Vinod Nair, Head of Research at Geojit Financial Services:

Domestic indices bounced back on a positive footing from the recent sell-off, due to strong momentum in global markets, favourable domestic economic data and good Q2 results announcement.

India’s manufacturing PMI increased to 55.9 in October from 53.7 in September as output and new orders improved amid easing Covid restrictions.

The sustenance of the trend will depend on the views provided by Fed regarding the current easy money policy to be announced on Wednesday.

Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments

The Nifty has risen smartly to get past the 17900 level. If we can keep above this level for a couple of trading sessions, the uptrend should resume and take the index higher.

On the downside, 17550-17600 has become a good support for the markets and until that does not break on a closing basis, it is safe to assume that the trend continues to remain on the upside.

Vijay Dhanotiya, Lead of Technical Research at CapitalVia Global Research:

The market witnessed some swift recovery from the support levels of 17600. Our research suggests, a significant breakout above the levels of 18000 could result in improvement of market breadth and market can rally till the levels of 18250.

We retain our cautious stance and advise the traders to refrain from building a fresh buying position, until we see further improvement and market sustain above 18000.

S Ranganathan, Head of Research at LKP securities:

The month began on a volatile note till the bulls wrested the initiative on the back of buoyant PMI data & GST collections for last month.

Despite the trends in e-way bills pointing towards higher GST collections in October ahead of festive demand, supply constraints in the automotive sector kept the street cautious.

Market Close: Benchmark indices ended higher with Nifty closing above 17900 supported by the rally in the metal, IT, realty stocks.

At close, the Sensex was up 831.53 points or 1.40% at 60,138.46, and the Nifty was up 258 points or 1.46% at 17,929.70. About 2099 shares have advanced, 1129 shares declined, and 186 shares are unchanged.

IndusInd Bank, Hindalco Industries, HCL Technologies, Bharti Airtel and Grasim Industries were among the major Nifty gainers. Losers included UPL, Bajaj Finserv, M&M and Nestle India.

All the sectoral indices ended in the green with metal, IT and realty indices up 2-3. BSE midcap and smallcap indices rose over 1 percent each.

Tata Motors total sales up 30% to 67,829 units in October

Tata Motors said its total wholesales increased by 30 percent to 67,829 units in October as compared with the same period last year.

The company’s total dispatches in October 2020 stood at 52,132 units.

The company’s domestic sales increased by 31 percent to 65,151 units in October as compared to the same month last year.

The company had dispatched 49,669 units in October 2020.

NMDC October production up 37% at 3.33 mt:NMDC in the month of October reported total production at 3.33 mt versus 2.43 mt, a growth of 37%, YoY.October sales were up 42% at 3.58 mt versus 2.52 mt, YoY.NMDC was quoting at Rs 145.85, up Rs 2.80, or 1.96 percent.

NCC receives one new order for Rs 442 crore in October 2021

NCC has received one new order for Rs 442 crore (exclusive of GST) in the month of October, 2021. This order pertains to Mining Division and is received from a State Government agency and does not include any internal order.

NCC was quoting at Rs 72.35, up Rs 1.10, or 1.54 percent.

Fino Payments IPO subscribed 78% on Day 2 of bidding

The initial public offering of fintech company Fino Payments Bank had been subscribed 78 percent by the afternoon of November 1, the third day of bidding, with investors putting in bids for 89.96 lakh shares against the IPO size of 1.14 crore shares.

The total offer size for public has been reduced to 1.14 crore equity shares from 2.09 crore shares after the company garnered Rs 538.78 crore from anchor investors on October 28.

Retail investors have bought 4.21 times the portion reserved for them, with employees bidding for 22,000 shares.

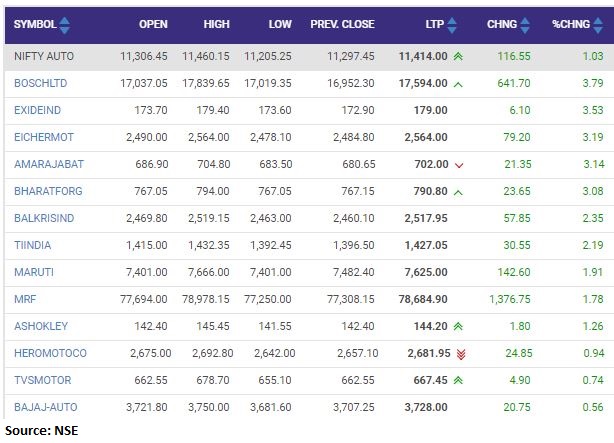

Nifty Auto index gained 1 percent supported by the Bosch, Exide Industries, Eicher Motors

Punjab & Sind Bank Q2

Punjab & Sind Bank has reported net profit of Rs 218.3 crore versus loss of Rs 401.3 crore and Net interest income (NII) was up 0.6% at Rs 617.1 crore versus Rs 613.4 crore, YoY.

Gross NPA was at 14.54 percent versus 13.33 percent and net NPA was at 3.81 percent versus 3.61 percent, QoQ.

unjab & Sind Bank was quoting at Rs 18.30, up Rs 0.50, or 2.81 percent.

October GST collections Rs 1.30 lakh crore:

Goods and Service Tax (GST) collections for October, the beginning of a demand-boosting festive season, came in at Rs 1.30 lakh crore, compared with Rs 1.17 lakh crore in September, indicating strengthening economic recovery in the second half of the fiscal year 2021-22.

October GST collections were not only the second highest for the fiscal year, but the second highest monthly collections since the introduction of the nationwide tax in 2017. The highest ever was also this year, at Rs Rs 1.41 lakh crore in April.

The October GST print takes total gross GST collection for the year to Rs 8.12 lakh crore. All but one month in the current fiscal year (June, Rs 92,849 crore) have been comfortably above the Rs 1 lakh crore mark.