Mohit Nigam, Head – PMS, Hem Securities

Indian equity markets continued their weak trade in late afternoon session on the back of selling in realty and IT stocks. Traders were cautious after Fitch Ratings slashed India’s GDP growth projection for FY23 to 7 per cent, saying the economy is expected to slow against the backdrop of global economy, elevated inflation and high interest rate. Further, weakness also prevailed in the markets as India’s merchandise trade deficit in August widened to $27.98 billion from $11.71 billion a year earlier.

In scrip specific, Tamilnad Mercantile Bank remained in focused, as it has debuted at Rs 510.00 on the BSE, down by 15 points or 2.86 percent from its issue price of Rs 525.

On the technical front, the key resistance level for Nifty is 18,000 and on the downside 17,750 can act as strong support. Key resistance and support levels for Bank Nifty are 41,800 and 40,800 respectively.

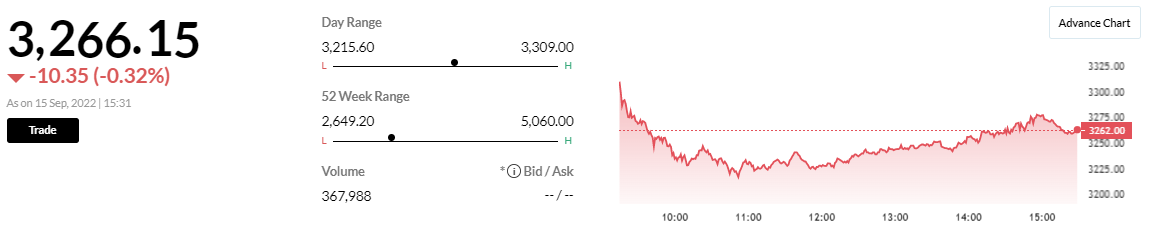

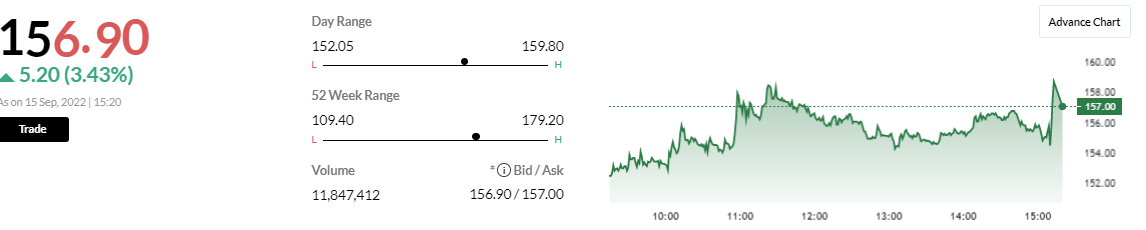

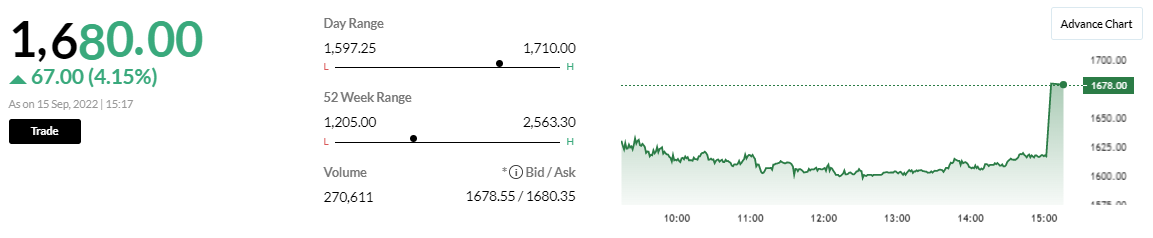

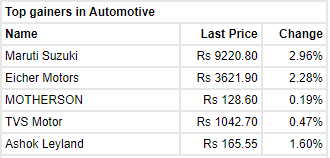

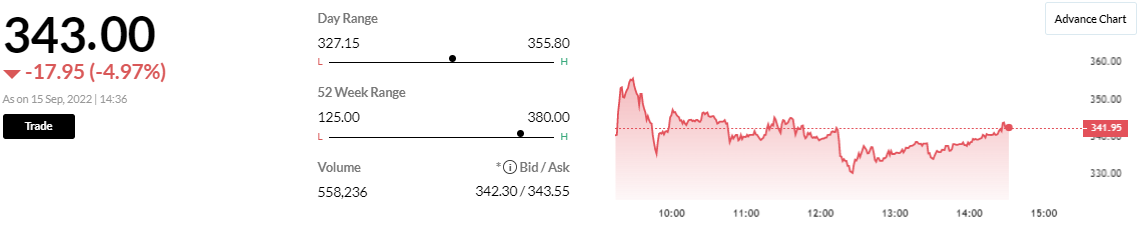

Markets at close Sensex is down 412.96 points or 0.68 percent at 59,934. Nifty shed 126.40 points or 0.70 percent, ending at 17,877.40. About 1648 shares advanced, 1754 shares declined, and 113 shares were unchanged.Among sectors, Nifty IT was the top loser with Infosys and Tech Mahindra losing 3 percent each. Autos were in the fast lane as Maruti Suzuki surged 3.2 percent. Eicher Motors rallied 2.7 percent to join the Rs 1 trillion market cap club. Pharma and realty sectors took a beating too, losing over a percent.

Rupee at close | Rupee ends at 79.70/$ versus Wednesday’s close of 79.44/$

Mindtree builds digital command & control solution for L&T’s Gujarat green hydrogen plant

Redington enters into a strategic partnership with Google Cloud India; stock up 3 percentRedington announced that it has entered into a strategic partnership with Google Cloud India. As a part of this collaboration, it will drive the distribution and adoption of Google Workspace and Google Cloud with SMBs, education and public sector, mid-market, and enterprise segments

MTAR Technologies bags orders worth Rs 540 cr in clean energy

Vinod Nair, Head of Research, Geojit Financial Services

The resilience of the domestic market is fuelled by the strong momentum of the banking sector. The major factors influencing the performance of banking stocks are asset quality, credit growth and FII activity. The recent rally in the market had largely taken into account the improving asset quality, while the market is yet to fully factor in the strong traction expected in credit demand.

FIIs turning net buyers is an additional catalyst supporting the trend. Even after factoring in the current rally, the Nifty Bank index is still attractive trading marginally above the long-term averages. While we continue to have a strong long-term outlook for the banking sector, especially for large private banks, we can’t rule out the prospect of short-term profit booking due to the spillover effect of a recession in the global economy.

Who is driving the rally in auto pack? Take a look

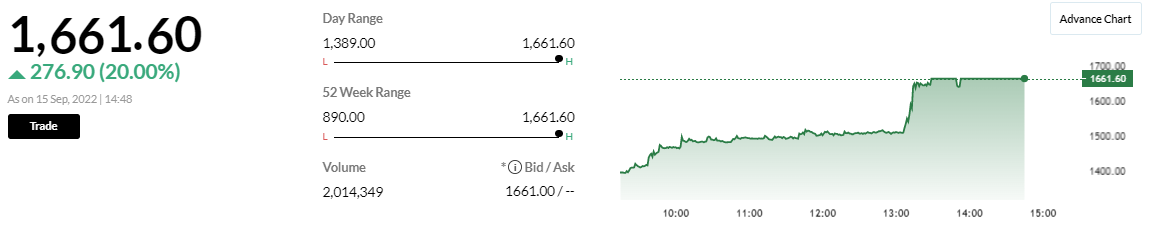

CEAT surges 20 percent; locked in upper circuitThe company hosted its annual investor meet recently to highlight its strategic roadmap. The company aims to double exports revenue to Rs 3500 cr by FY26 from Rs 1800 cr in FY22. Management emphasized its focus to increase market share across key segments and improve margin & return ratios.

Veranda Learning to raise funds worth Rs 300 cr via preferential issue and convertible warrants

Air India will strive to increase its market share to at least 30 percent in the domestic market in the next 5 years

Tapan Patel, Senior Analyst (Commodities), HDFC Securities

Gold prices fell below $1700 on growing optimism over aggressive rate hike from US FED with surge in inflation numbers. The dollar index was up, lowering demand for precious metals. We expect gold prices to trade sideways-to-down for the day with COMEX spot gold support at $1676 and resistance at $1705 per ounce. MCX Gold October support lies at Rs 49,500 and resistance at Rs 50,100 per 10 gram.