Indian markets remained bearish for the the second consecutive week ended May 13 as the benchmark share indices lost nearly 4 percent. Persistent worries over rising inflation, possibility of further rate hikes by global central bank, China lockdown and weakening rupee kept the investors on the edge.

During the last week, BSE Sensex declined 2,041.96 points (3.72 percent) to close at 52,793.62, while the Nifty50 shed 629.05 points (3.83 percent) to end at 15,782.20 levels. However, in the month of May Sensex and Nifty have lost more than 7 percent each.

During the week gone by, all the sectoral indices were in the red with BSE Metal and Power indices falling 13 percent each. BSE Telecom index shed 6.7 percent and Realty index declined 5.8 percent. In broader market, the BSE Mid-cap index lost 5.6 percent, Small-cap index shed 6.5 percent and Large-cap Index declined 4.4 percent.

In absence of any major event, market participants will be closely eyeing the performance of global stocks, the Russia-Ukraine war updates and China’s COVID situation for cues. Further, the listing of country’s largest insurer, LIC, would also be on the radar. On the data front, WPI Inflation numbers scheduled for May 17 would also be looked at, experts say.

“Markets have turned oversold after five weeks of continuous decline however there’s no sign of reversal yet. The fresh breakdown in the banking pack has further strengthened the bearish sentiment. Nifty has almost reached closer to the March low i.e. 15,671.45 levels and its breakdown would push the index to the 15,400 zone,” said Ajit Mishra, VP Research. Religare Broking.

“Since we’re seeing rotational selling across sectors, traders should align their positions accordingly and avoid contrarian trades. Investors, on the other hand, may consider nibbling selectively into IT, FMCG and auto pack,” he added.

Here are 10 key factors that will keep traders busy next week:

1) LIC Listing

After overwhelming response to the mega IPO of Life Insurance Corporation (LIC) , all eyes are now on its listing.

LIC will make its debut on the BSE and NSE on May 17 as per the schedule published in the prospectus.

The issue opened for subscription from May 4-9 and received bids worth Rs 43,933.5 crore.

The offer was subscribed 2.95 times as investors have put in bids for 47.82 crore equity shares against IPO size of 16.20 crore shares, as per the subscription data available on exchanges.

The participation by policyholders remained quite strong as they have bid 6.12 times the allotted quota and the value of shares subscribed for was Rs 12,034 crore

Retail investors and LIC policyholders were among the most enthusiastic for the offering, thanks to the discounts they were offered.

The portion reserved for them was fully taken up days before the offering was closed. The anchor portion of the IPO drew in sovereign funds from Norway and Singapore while other foreign investors picked up pace only on the last day.

2) Earnings

The earnings will remained in focus as more than 400 companies are going to announce their March quarter results in next week.

Bharti Airtel, DLF, Indian Oil Corporation, ITC, Ashok Leyland, Lupin, Dr. Reddy’s Laboratories, InterGlobe Aviation, Godrej Consumer Products, Hindustan Petroleum Corporation, NTPC and Shree Cement are among the big names to declare earnings next week.

Among other Bharat Forge, Century Plyboards, Glaxosmithkline Pharmaceuticals, Multi Commodity Exchange Of India, Raymond, Shankara Building Products, Uttam Sugar Mills, V.I.P.Industries, Bajaj Healthcare, E.I.D. Parry (India), GMR Infrastructure, Indoco Remedies, IRB Infrastructure Developers, Dr. Lal PathLabs, Mangalore Chemicals & Fertilizers, Minda Corporation, Sun Pharma Advanced Research Company, Zydus Wellness, Finolex Industries, Granules India ,Indraprastha Gas, Indian Overseas Bank, LIC Housing Finance, Pidilite Industries, Dhanlaxmi Bank, Gland Pharma, Punjab & Sind Bank, Ramco Systems, Ujjivan Financial Services, Amara Raja Batteries, Bajaj Hindusthan Sugar, Indiabulls Housing Finance, IDFC, JK Tyre & Industries, One 97 Communications, Pfizer, Sobha, Thermax, Zydus Lifesciences and J.K.Cement, to declare their earnings between May 16-21.

3) FII Selling

Foreign institutional investors (FIIs) continued their selling in the eight straight month (May 2022). FIIs sold equities worth of Rs 19,967.57 crore, while domestic institutional investors (DIIs) bought equities worth of Rs 18,202.10 crore, in the last week.

However, in the month of May till now FIIs sold equities worth Rs 32,701.03 crore, while DIIs purchased equities worth Rs 26,735.36 crore.

4) Russia-Ukraine war

Development on Russia-Ukraine war situation will also remain on global investor’s radar.

Ukrainian forces destroyed parts of a Russian armoured column as it tried to cross a river in the Donbas region, video from Ukraine’s military showed on Friday, as the Ukrainian defence minister predicted many weeks of grinding fighting ahead.

On the other hand, Ukrainian President Volodymyr Zelenskiy has reiterated an offer to hold direct talks with Russian President Vladimir Putin, and said Russia’s withdrawal from Ukraine should be the starting point for any discussions.

Ukraine and Russia have not held face-to-face peace talks since March 29, reported Reuters.

5) IPOs

The primary market will also remained in focus as three more IPOs are going to open for subscription next week.

Zuari Agro Chemicals-backed Paradeep Phosphates IPO will open on May 17 for subscription and close on May 19. The anchor investor bids will open on May 13.

It has set the price band for its initial public offering at Rs 39-42 a share. At the upper price band, the company plans to raise around Rs 1,502 crore. The company plans to go listed on May 27.

The IPO consists of a fresh issue of Rs 1,004 crore while an offer-for-sale of up to 118.51 million shares by its existing shareholders and promoters.

Ethos will open for subscription on 18 May and close on 20 May. The anchor book will open on 17 May. It has set a price band of Rs 836-878 a share for its initial public offering (IPO). The allotment of shares will be on 26 May and listing on 30 May.

The IPO consists of a fresh issue of Rs 375 crore and an offer for sale of up to 1.10 million shares by shareholders and promoters.

The public offer of Bengaluru-based eMudhra Ltd, the largest licensed certifying authority for digital signatures in India, will open for subscription on May 20 and close on May 24. It has set a price band for its initial public offering at Rs 243-256 a share, valuing the company at Rs 2,000 crore at the top end of the band.

The IPO consists of a fresh issue of Rs 161 crore and an offer-for-sale of up to 9.84 million shares by its existing shareholders and promoters.

6) Rupee

Dollar-Rupee movement will remain in focus after domestic currency touched new low (77.63) in last week.

“On a weekly basis, the rupee closed very weak down about a percent compared to last week as rate hike with rapid speed played negatively on overall sentiments,” said Jateen Trivedi, Senior Research Analyst at LKP Securities.

“The rupee will be seen taking weakness on any rise till the time market prices in the rate hike cycle,” he added.

The Indian currency market will remain shut on Monday (May 16) on account of Buddha Pournima.

The dollar slipped on Friday as a rally in equities contributed to a risk-on mood, but was still set for a sixth straight week of gains as investors remained concerned about slowing global growth and Federal Reserve policy tilting the United States into a recession.

7) Technical View

On Friday, Nifty index opened positive and moved in the upward direction for the first half of the session and crossed its previous day’s high. However it failed to hold at higher zones and slipped to 15740 in the latter part of the day.

It formed a Bearish candle on daily and weekly frame and has been making lower highs from the last five consecutive weeks.

“Now till it holds below 16000 zones, bounces could be sold for the downside move towards 15650 and 15500 zones whereas hurdles are placed at 16161 and 16350 zones,” Shivangi Sarda, Senior Executive | Analyst at Motilal Oswal Financial Services Limited.

8) F&O Cues

Option data suggests a wider trading range between 15500 to 16300 zones due to higher volatility.

India VIX was up by 4.98% from 24.26 to 23.05 levels. Volatility slightly cooled but is still at its higher zones which has smoothened the bear’s grip. Market shall remain uncertain unless VIX cools off.

On Option front, Maximum Call OI (Open Interest) is at 17000 then 16000 strike while Maximum Put OI is at 16000 then 15500 strike. Marginal Call writing is seen at 16100 then 16300 strike while Put writing is seen at 16000 then 15800 strike.

“For traders, 15900 would act as a key resistance level and below which the index could slip till 15650. However, 15900 would be the immediate trend reversal level for the bulls and above which we could see a strong pullback rally up to 16100-16300,” Amol Athawale, Deputy Vice President – Technical Research, Kotak Securities.

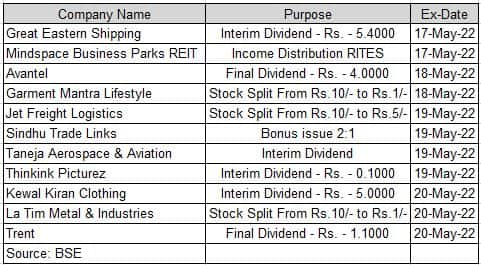

9) Corporate Action

Here are key corporate actions taking place in the coming week:

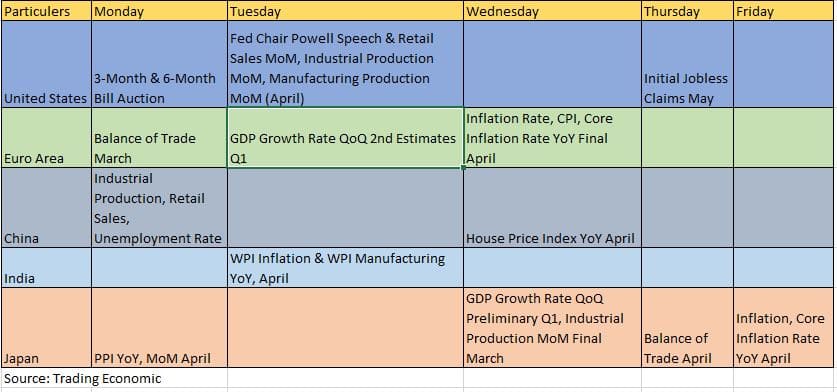

10) Global Data Points

Here are key global data points to watch out for next week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Download your money calendar for 2022-23 here and keep your dates with your moneybox, investments, taxes