifty50 fell 638.55 points (3.49 percent) to close at 17,617.2.

On the sectoral front, BSE Information Technology index lost 6.5 percent, BSE Telecom index fell 5.8 percent and Nifty Pharma index shed 5.2 percent. However, the BSE Power index added 2.6 percent.

Among broader indices, the BSE Midcap index declined 4.3 percent, while Smallcap indices lost three percent after hitting a fresh high during the week.

The next week will be a truncated one as the Indian market will remain shut on January 26 for Republic Day.

“In the coming week, the domestic market is expected to remain highly volatile with investors awaiting the budget,” said Vinod Nair, head of research at Geojit Financial Services.

“As recent earnings failed to excite the market, earnings outcomes in the coming week will be a key factor in determining investor confidence,” he added.

Here are 10 key factors that traders should watch out for in the truncated week:

Corporate earnings

Earnings will remain in focus as we enter into the last week of January. Those declaring results include Axis Bank, Larsen & Toubro, Marico, Cipla, Federal Bank, Maruti Suzuki India, Dr. Reddy’s Laboratories, Kotak Mahindra Bank, Punjab National Bank, and Bharat Heavy Electricals.

Others include Canara Bank, LIC Housing Finance, RBL Bank, Wockhardt, Bharat Electronics, Central Bank Of India, Chambal Fertilisers & Chemicals, D B Corp, Karnataka Bank, HDFC Asset Management Company, United Breweries, and Finolex Industries.

Other firms announcing there results are Suzlon Energy, Indusind Bank, Ramco Cements, SBI Cards and Payment Services, Steel Strips Wheels, NTPC, Indiabulls Real Estate, Pidilite Industries, Raymond, SRF, Torrent Pharmaceuticals, and United Spirits.

Coronavirus

The rising COVID-19 cases remain a concern. However, higher vaccination and lower need for hospitalisation have minimised the risk of the Omicron variant.

India reported 3.37 lakh (3,37,704) new COVID-19 cases in the 24 hours ending at 9 am on January 22, 9,550 lower than the previous day.

Maharashtra saw 46,393 new cases in a day to clock total active cases at 2,79,930.

FII selling

FIIs remained net sellers for the second consecutive week ended January 21.

They offloaded shares worth Rs 12,643.61 crore, while their local counterparts bought equities worth Rs 508.04 crore in the last week.

In the month till now FIIs have sold equities worth Rs 15,563.72 crore and locals have purchased shares worth Rs 7,430.35 crore.

IPO

Adani Wilmar is going to launch its initial public offer (IPO) on January 27. The issue will close on January 31.

Adani Wilmar is an equal joint venture between Adani Enterprises and Wilmar International, and the owner of the Fortune brand of edible oils.

It has set the price band for its public issue at Rs 218-230 per share, valuing the company at Rs 26,287.82 crore.

The firm has cut its IPO size to Rs 3,600 crore from Rs 4,500 crore and plans to list on February 8.

Kotak Mahindra Capital, JP Morgan India, BofA Securities India, Credit Suisse Securities India, ICICI Securities, HDFC Bank and BNP Paribas are the lead managers to the issue.

US Federal Reserve meeting

Investors will keep an eye on US Federal Reserve’s meeting on January 26, as they await clarity on interest rate hikes after US Treasury yields surged to a two-year high of 1.9% and crude oil price touched a more-than-seven-year high.

US Federal Reserve is expected to raise the interest rates by three times in 2022 with the first hike likely to be announced in March.

Crude oil

The sharp rise in the crude oil price also dented sentiments in the last week.

The Indian market remains under pressure as oil prices rose to more-than-seven-year high in the last week on possible supply disruptions after Yemen’s Houthi group attacked the United Arab Emirates, escalating hostilities between the Iran-aligned group and a Saudi Arabian-led coalition.

Technical view

Nifty formed a bearish candle on a weekly scale and wiped all its previous week’s gains. It negated its higher lows formation of the last three weeks and took a pause from positive momentum in the medium term perspective.

Now till it remains below 17,700, weakness could be seen at 17,500 and 17,350 whereas hurdles exists at 17,777 and 17,950 marks, said experts.

“Nifty is in the far end of the short-term correction and can attempt a bounceback. On the higher side, 17,700-17,800 is an immediate resistance zone,” said Gaurav Ratnaparkhi, head of technical research, Sharekhan by BNP Paribas.

“Once that is crossed, the index can test 18,000 on the upside. On the flip side, immediate support zone is at 17,600-17,500,” he added.

F&O expiry

The market may witness volatility ahead of monthly Future & Option expiry on January 27.

On the Option front, in monthly series Maximum Call OI (open interest) is at 18000 then 18500 strike while Maximum Put OI is at 17000 followed by 17500 strike.

Marginal Put writing is seen at 17500 and 17700 strike while meaningful Call writing is seen at 18000 and 17800 strike.

Option data suggests a wider trading range between 17300 and 18200 zones while immediate trading range is between 17450 and 17850 zones.

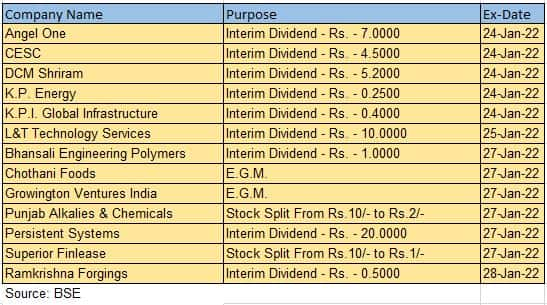

Corporate action

Here are key corporate events for the coming week:

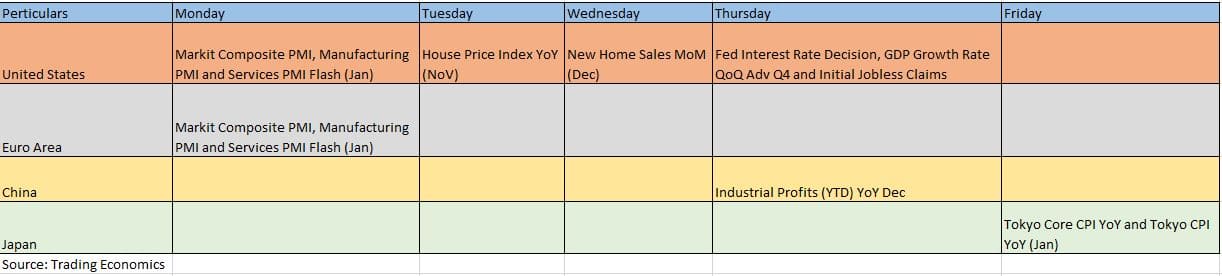

Global data points

Here are key global data points to watch out for the week:

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.