Vinod Nair, Head of Research at Geojit Financial Services:

Following a positive opening, benchmark indices gave up all gains led by losses in heavyweights in anticipation of the RBI meet next week. Meanwhile, investors were also cautious after India reported Omicron cases.

However, global equities traded with slight gains recovering from yesterday’s broad based sell-off led by fears on new covid variant and Fed chair’s comment on the bond-buying program.

RBI’s monetary policy meeting will be a key market driver as investors await MPC’s policy decision which is broadly expected to hold an accommodative stance considering the uncertainty surrounding the new variant.

Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments

The Nifty failed to keep above the 17400-17500 zone which is a bearish signal. We are resisting at higher levels and therefore the upside is definitely capped in that region.

Unless we do not get past the patch of 17400-17500 on a closing basis, we won’t really see a meaningful upside rally. If the markets were to break 17100 next week it would be a matter of concern as there is every possibility we re-enter the current bear trend.

Market Close: Benchmark indices broke the two-day winning streak and ended lower with Sensex closing below 58,000 mark.

At Close, the Sensex was down 764.83 points or 1.31% at 57,696.46, and the Nifty was down 205 points or 1.18% at 17,196.70. About 1722 shares have advanced, 1453 shares declined, and 137 shares are unchanged.

Power Grid Corporation, Reliance Industries, Tech Mahindra, Asian Paints and Kotak Mahindra Bank were among the major Nifty losers. The gainers included UPL, BPCL, ONGC, IOC and L&T.

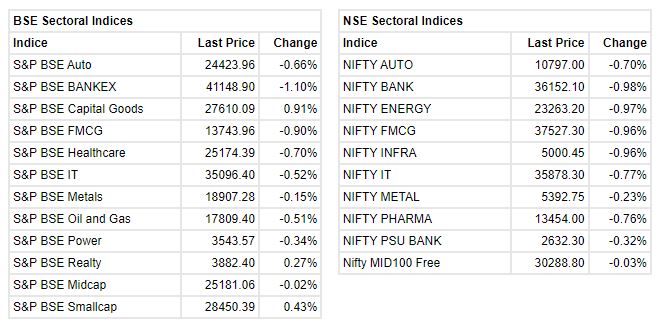

Except capital goods, all other sectoral indices ended in the red. BSE midcap and smallcap indices ended on flat note.

Star Health IPO Share Allotment | Check Latest Grey Market Premium, Listing Date

The offer comprised fresh issue of Rs 2,000 crore, and an offer for sale of Rs 5,249 crore, which will get reduced to the extent of undersubscription, by selling shareholders, including Safecrop Investments India LLP. The issue price could get finalised at the upper price band of Rs 900 a share.

Buzzing:

Maruti Suzuki’s share price was down over a percent in the afternoon trade on December 3 after CLSA downgraded the stock to “sell” from “underperform” and cut the target to Rs 6,420 from Rs 6,550 a share.

The brokerage firm said that if the company loses share in the SUV segment, it may lose 600 Bps market share in the passenger vehicle segment over FY20-22.

BSE FMCG index fell 1 percent dragged by the GRM Overseas, Parag Milk Foods, Varun Beverages

Punjab Alkalies board approves sub-division of equity share

The board of directors of Punjab Alkalies and Chemicals in its meeting held on 02.12.2021 considered and approved the sub-division of each equity share of face value of Rs 10 each into 5 equity shares of face value of Rs 2 each subject to the approval of shareholders.

It has touched a 52-week high of Rs 229.95 and was quoting at Rs 217, down Rs 1.95, or 0.89 percent.

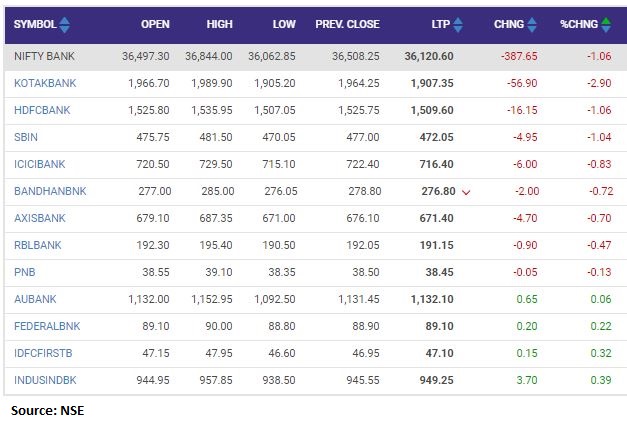

Nifty Bank index shed 1 percent dragged by the Kotak Mahindra Bank, HDFC Bank, SBI

Nagarjuna Fertilisers restarts urea production

Nagarjuna Fertilisers and Chemicals has restarted Urea Production in Plant -I, from December 01, 2021.

The company had taken a temporary shutdown of urea production on November 24, 2021, to take up temporary repairs

Nagarjuna Fertilisers and Chemicals was quoting at Rs 12.08, up Rs 0.57, or 4.95 percent on the BSE.

The share touched a 52-week high of Rs 20.67 and a 52-week low of Rs 4.40 on 15 July, 2021 and 25 January, 2021, respectively.

Currently, it is trading 41.56 percent below its 52-week high and 174.55 percent above its 52-week low.

Market at 3 PMBenchmark indices extended the fall in the final hour of trading with Nifty around 17200 dragged by FMCG and Financial names.The Sensex was down 744.24 points or 1.27% at 57717.05, and the Nifty was down 198.40 points or 1.14% at 17203.30. About 1682 shares have advanced, 1332 shares declined, and 123 shares are unchanged.

Sun Pharma Advanced in licensing agreement with Biomodifying

Sun Pharma Advanced Research Company (SPARC) has entered into an agreement with Biomodifying LLC (Biomodifying) to exclusively license Biomodifying’s intellectual property, including all patents and patent applications owned or controlled by Biomodifying, along with antibodies developed for multiple uses including for cancer, company said in its release..

Sun Pharma Advanced Research Company was quoting at Rs 254.00, up Rs 5.50, or 2.21 percent.

Lakshmi Iyer, CIO – Debt & Head – Products, Kotak Mahindra Asset Management Company:

As the cobwebs being to clear wrt policy making front, world central bankers are grappling with the debut of the Omicron variant of Covid virus! The path to normalisation has begun across the world, including India, and is less likely to stop for now.

We therefore expect a reasonably high chance of 15/20bps hike in reverse repo rate – a start to reduce the gap between repo and rev repo rate.

The policy stance may remain status quo and hinge on incremental developments in the near term. We expect VRRR as a tool to normalise liquidity to continue to gain momentum.