The price tag on the second-largest cement player may weigh heavily on the combined entity

Adani’s acquisition is the most expensive M&A in the cement sector in recent years. (Photo by Rodolfo Quirós/Pexels)

Adani Group is making its largest acquisition by value ever. It will be spending $10.5 billion (including the open offer to buy 26% from public shareholders) to buy Ambuja and ACC.

Here are some of the key figures on the combined entity, how its pricing looks from a historical perspective, and on the consolidation that has taken place in the industry.

The information has been sourced from a Jefferies report on the buy.

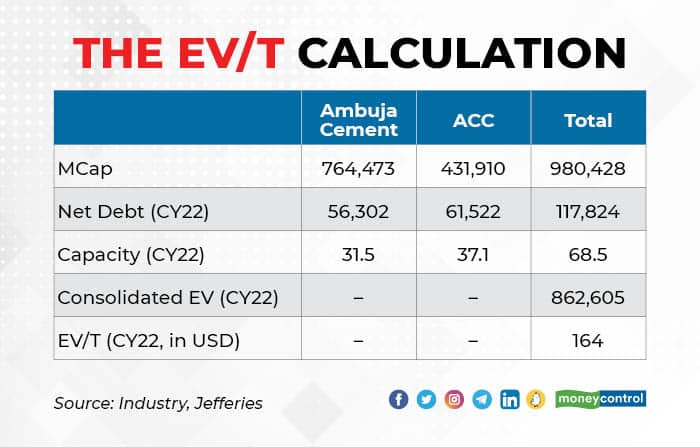

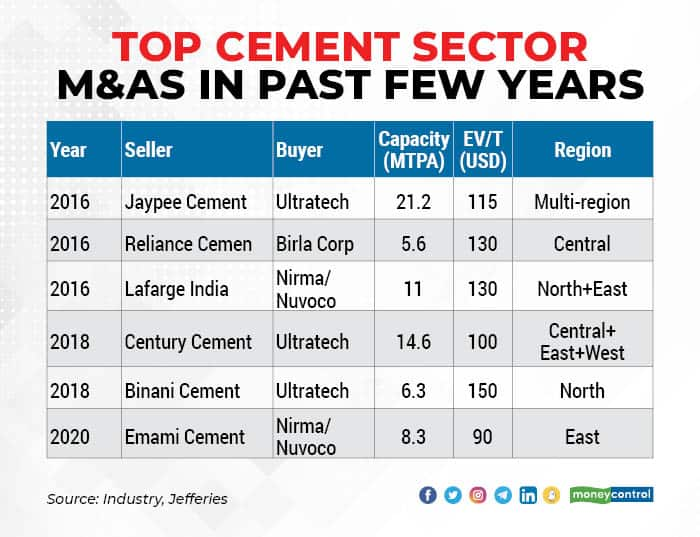

The EV/tonne for CY22 is $164 which is way higher than what Ultratech Cement paid for Binani Cement in 2018, which was an EV/tonne of $150.

Graphics by Rajesh Chawla

Graphics by Rajesh Chawla

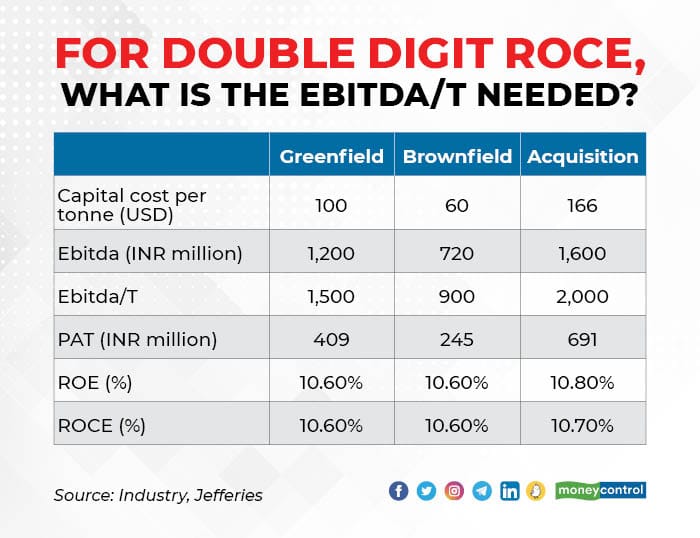

At this valuation, the new entrant will have to stick to the premium end of the market to make ROE and ROCE in the double digits.

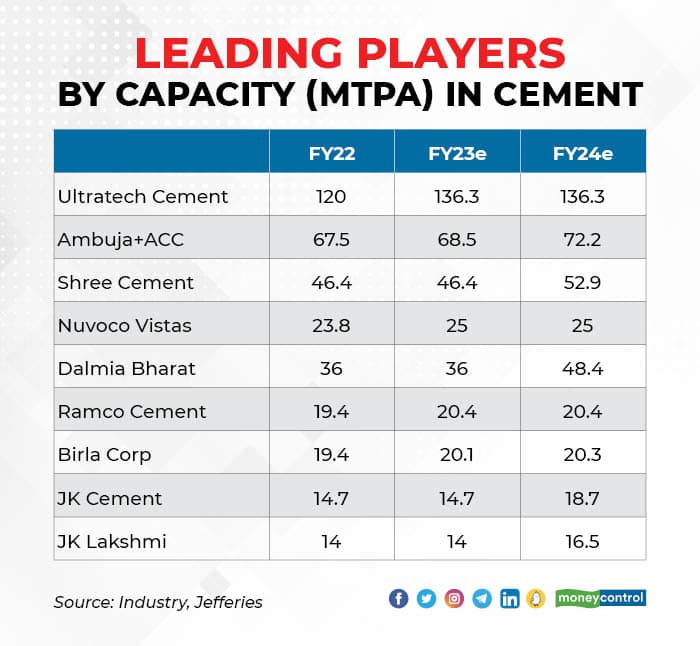

The industry will now clearly be dominated by two players.

Adani Group’s cement company will become the second-largest player in the sector, with half the capacity of the leader Ultratech Cement and with 43% more capacity than the third-largest Shree Cement.

Consolidation in the industry started nearly two decades ago, when foreign players such as Holcim and Lafarge began buying stakes in businesses here. A decade later, domestic players started buying stakes in local competitors too.

Adani’s acquisition is the most expensive M&A in the cement sector in recent years, and is the largest such transaction in the infrastructure and materials space.

Download your money calendar for 2022-23 here and keep your dates with your moneybox, investments, taxes