Deepak Jasani, Head of Retail Research, HDFC Securities

Nifty recovered from the early afternoon selloff on June 23 and closed higher despite fears of rising rates and recession across the globe. At close, Nifty was up 143.3 points or 0.93% at 15556.9.

Volumes on the NSE were in line with the recent average. Among sectors, Oil & Gas was the main loser while Auto, Realty, Capital Goods, Telecom, IT and Healthcare indices rose the most. Advance decline ratio jumped up to much above 1:1. Small and Midcap indices rose a little more than the Nifty.

Asian markets were mostly higher despite flat US markets overnight. European stocks retreated and bond yields tumbled as comments by Federal Reserve Chair Jerome Powell and growth data in Europe stoked fear about a global downturn. An indicator of euro-area economic activity fell to a 16-month low. US stocks are heading for their worst first-half losses since the 1970s.

Nifty seems to have made a higher bottom at 15385 and is now slated to make a higher high above 15,707. A downward breach of 15385 could lead to all bullish bets being taken off the table.

S Ranganathan, Head of Research at LKP securities:

Advancement of the southwest monsoon beyond the Eastern parts of the country coupled with a cool off in oil buoyed auto stocks today as they led the charge on the benchmark indices with good support from the IT stocks.

Engineering exports have looked up smartly in the first two months of the current fiscal bringing some cheer to the bulls in an environment which is devoid of positive newsflows.

Rupak De, Senior Technical Analyst at LKP Securities:

Nifty ended higher after a volatile trading session on the day of weekly expiry. On the daily chart, the Nifty registered a strong comeback after a day of decline in the previous session.

The daily RSI is in positive divergence. The trend is likely to remain positive in the near term.

Support on the lower end is placed at 15400; a close below 15400 may induce the resumption of a market sell-off. On the higher end, resistance is visible at 15600/15800.

Narendra Solanki, Head- Equity Research (Fundamental), Anand Rathi Shares & Stock Brokers

Indian markets opened on positive note following Asian market peers which were trading mostly green led by China. During the afternoon session markets trimmed some of their gains as European markets struggled to shrug off recession fears but managed to trade in green.

Buying in frontline stocks such as Maruti Suzuki, Asian Paints and Bharti Airtel were aiding sentiment, while selling in Power Grid, Titan Co and NTPC kept the gains in the markets in check.

Traders were encouraged as Prime Minister Modi said the government expects the Indian economy to grow by 7.5% this year. Additional support came with RBI data showing that the country’s foreign exchange reserves in nominal terms, including valuation effects, rose by $30.3 billion in 2021-22 fiscal against $99.2 billion expansion in FY2020-21.

Rupee Close:

Indian rupee ended marginally higher at 78.31 per dollar against Wednesday’s close of 78.38.

Market Close: Benchmark indices ended on positive note in the highly volatile session on June 23 with Nifty above 15,500.

At close, the Sensex was up 443.19 points or 0.86% at 52,265.72, and the Nifty was up 143.40 points or 0.93% at 15,556.70. About 2037 shares have advanced, 1188 shares declined, and 123 shares are unchanged.

Maruti Suzuki, Hero MotoCorp, Eicher Motors, M&M and Bajaj Auto were among the top Nifty gainers. The losers were Reliance Industries, Coal India, NTPC, Power Grid Corporation and Grasim Industries.

Auto Index rose 4 percent, while capital goods, Information Technology, pharma and realty indices up 1 percent each.

The BSE midcap and smallcap indices added 1 percent each.

Goldman Sachs View On UltraTech Cement

Research house Goldman Sachs has maintained buy rating on UltraTech Cement with a target at Rs 6,600 per share.

The company can continue to deliver solid volume growth and expect volume growth CAGR of 9-10% over FY23-FY25, said broking house.

The current correction in stock provides a good entry point.

The company is likely to emerge stronger in an uncertain & highly competitive environment, reported CNBC-TV18.

UltraTech Cement was quoting at Rs 5,416.20, up Rs 9.90, or 0.18 percent on the BSE.

BSE Midcap index added 1 percent led by the Oil India, Ashok Leyland, Nippon Life India Asset Management

Jefferies On Dalmia Bharat

Brokerage firm Jefferies has maintained buy rating on Dalmia Bharat but cut target price to Rs 1,600 per share.

The company expects cement demand CAGR of 9% over FY21-23, while unprecedented increase in input costs is a challenge for profitability.

The net debt turned negative for FY22, reported CNBC-TV18.

Dalmia Bharat was quoting at Rs 1,253.35, up Rs 6.15, or 0.49 percent.

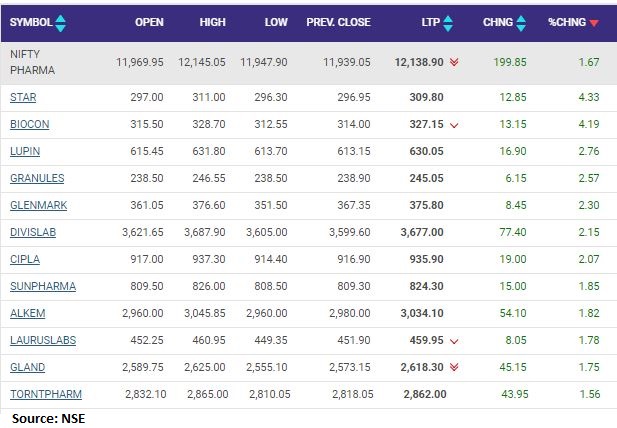

Nifty Pharma index rose 1 percent supported by the Strides Pharma Science, Biocon, Lupin

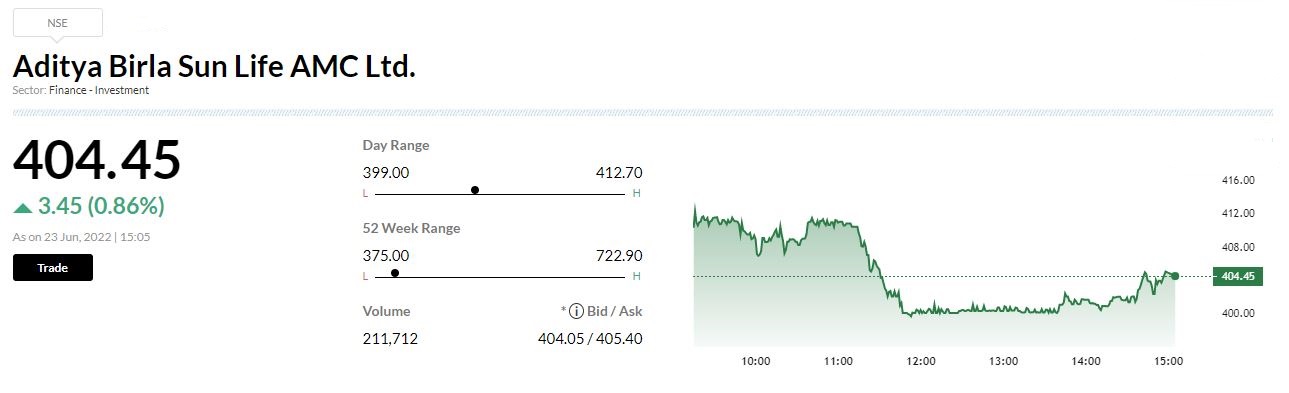

Citi On Aditya Birla Sun Life AMC Research firm Citi has initiated with a buy call on Aditya Birla AMC with a target at Rs 515 per share.It’s amongst leading AMCs in fixed income with over 10.5% market share and have potential to gain market share in equity on an improving investment performance.The Birla Group parentage gives AMC a strong brand & greater scope to cross-sell.At 20x FY23e P/E, stock looks more attractive than HDFC AMC’s 30x, reported CNBC-TV18.

Market at 3 PMBenchmark indices were trading higher in the final hour of the trading with Nifty above 15500.The Sensex was up 427.88 points or 0.83% at 52250.41, and the Nifty was up 143.00 points or 0.93% at 15556.30. About 1938 shares have advanced, 1155 shares declined, and 120 shares are unchanged.