After consolidating in the previous week, the market got back into action and made investors richer as benchmark indices hit new highs in the week ended September 17.

The announcement of a four-year moratorium on payment of adjusted gross revenues (AGR) for the telecom sector, a production-linked incentive for the automotive segment and government guarantees for security receipts worth Rs 30,600-crore to be issued by National Asset Reconstruction Company (NARCL), or the bad bank, along with positive economic data powered the rally.

The Sensex closed above 59,000-mark for the first time, rising 710.82 points or 1.22 percent to 59,015.89, and the Nifty50 climbed 215.90 points, or 1.24 percent, to 17,585.15.

The broader markets also traded in line with the benchmarks. The BSE midcap and smallcap indices gained more than 1.3 percent each. Auto, banks, and IT stocks led the rally, whereas realty and metals were under pressure.

The Sensex has, so far, gained 2.5 percent in September, increasing investors’ wealth by nearly Rs 9 lakh crore as BSE market capitalisation jumped to nearly Rs 259 lakh crore from Rs 250 lakh crore.

After the rally, experts expect some consolidation and range-bound action in next week before the resumption of the uptrend. In the absence of domestic cues, all eyes will be on the global cues, including Federal Reserve and its commentary over tapering plans, experts said.

“The weak global cues on account of worry over slower economic growth and rising Delta variant cases globally would see market oscillating between greed and fear. Nervousness would be seen in the market next week ahead of the Federal Reserve meeting, which could provide some indications on when the central bank will start withdrawing its monetary stimulus and start raising interest rates eventually,” said Siddhartha Khemka, Head – Retail Research at Motilal Oswal Financial Services.

Traders should refrain from taking aggressive bets owing to probability of unanticipated whipsaw movements, Samco Securities said.

Here are 10 key factors that will keep traders busy next week:

FOMC meet

Globally, the Federal Reserve and its commentary on tapering and interest rate timelines will be the key event to watch out for the next week.

Experts said tapering plans are unlikely to be announced in a meeting held on September 21-22, as the rising Delta variant cases and low economic data points towards delayed economic recovery.

Previous commentaries of Fed chair Jerome Powell clearly indicated that tapering, if any, will be gradual and rate hike is not on radar in near term.

“While the Fed’s planned reduction of bond purchases has garnered much of the focus this year, their view on interest rates may give new information that may move markets world over. However, it is widely assumed that policymakers would take fresh developments in inflation and the intensity of the delta variant into account before announcing tapering plans,” said Samco Securities.

The markets will also focus on meetings of other central banks as the Bank of England (September 23) and Bank of Japan (September 22) will hold their monetary policy during the week as well.

“The UK inflation data showed a much bigger than expected rise in consumer price last month further strengthening the case for monetary tightening. The Bank of Japan has, however, maintained a dovish stance and may continue with the same amid persisting virus risks,” said Ravindra Rao of Kotak Securities.

Coronavirus and vaccination

India has managed to keep daily infections to below 40,000 for more than a week now. With a significant increase in pace of vaccination and in recoveries, it is a big supportive factor for the economic recovery and rally in equity markets. Experts though still see a third Covid wave as a risk because the world’s largest economy United States is seeing a Delta variant cases and in fact it has been adding more than a lakh cases every day, the highest by any country.

With around 2.15 crore doses administered on September 17, more than 79.42 crore people have been got at least one dose in the country. Of these, 19.88 crore have completed their two doses.

IPO

Paras Defence and Space Technologies will open its initial public offering (IPO) from September 21-23. The price band for the offer has been fixed at Rs 165-175 per equity share.

The offer comprises a fresh issue of Rs 140.6 crore and an offer for sale of up to 17,24,490 equity shares by Sharad Virji Shah, Munjal Sharad Shah, Ami Munjal Shah, Shilpa Amit Mahajan and Amit Navin Mahajan. The net proceeds from fresh issue will be utilised for purchase of machinery and equipment, funding incremental working capital requirements, repayment of borrowings, and general corporate purposes.

Listing

Automotive components manufacturer Sansera Engineering will make its debut on the bourses on September 24.

The Rs 1,283-crore public issue was subscribed 11.47 times during September 14-16 period. The portion reserved for qualified institutional buyers was subscribed 26.47 times. The part set aside for non-institutional investors was subscribed 11.37 times, while retail investors put in bids 3.15 times their reserved portion and employees 1.37 times their limit.

FII flow

Significant FII inflow was one of the reasons that drove the market to new highs. FIIs net bought Rs 6,476 crore worth of shares in the week ended September 17, taking the month’s inflow to over Rs 7,200 crore.

The reforms announced by the government clearly lifted sentiment at the FII desk. An announcement with respect to the Fed tapering plan, movement in the dollar index and US bond yields will be closely watched.

“The movement of the dollar index and US bond yield will play a key role in the behaviour of emerging markets like India. The dollar index is trading near-critical resistance of 93.5 and if it manages to cross this level then we can expect a sharp surge, moreover, US 10-years bond yields are also giving signs of bottoming out.

“It will be important to see FIIs’ behaviour if there will be a rise in the dollar index and bond yields because we have seen a strong buying in the last few days by FIIs and that is leading to strong bullish momentum in largecap stocks,” said Santosh Meena, Head of Research at Swastika Investmart.

The dollar index, which measures the value of the dollar against a basket of the world’s six leading currencies, increased to 93.22 from 92.65 on week-on-week basis.

Domestic institutional investors, however, seem to have preferred to cash in the opportunity and net sold Rs 2,896 crore worth of shares during the week

Technical View

The Nifty50 snapped a three-day winning streak and fell 44.30 points, forming a bearish candle on the daily charts on September 17 as the closing was lower than opening levels. During the week, the index hit record highs, gaining 1.24 percent and saw a bullish candle formation on the weekly scale.

Considering the chart patterns, experts said there could be a minor correction in the coming week but the market is expected to remain strong in the longer term.

“A long bull candle was formed on the weekly chart with minor upper shadow. This market action signals that the long-term uptrend of Nifty remains intact and minor consolidation or weakness of next week could be a buying opportunity,” said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

Overall, the market seems to have started with profit booking and volatility at the new highs, he said. “Having moved up sharply in the last few sessions, there is a possibility of consolidation or minor weakness in the coming sessions. Important support is placed at 17,400 and there is a possibility of upside bounce from the lower levels.”

F&O Cues

The options data largely indicates that the Nifty may see a broader trading range of 17,300 to 18,000, while the immediate trading could be 17,400-17,800.

Maximum Put open interest was seen at 17,000 followed by 17,600 and 17,500 strikes, while maximum Call open interest was seen at 18,000 followed by 17,800 and 17,600 strikes. Call writing was seen at 17,800, 18,000 and 17,600 strikes, while Put writing was seen at 17,600, 17,700 and 17,400 strikes.

India VIX moved up sharply from 13.94 to 15.23 on week-on-week basis, indicating volatile swings in the market ahead.

“On the data front, the current upmove has put Call writers on the block and positions were moved to deep OTM strikes towards 18000. Despite significant writing at ATM and OTM Call strikes on Friday, we believe till major Put bases are not breached, one should remain positive,” said ICICI Direct.

“During the last couple of weeks, Put writers continued to strengthen the base. For the coming weekly settlement, 17,400 holds noteworthy open interest.”

India VIX moved to its highest levels in more than three months and closed above 15 levels. “While the market remains in an uptrend, such a sharp rise in volatility ahead of FOMC meet next week may induce some profit booking in the coming sessions,” said the brokerage, which advised holding long positions above 17,400.

Bank Nifty

The much-awaited announcement of bad bank formation with the government guarantee to security receipts to be issued by NARCL boosted the confidence among market participants, which pushed the Bank Nifty above the 38,000-mark for the first time.

The banking index hit an intraday high of 38,112.75 on September 17, gaining more than 3 percent with a sharp rally in PSU and private banks with Kotak Mahindra Bank (up 10.5 percent) and IndusInd Bank (up 13 percent) being the top gainers. Experts expect the momentum to take the Bank Nifty towards 39,000-mark in the coming days.

“Due to high volatility, the option open interest is placed from 36500 to 38500 strikes. However, major Put open interest writing was observed in 37,000 strike followed by 37,500. On the upsides, we feel Bank Nifty is likely to head towards 39,000 as money flow is likely to be seen from IT and metals to banking,” said ICICI Direct.

“The current price ratio of Bank Nifty/Nifty has reverted from its yearly low. We feel the outperformance in banking stocks should continue for a couple more days.”

Maximum Call open interest was seen at 38,000 followed by 38,500 & 39,000 strikes, while maximum Put open interest was seen at 37,000 followed by 37,500 and 36,500 strikes. Call writing was seen at 38,000, followed by 38,200 and 38,700 strikes, while Put writing was seen at 38,000, then 37,800 and 37,500 strikes.

Corporate Action

Here are key corporate actions taking place in the coming week:

Foreign exchange reserves for the week ended September 17 and deposit & bank loan growth for the fortnight ended September 10 will be released on September 24.

Global Data

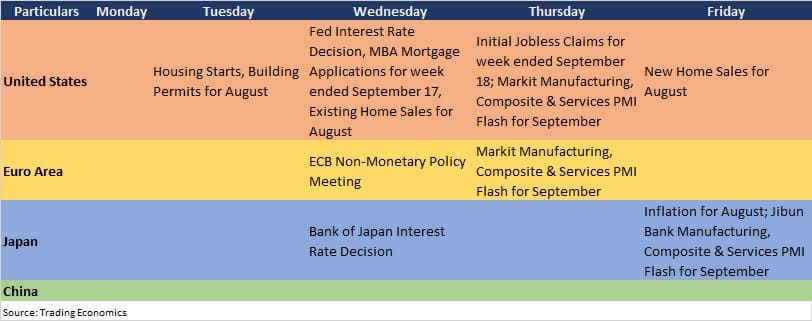

Here are key global data points to watch out for next week: