The passenger vehicle segment continues to face a severe semi-conductor shortage thereby relating to lower retail sales

PV segment ended the year with a 10.91 percent YoY de-growth in terms of retail sales. The industry also had to face constrains in terms of high cost of ownership, dismal sentiments across the rural sector, the ongoing work from home culture and onset of Omicron variant that had a deep impact on sales.

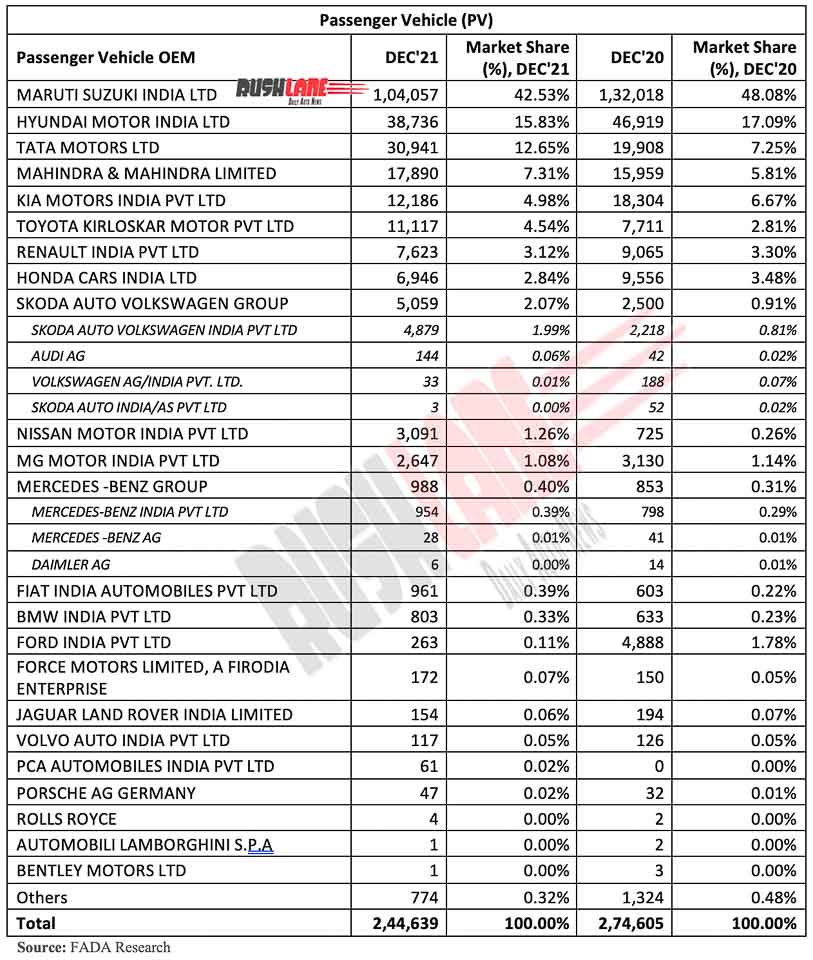

Federation of Automobile Dealers Associations (FADA), which collated data from 1,379 out of 1,590 RTOs across the country. It has released Passenger vehicle (PV) retail sales that fell last month to 2,44,639 units from 2,74,605 units retailed in December 2020. It was however, a growth of 11.77 percent over 2,18,881 units retailed in December 2019.

Not only the PV segment but two wheeler and tractor retails also dipped with total vehicle retail sales in India down by 16.05 percent in December 2021, to 15,58,756 units as compared to 18,56,869 units recorded in the same month of previous year.

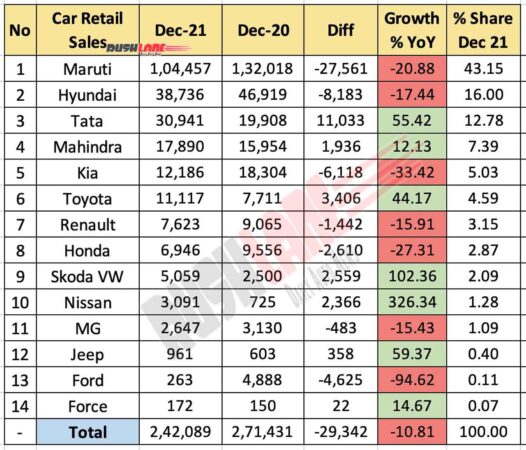

Car Retail Sales Dec 2021 – Maruti Commands 42.53% Market Share

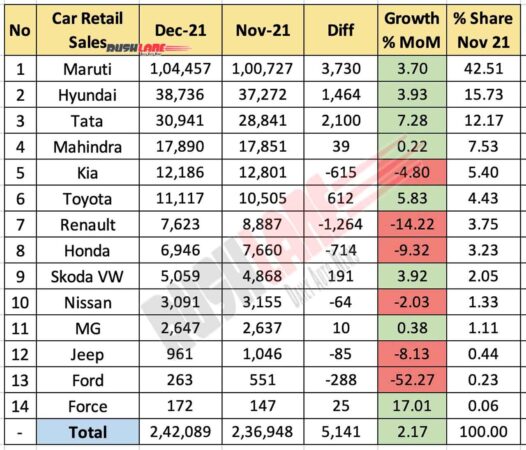

Maruti Suzuki commanded the list with a 42.53 percent market share down from 48.08 percent held in December 2020. Retail sales dipped to 1,04,057 units in the past month, down from 1,32,018 units sold in December 2020. Hyundai Motors India was in a second spot with a 15.83 percent market share and retails at 38,736 units, this was against a market share of 17.09 percent and retails of 46,919 units in December 2020.

Tata Motors had overtaken Hyundai in Dec 2021 wholesales. But in retail sales report, Tata Motors has not beaten Hyundai for the month and continues to be at No 3. Tata Motors has seen outstanding sales over the past month with strong demand for Nexon and recently launched Punch. Retail sales stood at 30,941 units with market share of 12.65 percent over 19,908 units retailed in December 2020 when market share was at just 7.25 percent.

Retail sales of Mahindra also increased significantly to 17,890 units with market share at 7.31 percent over 15,959 units sold in December 2020 when market share was at 5.81 percent. Mahindra has also seen increased demand for the new XUV700 and Thar even as the semi-conductor shortage has resulted in a long list of pending orders.

Kia, Toyota and Renault Retail Sales

Lower down the retail sales list as released by FADA was Kia, Toyota and Renault. Kia and Renault posted a YoY de-growth in terms of retails while Toyota sales increased to 11,117 units, up from 7,711 units sold in December 2020.

Toyota also reported a significant increase in market share which stood at 2.81 in December 2020 but increased to 4.54 percent in the past month. It was the Toyota Innova, Fortuner, Glanza and Urban Cruiser that contributed to these sales while the company expects better sales to come in from the Toyota Hilux which will be launching later this month.

Honda, Nissan, Ford Retail Sales

Even as Honda Car retail sales dipped to 6,946 units from 9,556 units sold in December 2020, it was the VW-Skoda Group that posted a two fold increase in retail sales. Sales which had stood at 2,500 units in December 2020 increased to 5,059 units last month thus bringing about an increase in market share to 2.07 percent.

Nissan India also posted a significant growth in retails to 3,091 units up from 725 units retailed in December 2020 while in the luxury segment, Mercedes Benz, Jeep India, BMW, Porsche and Rolls Royce also saw increased retails in December 2021.

Ford India, having announced its exit from the country, but select dealers continue to sell existing stock. Ford India retail sales for Dec 2021 were at 263 units – from 4,888 units sold in December 2020 while market share went down from 1.78 percent to 0.11 percent YoY.