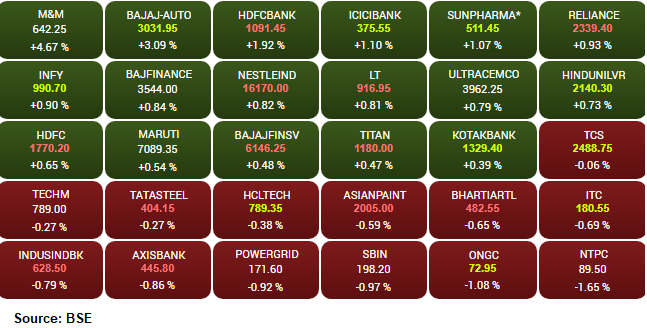

Sensex gainers & losers

KKR raises over $11 billion in Asia fund

As per news agency Reuters, private equity powerhouse KKR & Co has raised over $11 billion after the first-close of its fourth Asia-focused fund, its Beijing-based managing director Chris Sun said Wednesday.

KKR started marketing the new Asia fund towards the end of last year before the COVID-19 pandemic, targeting $12.5 billion in what would be the region’s biggest private equity fund, people familiar with the situation have said.

Sun, speaking at the AVCJ China Virtual Forum, said China, the world’s second largest economy, has been an important market for the fund, adding that Japan, India and Southeast Asia are also its focused markets.

Jateen Trivedi, Senior Research Analyst- Commodity & Currency- at LKP Securities

Rupee extended gains on Wednesday on overseas inflows into local debt and stocks and muted trades in the greenback amid Fed statement due later in the night at 11.30 pm.

FII inflows are heavy in both debt and stocks, while the dollar index has fallen has helped the rupee greatly. Important supports for the USDINR pair are at 73.40-73.20 whereas 73.90-74.10 zone is the resistance.

Deepak Jasani, Head of Retail Research

Addressing the FICCI National Executive Committee Meeting, Reserve Bank of India Governor Shaktikanta Das on September 16 assured that the RBI is closely monitoring economic situation, and the central bank is prepared to take further measures to prepare the economy and banking system to fight the COVID-19 pandemic.

He acknowledged that the economic recovery remains slow and will be gradual. The uptick noticed in some sectors in the economy in the June-July period seems to have levelled off. High frequency indicators of agricultural activity, purchasing managers’ index (PMI) for manufacturing and private estimates point to some stabilisation of economic activity in Q2.

Further, bank credit growth remains muted in the system. He hoped that the revival of businesses (due to moratorium or restructuring) will help keep NPAs low.

These reassuring statements helped the Nifty to rise towards the recent highs.

Institutional flows to slow down, markets to consolidate near-term: BofA Securities

In continuation of the trend seen in July, FII and DII flow into Indian equities had contrasting trails in August: $6.3bn inflows by FIIs vs $0.6bn DII redemption.

Going forward, with MSCI India’s valuation premium to EM currently well above the historical average, we expect institutional flows to slow down and markets to consolidate near-term, said BofA Securities.

Any rally thereafter could be led by select private sector financials once clarity on NPAs emerges. The recent large fundraises and resulting highest ever capital ratios provide downward support to valuations of financial stocks meantime, BofA Securities said.

Besides, BofA Sec also continues its overweight on industrials and materials and see scope for FII repositioning in these sectors on improving traction for Make in India and the government’s CAPEX push.

FIIs inflows into Indian equities continued to be robust in August at nearly $6.3bn, highest in 5 years.

Even adjusted for primary market flows on $3.9bn led by the banking sector fundraises, FII inflows were still robust at $2.4bn.

This despite $78mn outflows by passive funds, the continuation of a trend seen over the last eight months.

While India saw strong FII inflows, most EMs witnessed FII outflows in August: South Korea (-$2.3bn), Taiwan (-$2.2bn), South Africa (-$1.3bn) and Thailand (-$0.9bn).

With MSCI India’s valuation premium to EM currently more than 25 percent above the historical average, BofA Securities thinks Indian markets could now consolidate near-term and incremental FII flows could slow down; flows in September so far have already been nearly flat (-$153mn).

As picking quality stocks is the mantra now, brokerages bet on these 12 stocks

After showing up-move from the lows recently, the Nifty struggled to sustain the gains on September 14 and closed the day lower by 24 points amid high volatility.

Market Update: Sensex is up 248.39 points or 0.64 percent at 39,292.74, and the Nifty gained 73.50 points or 0.64 percent at 11,595.30. Mahindra & Mahindra, Tata Motors and Hindalco Industries are the top gainers while Reliance Industries, Bajaj Finance and Tata Motors are the most active stocks.

Among the sectors, the auto index gained close to 2 percent while Bank Nifty added half a percent.

Tapan Patel- Senior Analyst (Commodities), HDFC Securities: Gold prices traded strong with COMEX spot gold traded near USD 1,967 on Wednesday. Gold October future contract at MCX were trading half a percent up to Rs 51,976 per 10 grams for the day. Gold prices fluctuated on WTO ruling over US tariffs on China and speculation over US FOMC meeting. Gold was trading near a two-week high and the dollar at a two-week low when the WTO deemed that the Trump administration’s tariffs on USD 200 billion worth of Chinese goods were illegal.

We expect gold prices to trade up with support at USD 1,930 and resistance at USD 2,000. MCX Gold October support is at Rs 51,400 and resistance lies at Rs 52,200/52,500.

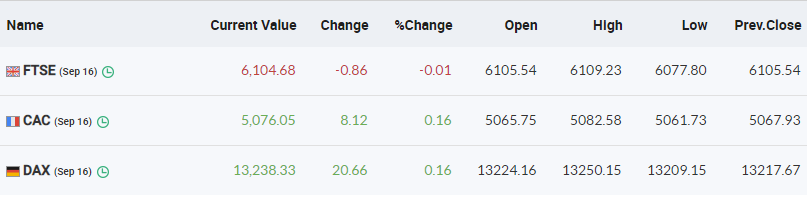

European markets trade mixed with FTSE down close to a percent.

Rahul Gupta, Head of Research- Currency, Emkay Global Financial Services: The Indo-China border skirmish is keeping the USD-INR spot afloat. Also, RBI is seen protecting the fall in spot. The USD-INR spot has not broken the crucial resistance of 73.75, on subdued dollar ahead of today’s Fed outcome. We don’t expect any changes in tonight’s monetary policy but the main focus will be on details over measures to boost economic growth. If Fed sounds less dovish than expected while providing details over average inflation targeting, then we can expect an uptick in dollar index and further rise in USD-INR spot. A consistent trading above 73.75 will open doors for 74 and above levels with 73.20 being the crucial support.