Economy

Updated : 2020-09-17 08:52:46

The Indian market is likely to open lower on Thursday following losses in global markets after the US Federal Reserve’s policymaking committee indicated the overnight rate could stay close to zero for years to reach its 2% inflation target. At 7:20 am, the SGX Nifty was trading 29.00 points or 0.25 percent lower at 11,572.00, indicating a negative start for the Sensex and Nifty50.

CNBCTV18.com

1. Asia: Stocks in major Asia-Pacific markets mostly traded lower Thursday morning as investors react to overnight developments from the U.S. Federal Reserve.Japan’s Nikkei 225 slipped 0.14 percent in early trade while the Topix index hovered above the flatline. South Korea’s Kospi shed 0.18 percent. In Australia, the S&P/ASX 200 traded slightly lower. Overall, the MSCI Asia ex-Japan index shed 0.13 percent, reported CNBC International. (Image: Reuters)

2. US: U.S. stock futures were flat on Wednesday night as traders digested the Federal Reserve’s pledge to keep rates low over the next few years. Dow Jones Industrial Average traded just below the flatline. S&P 500 and Nasdaq 100 futures were also little changed. Members of the Federal Open Market Committee indicated the U.S. overnight rate could stay anchored to the zero-bound through 2023 as the central bank tries to spur inflation, reported CNBC International. (Image: AP)

3. Market At Close On Wednesday: The Indian benchmark equity indices, Sensex and Nifty ended higher Wednesday led by gains in pharma, auto and realty stocks amid strong global cues. The Sensex ended 258.50 points or 0.66 percent higher at 39,302.85 while the Nifty gained 82.75 points or 0.72 percent to settle at 11,604.55. Broader indices ended mixed with Nifty Smallcap100 ending flat while Nifty Midcap100 gaining 0.3 percent. Rally in heavyweights such as M&M, Bajaj Finance, Bajaj Auto, Infosys, among other lofted Nifty above 11,600 levels. (Image: Reuters)

4. Crude Oil: Oil prices were mixed in early trade on Thursday, just clinging to overnight gains, as concerns about weak fuel demand were in the frame again after Hurricane Sally blasted through the Gulf of Mexico into the southeastern United States. U.S. West Texas Intermediate crude futures were flat at $40.16 a barrel at 0118 GMT, after jumping 4.9 percent on Wednesday. Brent crude futures gained 5 cents, or 0.1 percent, to $42.27 a barrel, after climbing 4.2 percent on Wednesday, reported CNBC International. (Image: Reuters)

5. Rupee Close: The Indian currency ended higher on Wednesday amidst positive equity markets. The rupee ended at 73.52 against the US dollar as compared to the previous close of 73.64. (Image: Reuters)

6. Govt On Attracting Investments: As India looks to attract more investments, the government is giving a leg-up to specific sectors such as textiles, start-ups, steel and agricultural exports. Sources told CNBC-TV18 that a secretaries’ panel on commerce and industries, headed by Commerce Secretary Anup Wadhawan in a recent meeting, provided a detailed update to the Prime Minister’s Office (PMO) and Cabinet Secretary on vision 2020 with regards to these sectors. According to the panel, the expenditure finance committee is working on setting up seed funding and credit guarantee scheme for start-ups – which are at an advanced stage. “The government has released Rs 1,200 crore for start-ups under the fund of funds scheme,” sources said. The fund of funds scheme was approved by the government to promote start-ups, under which a sum of Rs 10,000 crore will be provided to start-ups by 2025. (Image: Reuters)

7. Finance Minister On Banking Regulation Changes: Finance Minister Nirmala Sitharaman on Wednesday said amendments to the banking regulation law seeking to extend the supervision of RBI to cooperative banks are aimed at improving their governance and protecting depositors’ money. Moving the Banking Regulation (Amendment) Bill, 2020 in the Lok Sabha, Sitharaman said the government was compelled to come out with an ordinance during the lockdown period as the condition of the cooperative banks was “grave”. Gross non-performing assets (NPAs) of cooperative banks increased from 7.27 per cent in March 2019, to over 10 per cent by March 2020, she said, adding as many as 277 urban cooperative banks have reported losses in 2018-19 fiscal. (Image: PTI)

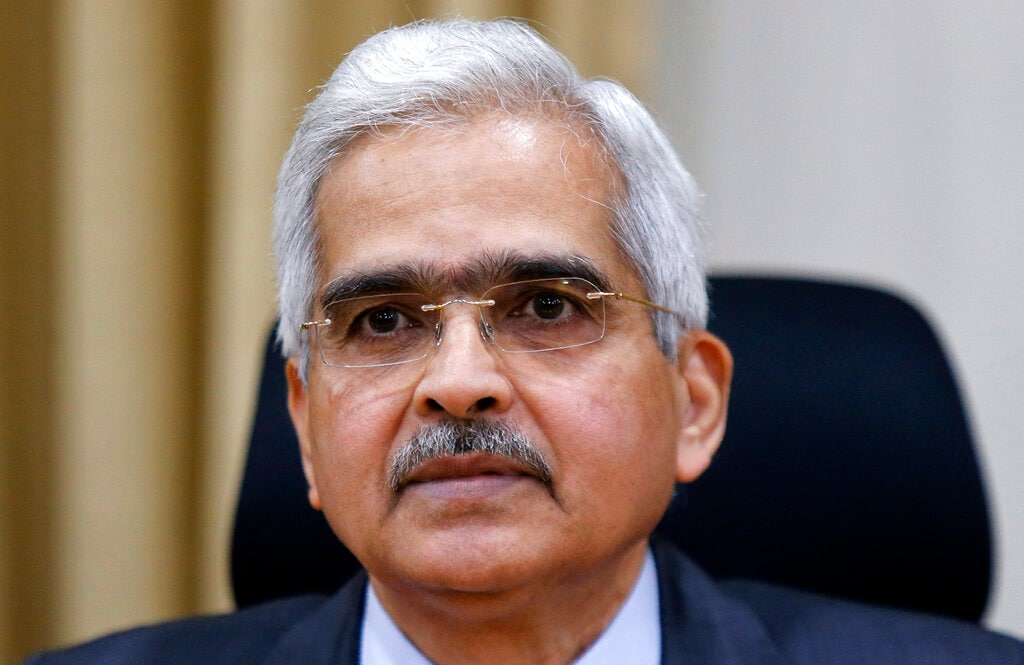

8. RBI Governor On Economic Recovery: India’s Gross Domestic Product (GDP) contracting by 23.9 percent in the first quarter of the year was a telling reflection of the ravages of COVID19, Reserve Bank Governor Shaktikanta Das today said. While agricultural activity, private estimates for employment and the manufacturing Purchasing Managers’ Index (PMI) point to some stabilisation in the second quarter, Das said that recovery is not yet fully entrenched. “In some sectors, upticks in June and July appear to be levelling off. By all indications, the recovery is likely to be gradual as efforts towards reopening of the economy are confronted with rising infections,” the governor noted in his remarks at the FICCI National Executive Committee Meeting on Wednesday morning. (Image: AP)

9. Direct Tax Collections Slip: At a time when India GDP growth contracted by 23.9 percent in the first quarter, the direct tax collection is not something to write home about. According to government sources, as per the initial estimates, the direct tax collection has shown a decline of 22.5 percent. This as income tax department received the second installment of advance by September 15. CNBC-TV18 has learnt that tax collections between April and September 15 have come in at about Rs 2.53 lakh crore versus Rs 3.27 lakh crore collected during the same period last year. Looking at the top regions, it was only Bangalore that could clock in some growth, of 9.9 per cent in collections, recording tax collections of Rs 40,665 Cr during April-15th September vs Rs 36,986 Cr during the same period last year, sources said. (stock image)

10. Bank of America Survey On Fund Managers: Following a historic rally from March lows, Bank of America Securities’ latest Fund Manager Survey showed that a majority of the respondents believed a new bull market had started. The survey, conducted between September 3 and 10, involved 224 managers with assets worth $646 billion under management. Around 58 percent percent managers said that the market is bullish, compared to 25 percent in March. However, 29 percent were of the view that the market is still bearish. While 41 percent of those surveyed said that COVID-19 vaccine could trigger higher bond yields, 37 percent said that inflation would be responsible for higher bond yields. (stock image)