Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

The subdued mood in the market continued for the third straight session as investors preferred to liquidate their holdings in stocks which are still highly valued. Investors are also waiting for the US FOMC minutes that will provide some clarity on where the market could move in the near-term.

Technically, on intraday charts, from the last three days the Nifty is holding lower top formation. And on daily charts, it has formed a bearish candle which is broadly negative.

We are of the view that the short-term market structure is weak but it is in an oversold territory. For traders, now 16000 would act as a sacrosanct level. If the index succeeds to trade above the same, then it could move up to 16150-16260. However, below 16000 the selling pressure is likely to increase. Below the same, the chances of hitting 15900-15850/53300 would turn bright.

S Ranganathan, Head of Research at LKP securities:

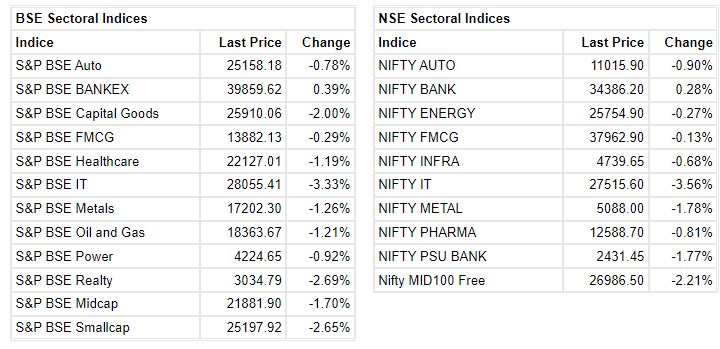

On a day when the Bank Nifty held steady, the other sectoral indices led by IT saw intense profit taking by FII’s with geo-political issues and supply-side disruptions taking centre-stage.

Declines outnumbered advances in the broader market even though measures to reign in inflation were taken to curb exports in sectors which have earned bumper profits.

A look at the Midcap & Smallcap100 Indices today is reflective of the damage done outside the benchmark indices.

Vinod Nair, Head of Research at Geojit Financial Services:

Domestic indices wavered tracking mixed sentiments from the global markets as investors assessed the possibility of a recession in the US followed by the Fed policy tightening.

Global markets are awaiting the release of the Fed minutes, which will be evaluated for details on the path of the upcoming rate hikes. In this whipsaw market, investors can resort to defensives & value stocks & sector.

Market Close: Benchmark indices ended lower for the third consecutive day on May 25 with Nifty below 16,100.

At close, the Sensex was down 303.35 points or 0.56% at 53,749.26, and the Nifty was down 99.40 points or 0.62% at 16,025.80. About 696 shares have advanced, 2548 shares declined, and 109 shares are unchanged.

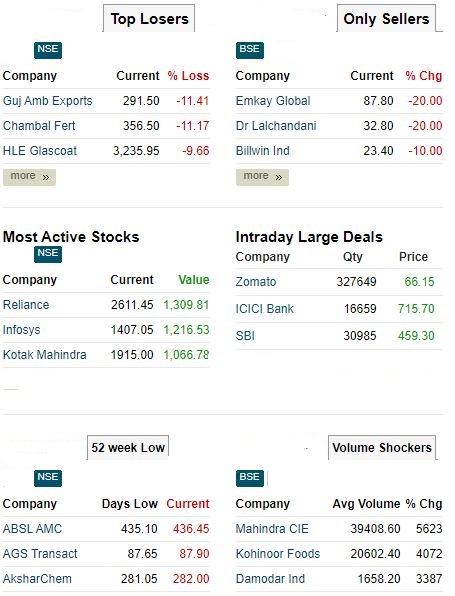

Asian Paints, Adani Ports, Divis Labs, UPL and TCS were among the top Nifty losers, while gainers included NTPC, HDFC Life, SBI Life Insurance, HDFC and Bharti Airtel.

Except bank, all other sectoral indices ended in the red with oil & gas, metal, pharma, realty, capital goods and IT index down 1-3 percent.

BSE midcap index shed 1.9 percent and smallcap index lost 2.9 percent.

Nifty Pharma index shed 0.7 percent dragged by the Granules India, Aurobindo Pharma, Divis Lab

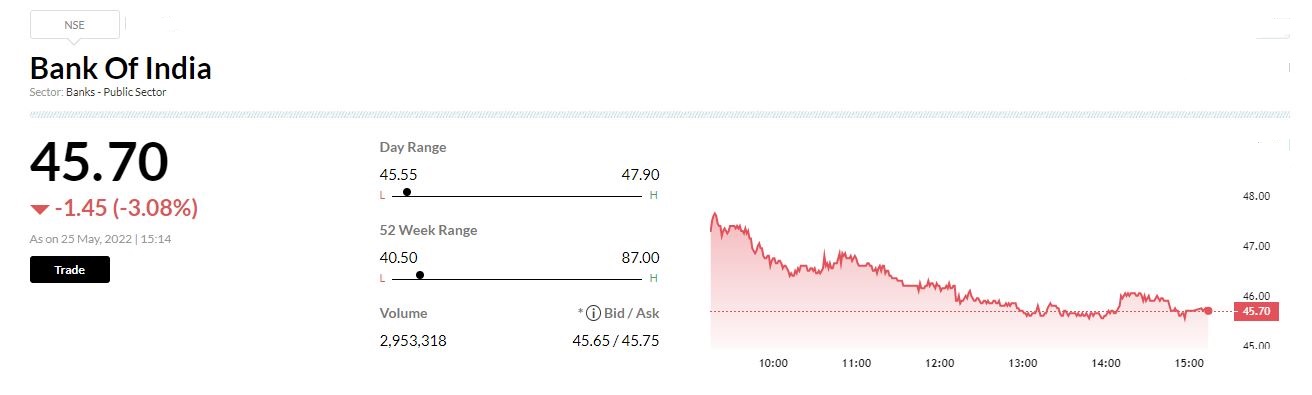

Morgan Stanley View On Bank Of India Brokerage firm Morgan Stanley has kept underweight rating on Bank Of India with a target price at Rs 49 per share.Its profit missed estimate owing to treasury losses & higher provisions, while healthy growth & NIM upturn led to a topline beat.The capital & asset quality are healthy.Weak profitability & overhang from increase in share count keep us underweight, reported CNBC-TV18.

Geojit View on JK Lakshmi Cements:

Demand outlook is positive given GoI’s strong focus on infra & Housing. The expansion of 2.5MT will support the future growth. The stock currently trades at 7x 1Yr Fwd EV/EBITDA.

Considering the current input price inflation, we value at 6x FY24E EV/EBITDA (3Yr Avg=7.4x) to arrive at a revised target of Rs 552 (earlier Rs 470).

Upgrade to Buy rating considering the capacity expansion and attractive valuation.

BSE Midcap index shed nearly 2 percent dragged by the JSW Energy, Macrotech Developers, IDBI Bank

Today’s Stock Market Action

Market at 3 PMBenchmark indices are trading lower in the final hour of the trade with Nifty around 16000.The Sensex was down 282.56 points or 0.52% at 53770.05, and the Nifty was down 93 points or 0.58% at 16032.20. About 620 shares have advanced, 2515 shares declined, and 85 shares are unchanged.

Credit Suisse says market to bottom out soon as double-digit earnings growth expected over next few years

The Credit Suisse report reiterates its overweight call on equities globally saying that there is extreme investor pessimism and their base case is not for the US or a global recession.

Gold prices dented by stronger dollar ahead of Fed minute

Gold prices fell on Wednesday as the dollar firmed in the run-up to minutes from the U.S. Federal Reserve’s May policy meeting, which could provide cues on its policy tightening path.

Spot gold was down 0.4% at $1,859.39 per ounce by 0820 GMT, after rising to a two-week high of $1,869.49 on Tuesday. U.S. gold futures dropped 0.4% to $1,857.80.

The dollar advanced after hitting its lowest level in a month in the previous session, making greenback-priced bullion more expensive for buyers holding other currencies.