Ajit Mishra, VP – Research, Religare Broking:

After a breather, bears took tight control over markets as it ended with sharp losses. The benchmark started on a muted note tracking weak Asian markets and further negative bias continued throughout the day as selling pressure widened in metals, media and energy.

Consequently, the Nifty ended lower by 1.44% at 15,413.3 levels. The broader markets, midcap and small-cap ended in-line with the benchmark. All the sectoral indices ended in the red.

On Thursday i.e.23th June, markets will first react to the Fed chairman speech scheduled tonight. Besides, progress on monsoon, crude price and currency movement will be key monitorable. We reiterate our cautious stance on the markets and expect volatility to remain high in the near term. Meanwhile, traders are advised to keep a hedge position while investors should focus on stock selection.

Deepak Jasani, Head of Retail Research, HDFC Securities:

Nifty on June 22 gave up almost all the gains made on the previous day. Asian shares were mostly lower Wednesday as markets shrugged off a rally in the US and awaited congressional testimony by Fed Chair Jerome Powell. European stocks hit fresh one-year lows on Wednesday as a fall in oil and metal prices hurt commodity-related stocks.

Markets have fallen sharply on below normal volumes, suggesting lack of adequate buying to offset the selling pressure. Now Nifty has support at 15293-15350 band while on upmoves, it could face resistance from 15565 and later 15670.

Rupak De, Senior Technical Analyst at LKP Securities:

Nifty slipped lower after a volatile trading session. On the higher end, 15500 remains a level of resistance. The trend is likely to remain weak as long as the Nifty remains below 15500. On the lower end, support is visible at 15300.

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Markets once again went into a plunge mode as panic-stricken investors taking cues from an early slump in European indices and weakness in other Asian gauges dumped equities, especially metal, power & realty stocks.

The market is currently in a very fragile mode as any signs of negativeness is prompting traders to exit stocks at will. Technically, the Nifty has also formed a bearish candle which suggests further weakness from the current levels.

On intraday charts, the index has formed non directional formation while the texture of the chart is suggesting that a range bound activity is likely to continue in the near future.

For traders, 15500 would act as an immediate resistance level, above which it could rally till 15600-15650. On the flip side, 15350 could be the key support level to watch out for. Below the same, the index could slip till 15250-15200.

Vinod Nair, Head of Research at Geojit Financial Services:

The short-lived pull-back rally displays the level of uncertainty in today’s market. The weakness of the global market due to quantitative tightening pulled the market down. The US Fed Chair’s testimony later in the day will be keenly watched for clues about the central banks’ future dot-plot.

Rupee Close:

Indian rupee ended at fresh record low. It has closed 3p paise lower at 78.38 per dollar against Tuesday’s close of 78.08.

Market Close: Benchmark indices ended lower on June 22 with Nifty around 15400 with selling seen across the sectors.

At Close, the Sensex was down 709.54 points or 1.35% at 51,822.53, and the Nifty was down 225.50 points or 1.44% at 15,413.30. About 1218 shares have advanced, 2025 shares declined, and 105 shares are unchanged.

Hindalco Industries, UPL, Tata Steel, JSW Steel and Wipro were among the top Nifty losers. The gainers were BPCL, Hero MotoCorp, TCS, Maruti Suzuki and Power Grid Corporation.

All the sectoral indices ended in the red with metal index down 5 percent.

The BSE midcap index fell 1.5 percent and smallcap index shed 1 percent.

Thyssenkrupp, Tata lose fight against EU veto of joint venture

Thyssenkrupp and Tata Steel lost their fight on Wednesday against a European Union antitrust veto of their proposed landmark joint venture three years ago, after Europe’s second-highest court rejected their arguments.

The companies had sought to tackle over-capacity and other challenges in the steel industry via the joint venture but the European Commission said the deal could result in price hikes.

The EU competition enforcer in its 2019 decision said the companies had not offered sufficient remedies to address such concerns, forcing it to block the deal and the companies to challenge the finding at the Luxembourg-based General Court.

CLSA View On IndusInd BankBroking house CLSA has maintained buy rating on IndusInd Bank with a target at Rs 1,060 per share.The company is back to improving growth trajectory and better placed on liabilities, as this cycle will be a true test.The asset quality worries are behind & credit costs to normalise from FY23.RoA getting back to 1.8%; and no capital raising plan in near-term, reported CNBC-TV18.

BSE Information Technology index fell 1 percent dragged by the Brightcom Group, Tanla Platforms, C.E. Info Systems:

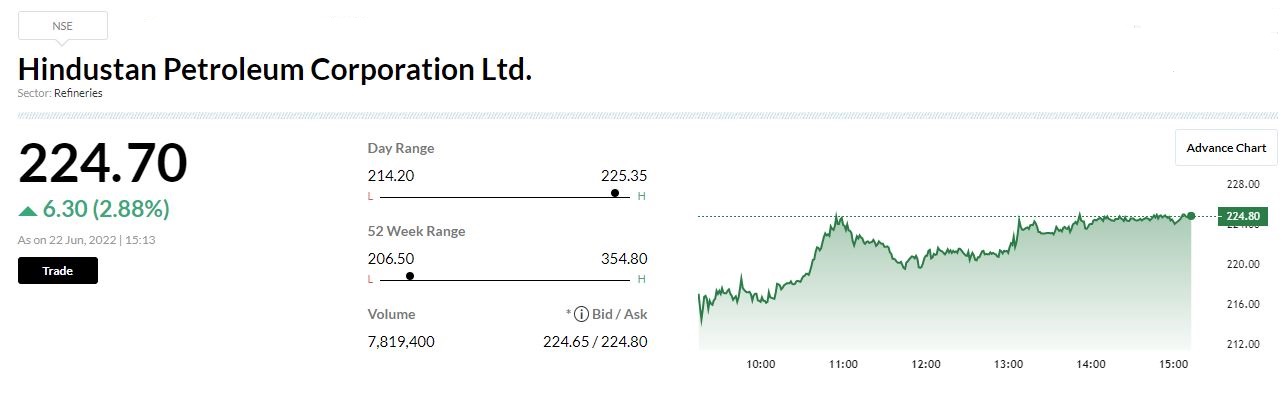

Moody’s affirms HPCL’s Baa3 rating with stable outlook, reported CNBC-TV18.

Oil slumps by around $5 as Biden calls for fuel tax cut

Oil prices tumbled on Wednesday amid a push by U.S. President Joe Biden to cut taxes on fuel to cut costs for drivers amid aggravated relations between the White House and the U.S. oil industry.

Brent crude futures were down $4.65, or 4.1%, at $110.00 a barrel while U.S. West Texas Intermediate (WTI) futures fell $5.08, or 4.6%, to $104.44 by 0918 GMT.