Stocks In News: Check out the companies making the biggest headlines before the opening bell.

Avenue Supermarts: Its standalone revenue from operations stood at Rs 5,031.75 crore in Q1FY22, increasing from Rs 3,833.23 crore in the corresponding quarter of last fiscal. The total number of stores as of June 30, 2021 stood at 238.

HDFC: HDFC Investments Limited, a wholly owned subsidiary of the Corporation, had agreed to sale its entire stake of 7,960 Ordinary Class B shares of par value USD 1 each of India Asset Recovery Management Limited, a company situated in Mauritius, representing 19.9% of the issued and paid-up capital of IARM and that the said transaction would be completed within a period of 10-12 months. HDFC Investments has concluded the sale of 7,960 Ordinary Class B shares to WL Ross & Co. LLC and/or its affiliates for a total consideration of USD 1,29,663.23 equivalent to Rs 96.94 lakh.

HCL Technologies: The company announced a multi-year agreement with Fiskars Group, consisting of a family of lifestyle brands including Fiskars, Gerber, Iittala, Royal Copenhagen, Waterford and Wedgwood, for digital transformation.

India Pesticides: India Pesticides will list its equity shares on the bourses on July 5, the final price has been fixed at Rs 296 per share.

Wonderla Holidays: Wonderla Resort in Bangalore is all set to reopen its business from July 5, 2021 with a 50% capacity as a crowd control measure.

CSB Bank: Total provisional deposits in June quarter 2021 at Rs 18,652.80 crore increased by 14.17% YoY, and gross advances grew by 23.71% to Rs 14,146 crore including advances against gold & gold jewellery that increased 46.16% to Rs 5,617.68 crore YoY.

Udaipur Cement Works: CARE has upgraded the company’s credit rating for its various long-term borrowings by one notch to ‘AA’ (Credit Enhancement-CE)/Stable; from ‘AA-‘ (CE)/Stable, which is based on credit enhancement on the back of the corporate guarantee provided by the holding company, JK Lakshmi Cement for its borrowings.

Aarey Drugs & Pharmaceuticals: The company reported profit at Rs 1.4 crore in Q4FY21 against Rs 0.99 crore in Q4FY20, revenue rose to Rs 178.25 crore from Rs 110.68 crore YoY.

Nagarjuna Fertilizers and Chemicals: The company reported consolidated loss at Rs 218.99 crore in Q4FY21 against loss of Rs 134.15 crore in Q4FY20, revenue fell to Rs 401.06 crore from Rs 425.3 crore YoY.

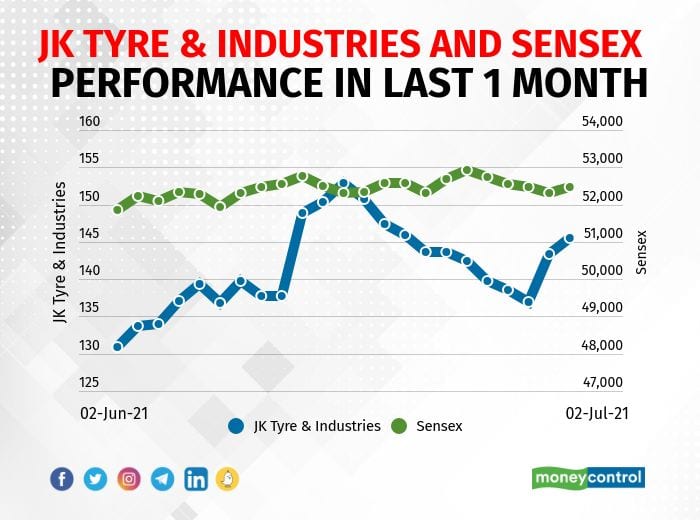

JK Tyre & Industries: CARE has upgraded the credit rating for long term bank facilities of JK Tornel Sociedad Anonima De Capital Variable, Mexico (a subsidiary of JK Tyre & Industries) to BBB+/stable, from BBB/Negative.

Uttam Sugar Mills: The company has successfully commissioned the distillery with 50 KLPD capacity at Libberheri unit.

Canara Bank: India Ratings has revised the bank’s outlook to Stable from Negative while affirming the Long-Term Issuer Rating at ‘AAA.’

Vodafone Idea: Telecom watchdog wants government to reject V! plea for deferring payments.

Indian Hume Pipe Company: The company has received the Letter of Acceptance for the work of about Rs 257.60 crore from Madurai City Municipal Corporation for dedicated water supply scheme for Madurai City Municipal Corporation for construction of distribution Network System (DI & HDPE), House service connections and Instrumentation for Madurai City Municipal Corporation added area-package-4. The project is to be completed within 36 months. The agreement will be signed in due course.

Vivimed Labs: Alpha Leon Enterprises LLP bought 4,22,237 equity shares in the company at Rs 22.65 per share on the NSE, the bulk deals data showed.

Pricol: Sunidhi Securities & Finance acquired 10 lakh equity shares in the company at Rs 94.05 per share on the NSE, the bulk deals data showed.

Mangalam Cement: Navodya Enterprises bought 1.5 lakh equity shares in the company at Rs 364.71 per share on the NSE, the bulk deals data showed.

Cupid: Equity Intelligence India bought 1,40,000 equity shares in Cupid at Rs 233.8 per share on the NSE, the bulk deals data showed.

Mohini Health & Hygiene: Plutus Capital Management LLP acquired 1.29 lakh equity shares in the company at Rs 20.41 per share on the NSE, the bulk deals data showed.

Moneycontrol News