Mohit Nigam, Head – PMS, Hem Securities:

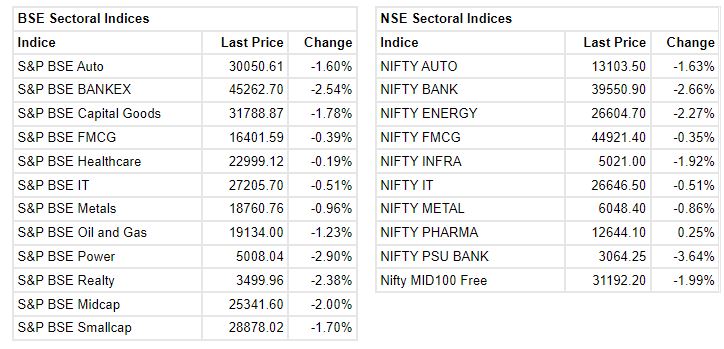

Indian benchmark indices made a gap down opening and closed in red for the third consecutive session. Nifty50 closed at 17327.30 (-1.72%) and Sensex closed at 58098.92 (-1.73%). Among sectors Selling was visible in Banks, Financials, Capital goods, Reality whereas Nifty pharma closed in green.

Indian markets are reacting to the rate hikes by various central banks which led the dollar index to 112 levels and USD INR touched record low of 81.2.

On the technical front, the key resistance levels for Nifty50 are 17500 and on the downside 17150 can act as strong support. Key resistance and support levels for Bank Nifty are 40000 and 39000 respectively.

Siddhartha Khemka, Head – Retail Research, Motilal Oswal Financial Services:

Negative global cues and FIIs turning heavy sellers, impacted investor’s sentiments on the last day of the week. US Fed’s aggressive stance has increased recessionary fears on global front and created nervousness on domestic markets as well.

Nifty was showing signs of weakness from its opening and broke its crucial support of 17,400 levels. India VIX rose sharply by 9.2% to 20.5 levels, indicating that volatility may remain high going forward.

India would continue to take cues from global front as well as upcoming RBI meeting which is also expected to hike interest rates in line with US Federal Reserve.

Nifty opened gap down and witnessed another day of intense selling to close near day’s low. All sectorial indices, including broader market under performed with Realty, PSU Bank down by more than 3%.

Vinod Nair, Head of Research at Geojit Financial Services:

A rise in the US 10-year bond yield and a strong dollar index influenced FIIs to flee emerging markets. A fall in liquidity in the banking system, a weak currency and a current premium valuation have set the market outlook bearish for the near term.

With aggressive monetary policy action by central banks, the global growth engines are in a slowdown mode, whereas India is currently in a better position with a pickup in credit growth and an uptick in tax collection.

The current volatility might persist for a while. Investors are advised to wait and watch until the dust settles.

Divam Sharma, smallcase manager & Co founder, Green Portfolio:

The monetary policy will continue to diverge for the RBI. Inflation prints in the US and EU are running at 400% above their target, whereas in India the divergence is only 16% above our upper band. RBI will give relatively more priority to upholding economic growth instead of solely focusing on the price levels because the RBI can afford to. We expect a 40-50bps increase in the policy rates in the coming meeting.

Rupee Close:

Indian rupee closed 13 paise lower at 80.99 per dollar on Friday against previous close of 80.86

Market Close: Benchmark indices ended in the red for the third straight session on September 23 amid selling across the sectors.

At Close, the Sensex was down 1,020.80 points or 1.73% at 58,098.92, and the Nifty was down 302.50 points or 1.72% at 17,327.30. About 959 shares have advanced, 2417 shares declined, and 106 shares are unchanged.

Power Grid Corporation, Apollo Hospitals, Hindalco Industries, Adani Ports and SBI were among the top losers on the Nifty.

However, gainers included Divis Laboratories, Sun Pharma, Tata Steel, Cipla and ITC.

All the sectoral indices ended in the red with capital goods, power, realty, bank down 2-3% each.

BSE Midcap and Smallcap indices shed 2 percent each.

Zydus Lifesciences to pick 11.86% stake in AMP Energy Green Nine

Zydus Lifesciences has entered into share purchase, subscription and shareholder’s agreement (SPSSA) to acquire upto 11.86% stake in AMP Energy Green Nine. With this, it will set up captive wind solar hybrid power project in Gujarat.

Zydus Lifesciences was quoting at Rs 356.70, down Rs 6.25, or 1.72 percent.

Goldman Sachs View On One 97 Communications (Paytm)

Research firm Goldman Sachs has kept buy rating on the stock with a target at Rs 1,100 per share.

Goldman Sachs have steadily raised FY24 revenues estimate by 13% and expect elevated growth in high margin segments to lead to faster profitability.

It recognise that lock-in expiry in November 2022 may represent an overhang on stock and expect Paytm to deliver 50% revenue growth for next few quarters.

Broking house expect company to continue its transition from payments-only business to fin services portfolio, reported CNBC-TV18.

One 97 Communications (Paytm) was quoting at Rs 693.35, up Rs 8.75, or 1.28 percent.

Gaurang Somaiya, Forex & Bullion Analyst, Motilal Oswal Financial Services:

Rupee fell to fresh all-time lows against the US dollar after the Fed raised rates earlier this week. Most of the currencies are under pressure as the dollar continues to strengthen.

Volatility in Yen remained elevated after the Bank of Japan intervened to curb sharp depreciation. Bank of England released its policy statement and raised rates by 50bps.

Focus will be on the preliminary manufacturing PMI number that will be released from the US, EZ and UK. We expect the USDINR(Spot) to trade sideways and quote in the range of 80.40 and 81.20.

Manappuram Finance accepts right issue proposal of arm Asirvad Micro FinanceThe Board of Directors of Manappuram Finance accepted the right issue proposal of Asirvad Micro Finance Limited, subsidiary of the

Company. Company is entitled to purchase 90,96,333 number of shares having face value Rs 10 per share for Rs 268 per share including a premium of Rs. 258 per share. The total issue size is 93,28,358 shares.The last date of acceptance of the offer is September 28, 2022.The board approved subscription to rights issue upto 93,28,358 having value of Rs 250 crore (approx..), in case of renunciation available.

RBI may slow intervention in October-March to allow weakness in rupee: Kotak Bank

The rupee dropped to a record low of 81.2250 to the dollar on Friday, prompting the RBI to sell dollars to prop up the currency, traders said.

Market at 3 PMMarket extended the losses and trading at day’s low level with Nifty around 17350.At 15:00 hrs IST, the Sensex is down 934.18 points or 1.58% at 58185.54, and the Nifty down 276.80 points or 1.57% at 17353. About 838 shares have advanced, 2385 shares declined, and 85 shares are unchanged.