Follow our LIVE blog for the latest updates on the novel coronavirus pandemic and its impact

Market Close: In the highly volatile session on April 19 the benchmark indices ended lower with Nifty finishing below 17,000 mark.

At close, the Sensex was down 703.59 points or 1.23% at 56,463.15, and the Nifty was down 215.00 points or 1.25% at 16,958.70. About 1111 shares have advanced, 2216 shares declined, and 118 shares are unchanged.

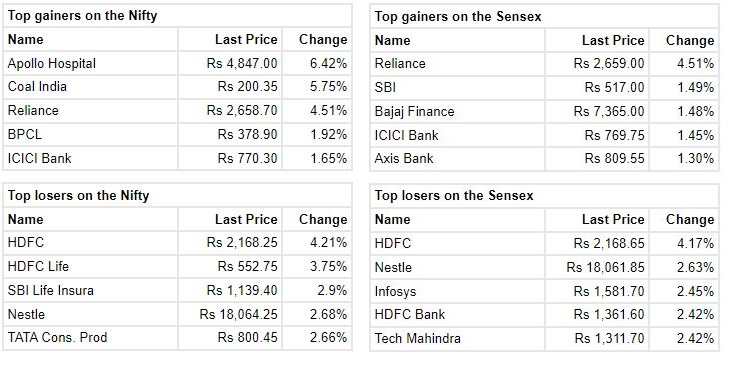

HDFC, HDFC Life, SBI Life Insurance, HDFC Bank and Tata Consumer Products were among the top Nifty losers. Apollo Hospitals, Coal India, Reliance Industries, ICICI Bank and BPCL were the top gainers.

Among sectors, except oil & gas all other indices ended lower with IT, power, realty and FMCG indices down 2 percent each.

BSE midcap and smallcap indices lost a percent each.

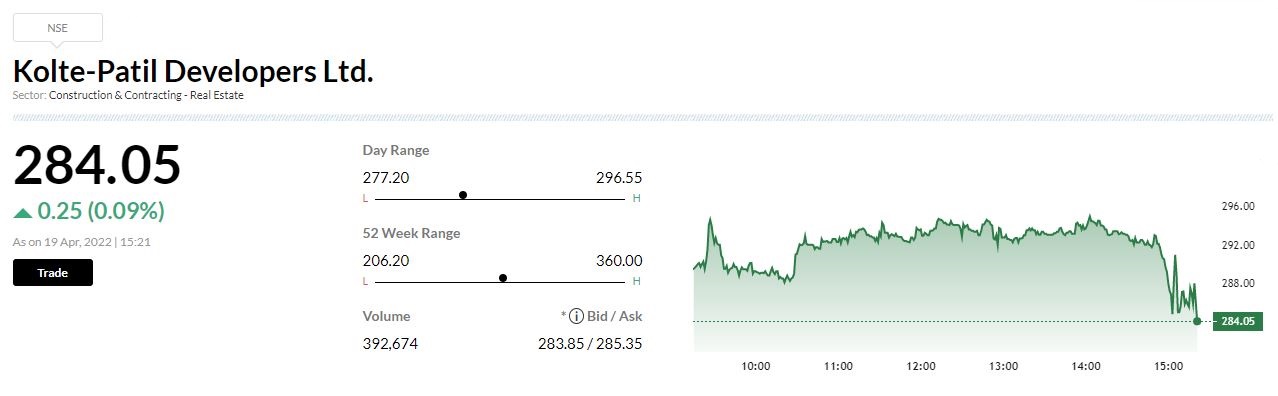

Kolte-Patil Developers Business Updates:Kolte-Patil Developers achieved sales value of Rs 1,739 crore in FY22, up 45% YoY, which is by far the highest ever recorded by the company.Sales Volumes of 2.71 million sq. ft. in FY22 saw significant uptick compared to FY21 (2.08 million sq. ft.) and FY20 (2.51 million sq. ft.)Substantial improvement in APR during FY22, driven by firm realizations in project sales across Pune and Bengaluru markets as well as 26% contribution to sales value from Mumbai, company said in its press release.

Morgan Stanley view on Mindtree:

The research house Morgan Stanley has kept an equal-weight rating on Mindtree and cut the target price from Rs 5,100 to 4,450 per share.

The results were in line with constructive management commentary.

Despite volatile macro, street EPS estimates appear achievable, reported CNBC-TV18.

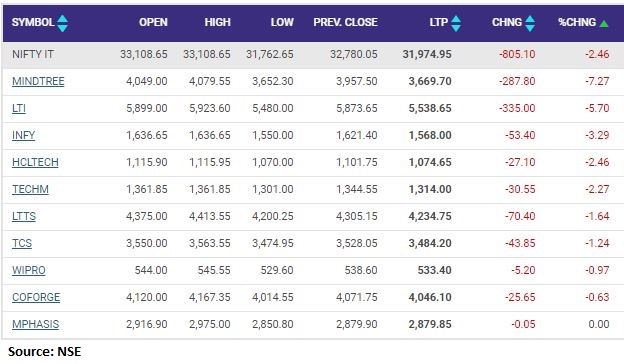

Nifty IT index shed 1 percent dragged by the Mindtree, L&T Infotech, Infosys

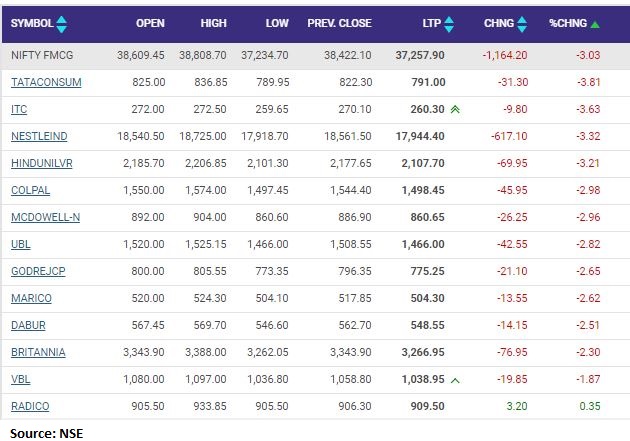

Nifty FMCG index fell 1 percent dragged by the Tata Consumer Products, Nestle India, ITC

BSE Energy index hits fresh high:

Gaurang Somaiya, Forex & Bullion Analyst, Motilal Oswal Financial Services:

Dollar index in the last few sessions has been inching higher on back of prospects that the Federal Reserve could adopt to a more aggressive rate hike process than estimated earlier.

The Fed has already begun raising rates this year and rising inflation is one if the factors that is supporting the view for more rate hikes.

Fed minutes released earlier suggest that officials at the central bank have also started to discuss about balance sheet trimming, another tool to manage its fight against inflation.

Going ahead, hawkish stance by the Federal Reserve is likely to extend gains for the greenback. We expect the dollar index to test levels of 103.20 in the near future and downside could be restricted to levels of 97.20.

Market at 3 PMBenchmark indices erased the intraday gains and turned negative with Nifty around 17100.The Sensex was down 188.13 points or 0.33% at 56978.61, and the Nifty was down 54.90 points or 0.32% at 17118.80. About 1737 shares have advanced, 1463 shares declined, and 94 shares are unchanged.

Jefferies’ Mahesh Nandurkar remains bullish on IT sector

The bullishness stems from the recent commentary from Infosys and TCS on strong hirings and the revenue visibility, Nandurkar has said

Adani Power seeks additional tariff from Rajasthan discoms

In the contempt case concerning the compensatory tariff between Adani Power and three Rajasthan distribution companies (discoms), the Supreme Court (SC) was informed today on April 19 that over Rs 5,995 crore has been paid out thus far to Adani in the dispute.

The three discoms are the Rajasthan Urja Vikas Nigam, Jaipur Vidyut Vitran Nigam and Jodhpur Vidyut Nigam.

The payout comes shortly after the SC directed the discoms to make payment towards compensatory tariff in line with the judgment of the court passed in 2020. The backlog of payment was calculated for the period starting from 2013, owing to the pricier coal required for power production.

Today, Adani Power, however, sought an additional sum of Rs 1,300 crore towards compensatory tariff, which was opposed by the power companies. The discoms argued that the additional sum cannot be claimed, given that coal for power production was available domestically since November 2021 and no import of coal was needed.

The apex court, refraining from passing orders on this aspect, allowed Adani Power to approach an appropriate forum for its additional claims. Click To Read More

HDFC- HDFC Bank in focus

Since April 4th, HDFC Bank’s market cap has got eroded by Rs 1.67 lakh crore in just nine days; HDFC has lost Rs 91,595 crore in market value.