Economy

Updated : 2020-06-30 08:14:30

Indian shares are likely to open higher on Tuesday, in-line with the global peers along with the beginning of Unlock 2 phase in India. At 7:45 am, the SGX Nifty traded 55 points higher at 10,317.50, indicating a higher start for the Sensex and the Nifty50.

CNBCTV18.com

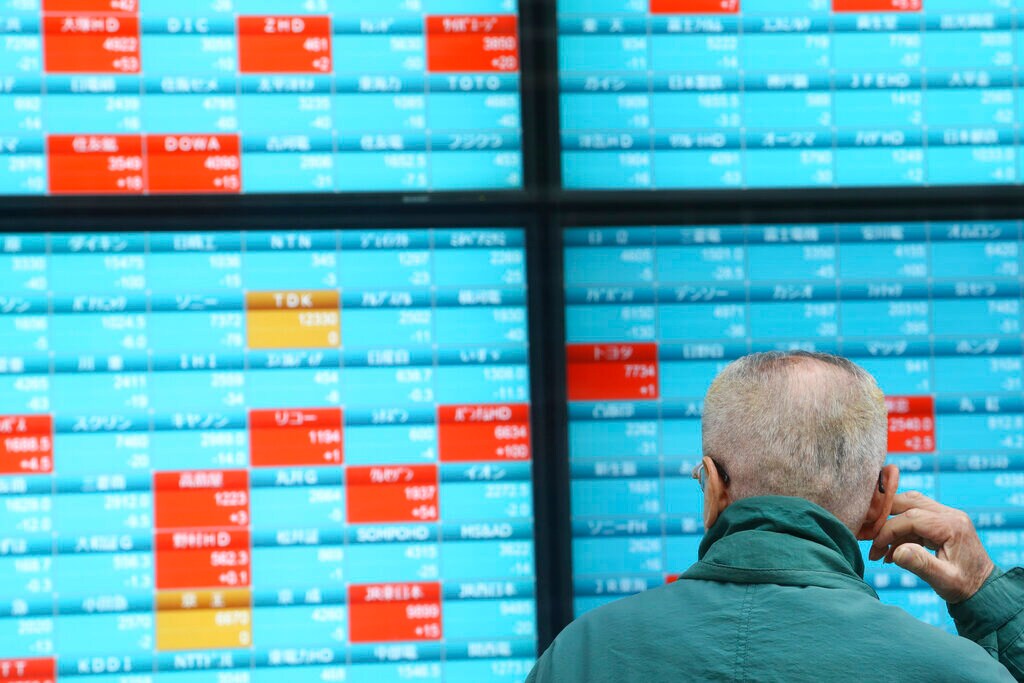

1. Asia: Stocks in Asia Pacific rose in Tuesday morning trade as China’s official manufacturing Purchasing Manager’s Index for June came in above expectations. The Nikkei 225 in Japan rose 1.85 percent in morning trade, following its more than 2 percent slide on Monday. The Topix index also added 1.37 percent. In South Korea, the Kospi gained 1.55 percent. Meanwhile, the S&P/ASX 200 in Australia added 1.66 percent. Overall, the MSCI Asia ex-Japan index traded 0.77 percent higher. (Image: AP)

2. US: U.S. stock futures rose slightly in overnight trading and pointed to gains at the open on Tuesday, the final trading day of a volatile month for stocks. Dow futures rose 20 points, or 0.2 percent. The S&P 500 and Nasdaq-100 were also set to open higher, with gains of 0.3 percent and 0.4 percent, respectively. On Monday, the Dow climbed 580 points, helped by a 14.4 percent gain in Boeing’s stock, as certification flights for the Boeing 737 Max began Monday. The S&P 500 also registered a gain, climbing 1.5 percent. (Image: Reuters)

3. Market At Close On Monday: Indian shares ended lower on Monday as a jump in coronavirus cases stoked fears of renewed restrictions that could hit business activities, dimming hopes of a quick economic recovery. The Sensex ended 210 points lower at 34,961 while the Nifty fell 68 points to settle at 10,315. Index heavyweights Infosys, RIL, Axis Bank and HDFC contributed the most to the losses. Broader markets also fell during the day with Nifty Midcap and Nifty Smallcap down 1.6 percent and 1.3 percent, respectively. (Image: Reuters)

4. Crude Oil: Oil prices rose about $1 a barrel on Monday, after bullish data from Asia and Europe, but investors are wary about sharp spikes in new coronavirus infections around the world. Brent crude rose 74 cents, or 1.8 percent, to $41.76 a barrel. U.S. crude gained $1.21, or 3.1 percent, to $39.70 a barrel. Brent is set to end June with a third consecutive monthly gain after the Organization of the Petroleum Exporting Countries and allies, known as OPEC+, extended its 9.7 million barrels-per-day (bpd) supply cut agreement into July. (Image: Reuters)

5. Rupee Close: Indian rupee ended higher at 75.58, amid selling seen in the domestic equity market. Forex traders said weak domestic equities, foreign fund flows and concerns over rising COVID-19 cases restricted rupee gains. It opened flat at 75.63 per dollar against Friday’s close of 75.64 and traded between 75.52-75.65. (Image: Reuters)

6. Govt Sets Up Panel To Reduce Import Of Aluminium: India has started mulling measures to reduce import of aluminium amid a spike in shipments of the metal from China. Ministry of Mines has constituted an Inter-Ministerial Committee (IMC) to analyse import curbs in aluminium and also propping up the domestic smelters of the metal to substitute overseas supply. The move comes amid rising border tensions between the two emerging Asian economies even as government departments in New Delhi are discussing possible measures to restrict “cheap” and “low quality” Chinese imports. (stock image)

7. Custom Inspection Norms For Top Importers Eased: A week since customs authorities started scrutinising consignments from China at all major ports, there appears to be some let up. Industry sources told CNBC-TV18 that top tier importers are being exempt from the 100 percent examination drive. This comes as a relief for firms like Toyota, Honda, Samsung, LG, HP and Siemens. Sources said importers who qualify as AEO-T3, are eligible for these relaxations. This relaxation, however, will do little to address the wider issue of Customs restrictions on Chinese imports. Only 11 out of the 3500-odd entities, registered under the AEO scheme, fall in the T3 category. (Image: Reuters)

8. RBI To Conduct Special Open Market Operations: The Reserve Bank of India (RBI) on Monday announced to conduct simultaneous purchase and sale of Government securities under Open Market Operations (OMOs) for an aggregate amount of Rs 10,000 crores each on July 2. The RBI will purchase four government securities with maturity ranging from 7 to 13 years using the multiple price auction method. Simultaneously, it will also sell securities with a maturity of 4 months to 10 months. Eligible participants should submit their bids/offers in electronic format on the Reserve Bank of India Core Banking Solution (E-Kuber) system between 10:00 am and 11:00 am on July 02. (Image: Reuters)

9. R Gandhi On Policy Revisit: Former RBI deputy governor R Gandhi on Monday said the central bank needs to relook at rules restricting large corporates from promoting banks and allow single entity to hold up to 26 per cent by having the necessary safeguards. He said the needs and aspirations of the Indian economy make it necessary to look at sources of large capital from entering the banking fray, so that large projects can be supported and also pitched for a renewed thrust to be given to the wholesale banks model. (Image: Reuters)

10. Exporters On Clearance Of Import Shipments From China: Seeking intervention of the commerce and finance ministries, exporters demand fast-tracking the clearance of containers coming from China and Hong Kong at all ports, saying delays impact their manufacturing operations. They claimed that at all airports and seaports, including Mumbai, Delhi, and Chennai, Indian customs are opening and checking all containers coming from these countries, which is causing inordinate delays in clearance of import consignments. “Domestic manufacturers who are importing their inputs of raw materials should get priority in clearance of containers. It should be fast tracked,” Federation of Indian Export Organisations (FIEO) Director General Ajay Sahai said. (Image: Reuters)