CLSA believes that the turning rate cycle is positive for bank margin. It has maintained a positive view on large banks with Axis Bank, ICICI Bank and State Bank of India as its top picks.

The Indian stock market is trading on a handsome note led by gains from banks and financials and metals stocks. Sensex is up 477.47 points or 0.95 percent at 50774.36, and the Nifty jumped 153.10 points or 1.03 percent at 15072.20.

Banks gained the most with the PSU Bank index jumping 3 percent led by Punjab National Bank which jumped over 4 percent followed by Bank of Baroda, Central Bank of India, Canara Bank, State Bank of India and J&K Bank which added 2-3 percent each.

PSU stocks have been buzzing of late, especially after the Budget 2021 which highlighted the government’s intent to speed up privatisation. Analysts expect privatisation to be a strong step in boosting the economic growth of the country.

Global research firm CLSA believes that the turning rate cycle is positive for bank margin. It has maintained a positive view on large banks with Axis Bank, ICICI Bank and State Bank of India as its top picks, according to a CNBC-TV18 report.

CLSA sees 15-30 bps margin improvement for banks in a turning rate cycle while for NBFCs and HFCs the uptick in rates will normalise ultra-low bond pricing.

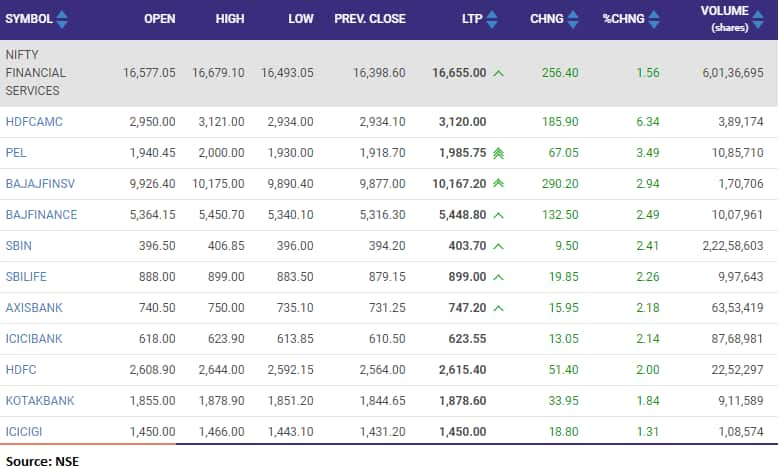

Nifty Financial Services added a percent with Bajaj Finance, HDFC and Bajaj Finserv gaining over 2 percent each followed by HDFC AMC, SBI Life, Cholamandalam Investment and Axis Bank.

Rusmik Oza, Executive Vice President, Head of Fundamental Research at Kotak Securities recommends buying SBI with a target of Rs 450 per share.

Sameet Chavan, Chief Technical & Derivatives Analyst at Angel Broking however has sell calls on ICICI Bank and Bajaj Finance with targets of Rs 564 and Rs 5,080 per share respectively.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.