Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Markets once again gyrated in a volatile trading session as investors are worried about the rising inflation and hawkish stance being undertaken by central banks world over.

Currently, the market is lacking conviction to bounce back although select bouts of recovery are not ruled out. Technically, after a sharp decline, the Nifty is consolidating in the range of 15700- 15850.

The short term formation is still on the weak side. And we are of the view that if the index slips below the level of 15700, it could hit 15600-15550 levels. On the flip side, 15850 would act as an immediate hurdle for the bulls. Above which it could move up to 15950-16000.

Ajit Mishra, VP – Research, Religare Broking:

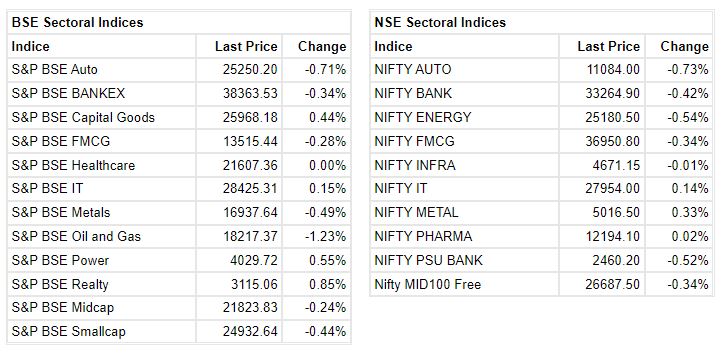

Markets ended marginally lower in a volatile trading session, in continuation of the prevailing trend. After the soft start, the benchmark made multiple attempts to recover but selling pressure in heavyweights capped the upside till the end. Eventually, the Nifty index ended lower by 0.3% to close at 15,732 levels. Meanwhile, the sectoral indices traded mixed, Oil & Gas, Metal and Auto ended with losses whereas Realty and IT ended with gains. The broader markets too ended with similar losses.

Markets are witnessing pressure ahead of the crucial US Fed meet outcome scheduled on Wednesday. Given the inflation data at a 40-year high in the US, expectations of 75 bps hike have increased.

We thus reiterate our cautious view on markets and suggest limiting leveraged position ahead of the event.

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities:

The Bank Nifty index ahead of the FOMC meeting is trading near a major make-or-break zone. The index is still trading in a downtrend and if fails to sustain the level of 33,000 on a closing basis will lead to further selling pressure.

The upside momentum to resume, the index has to close above the level of 34,000 where the height of open interest is built up on the call side.

Vinod Nair, Head of Research at Geojit Financial Services:

Domestic market restrained from heavy sell-off as CPI data moderated on MoM basis and this had a calm down effect amidst global volatility.

However, elevated WPI data continued to dominate the broad market, which is cautious awaiting tomorrow’s outcome of Fed policy.

Earlier the global market was anticipating a 50bps hike but now is worried about a higher rate hike due to persistent US inflation.

Rupak De, Senior Technical Analyst at LKP Securities:

The Nifty started the day on a negative note on Tuesday and remained mostly sideward during the day. On the lower end, it found support at the historical swing low and before closing a bit higher.

The daily RSI is in the bearish crossover. The trend is likely to remain sideward in the short term. On the lower end, support is visible at 15,650. On the higher end, resistance is placed at 15,900/16,000.

Rupee Close:

Indian rupee ended marginally higher at 77.99 per dollar versus Monday’s close of 78.03.

Market Close: Indian benchmark indices ended lower in the volatile session on June 14 with Nifty below 15,750.

At close, the Sensex was down 153.13 points or 0.29% at 52,693.57, and the Nifty was down 42.30 points or 0.27% at 15,732.10. About 1506 shares have advanced, 1730 shares declined, and 132 shares are unchanged.

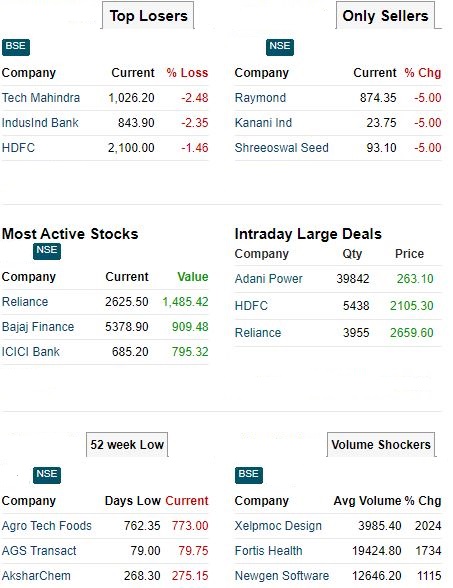

Bajaj Auto, IndusInd Bank, Hindalco Industries, ONGC and Tech Mahindra were among the top Nifty losers, while gainers were NTPC, M&M, Bharti Airtel, Apollo Hospitals and Divis Labs.

Among sectors, auto, metal and oil & gas ended in the red, while capital goods, power and realty indices ended higher.

The BSE midcap and smallcap indices ended marginally lower.

Bajaj Auto board defers share buyback planThe board of Bajaj Auto, which held a meeting on June 14, decided to defer the share buyback plan which was brought before it for consideration.The company, in a regulatory filing, said it will not move ahead with the proposed plan as of now as it requires “further deliberations”.

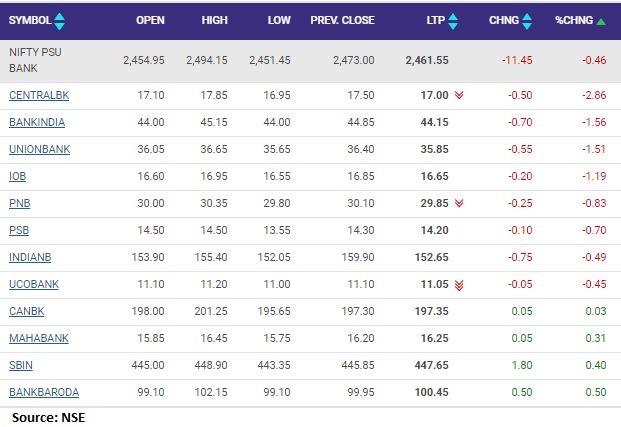

Nifty PSU Bank index shed 0.5 percent dragged by the Central Bank of India, Bank of India, Union Bank of India

Fitch expects RBI to raise interest rates to 5.9% by December-end

In its update to Global Economic Outlook, Fitch said India’s economy faces a worsening external environment, elevated commodity prices, and tighter global monetary policy.

Market at 3 PMBenchmark indices were trading lower in the final hour of trading with Nifty around 15700.The Sensex was down 185.99 points or 0.35% at 52660.71, and the Nifty was down 56.40 points or 0.36% at 15718. About 1404 shares have advanced, 1713 shares declined, and 117 shares are unchanged.

Today’s Stock Market Action