Heineken Acquires Additional 14.99% Stake In UBL

Heineken Acquires Additional 14.99% Stake In UBL” title=”

Heineken Acquires Additional 14.99% Stake In UBL” title=”Heineken Acquires Additional 14.99% Stake In UBL

“>

Heineken got an open offer exemption from SEBI to buy an additional 14.99 percent stake in the company from the Bangalore debt recovery tribunal.

Follow our LIVE blog for the latest updates on the novel coronavirus pandemic and its impact

Rahul Gupta, Head Of Research- Currency, Emkay Global Financial Services:

The USDINR spot is following the trend in dollar. Fed Powell downplaying the threat of tapering is not weighing on the spot, rather Fed rate hike worries has kept all the dollar bulls active. So until the spot tries above 73.75-73.80, it will remain afloat with immediate resistance around 74.50 and then 74.75 zone. While the major supports lies around 73.75-73.50-73.45.

Ashis Biswas, Head of Technical Research at CapitalVia Global Research:

The market witnessed a very volatile movement in the range of 15700-15850. It is suggested, trading above 15700 is positive from a short-term perspective. If the market closes below 15700, market expects a correction till the level of 15500. The technical indicator suggests, a volatile movement in the market in the range of 15500-15900. As such the traders are advised to refrain from building a fresh buying position until further decisive movement is seen in the market.

Rupee Close:

Indian rupee ended marginally higher at 74.28 per dollar, amid volatile trade saw in the domestic equity market.

Rupee opened 10 paise higher at 74.26 per dollar versus previous close of 74.36 and traded in the range of 74.16-74-39.

Market Close: In the volatile session on June 23, the benchmark indices ended near the day’s low with Nifty below 15700.

At close, the Sensex was down 282.63 points or 0.54% at 52306.08, and the Nifty was down 85.80 points or 0.54% at 15687. About 1335 shares have advanced, 1629 shares declined, and 116 shares are unchanged.

Adani Ports, Wipro, JSW Steel, Divis Labs and L&T were among major losers, while Maruti Suzuki, Titan Company, Bajaj Finserv, ONGC and M&M were among major gainers.

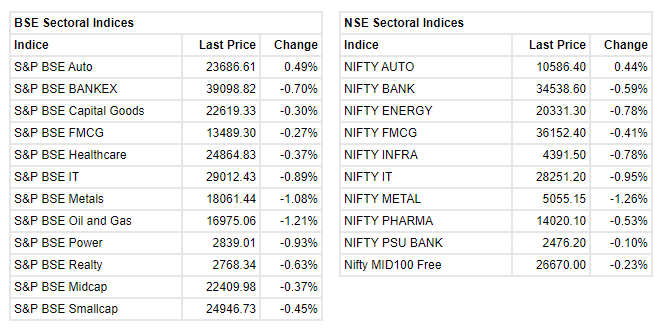

Except auto, all other sectoral indices ended lower. BSE Midcap and Smallcap indices ended in th

e red.

India Pesticides IPO subscribed 83% on day 1

The initial public offering (IPO) of India Pesticides has been subscribed 83 percent so far on June 23, the first day of bidding. The public issue of the agro-chemical manufacturer received bids for 1.6 crore equity shares against the IPO size of 1.93 crore equity shares.

The IPO size has been reduced by 81,08,107 equity shares to 1.93 crore equity shares after the company raised Rs 240 crore from anchor investors on June 22.

The portion set aside for retail investors has been subscribed 1.63 times and that of non-institutional investors 7 percent, the subscription data available on the exchanges showed. Qualified institutional investors have put in their bids yet.

Abhishek Bansal, Founder Chairman, Abans Group:

Fuel demand optimism is supportive for energy prices; WTI crude oil prices are trading firm for the last several months following global recovery in energy consumption post covid. WTI crude oil is now trading at $73.53 which is sharply higher from last week low of $69.77

WTI Crude oil price is likely to trade firm while above the key support level of 20 days EMA at $69.78 and 50 days EMA of $67.08, while it may find stiff resistance near $73.17-$74.69

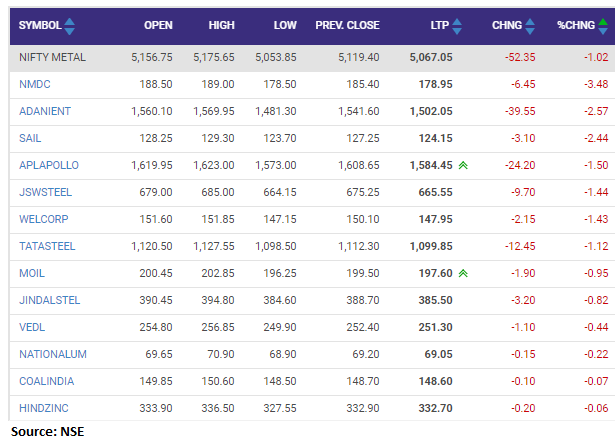

Nifty metal index shed 1 percent dragged by the NMDC, Adani Enterprises, SAIL, APL Apollo

Rupee Updates:

Indian rupee is trading marginally higher at 74.30 per dollar, amid volatile trade seen in the domestic equity market.

Rupee opened 10 paise higher at 74.26 per dollar versus previous close of 74.36.

Market at 3 PMBenchmark indices extended the losses and trading at day’s low with Nifty below 15700.The Sensex was down 290.30 points or 0.55% at 52298.41, and the Nifty was down 90.60 points or 0.57% at 15682.20. About 1389 shares have advanced, 1556 shares declined, and 116 shares are unchanged.

Yash Gupta Equity Research Associate, Angel Broking

Cipla announced that the company has received final approval for its Abbreviated New Drug Application (ANDA) for Arformoterol Tartrate Inhalation Solution from the United States Food and Drug Administration (US FDA). Cipla’s Arformoterol Tartrate Inhalation Solution is AN-rated generic therapeutic equivalent version of Sunovion Pharmaceuticals Inc.’s Brovana.

Brovana is a long-acting beta-2 adrenergic agonist indicated for administration in the maintenance treatment of bronchoconstriction in patients with chronic obstructive pulmonary disease (COPD), including chronic bronchitis and emphysema.

We believe that this is an important product approval for the Cipla limited and it will increase its exposure to USA sales from FY2022 itself as the product is ready to be shipped immediately. In the last 12 months, sales of Brovana are around Rs 438 million as per the IQVIA data and Cipla will launch the generic version of it immediately, so we expect Cipla to have a good opportunity to take market share for Brovana. We have a positive outlook for Cipla.