In its bi-monthly review on Wednesday, the Reserve Bank of India hiked the repo rate by another 50 basis points. This move, and the RBI’s focus on the withdrawal of its accommodative policy, both in response to rising inflation, are expected to lead to a further rise in interest rates in the banking system.

Why has RBI hiked the repo rate?

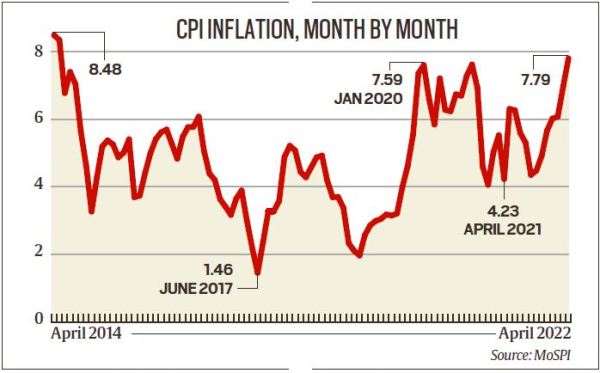

The 50-basis-point hike, which follows a 40-basis-point hike on May 4, has been done with a view to taming inflation. Noting that headline inflation has risen by 170 bps between February and April 2022, the RBI has projected it at 7.5% in Q1 Of FY 22, 7.4% in Q2, 6.2% in Q3, and 5.8% in Q4, with a baseline inflation of 6.7% for 2022-23. The RBI aims to bring inflation down to its targeted 4% (±2%). The two hikes in repo rates over the last five weeks, totalling 90 bps, takes the rate to 4.9%.

Repo rate refers to the rate at which the RBI lends to commercial banks. When interest rates are raised, it makes money more expensive, thereby resulting in reduction of demand in the economy and bringing down inflation.

Even as it looks to support the economic recovery from the impact of the pandemic, RBI’s concerns around inflation has been the primary factor in raising the rates. It said in its statement on Wednesday, “The war in Europe is lingering and we are facing newer challenges each passing day which is accentuating the existing supply chain disruptions. As a result, food, energy and commodity prices remain elevated… A large part of the rise in inflation is primarily attributed to a series of supply shocks linked to the war. In these circumstances, we have started a gradual and orderly withdrawal of extraordinary accommodation instituted during the pandemic.”

Best of Express Premium

Premium

Premium Premium

Premium Premium

PremiumHow will it impact borrowers and depositors?

While both borrowers and depositors are expected to see a hike in lending rates and offering on deposit rates, respectively, over the coming days and weeks, borrowers are likely to be impacted earlier. Banks and housing finance companies, which have already raised their lending rates between 40 bps and 50 bps points following the 40 bps hike in repo rate in May, are now expected to raise the rates again.

If the 90-bps hike in repo rate raises the lending rate by 100 bps, it will have a significant impact on EMIs. For example, if the rate on your home loan goes up by 100 basis points from 7% in April to 8% in the next couple of weeks, the EMI on principal outstanding of Rs 50 lakh for 15 years will go up from Rs 44,941 to Rs 47,782 — a jump of Rs 2,841 monthly if you keep the tenure unchanged.

Should the rates rise by 150 bps by the end of the year (which is expected given RBI’s enhanced concerns around inflation), the loan rate would go up to 9.5%, and the EMI for the the same loan to Rs 49,236 — an increase of Rs 4,295 per month. This would severely hit individuals whose incomes have already declined compared to pre-Covid levels.

So, more rate hikes are expected?

Given the RBI’s projected inflation of 6.7% for 2022-23 and enhanced concerns around it, market participants feel it may go for an additional hike of 50-100 bps over the remaining part of the year. Indeed, RBI Governor Shaktikanta Das has said future decision on rate hikes would be in line with developments around inflation. “These are extremely uncertain conditions and it is not possible to provide outlook on guidance… we will deal as the situation arises,” Das told the media on Wednesday.

In a report released after the RBI’s rate hike, Bank of Baroda said, “RBI’s hawkish policy is focussed largely on heightened inflationary concerns. It has raised policy rate by 50bps. CPI forecast has been revised upward by 100bps in FY23 to 6.7% (our est.: 6.5%). More importantly in the next three quarters, headline CPI is expected to be above RBI’s upper tolerance band… We expect another 50-75b ps rate hike in the current cycle.”

A report by HSBC Global Research has estimated that RBI may hike repo rates by 60 bps to 5.5% by December 2022 and by 110 bps to 6% by mid-2023.

Source: MoSPI

Source: MoSPI

What’s the RBI assessment on inflation?

Inflation is expected to be above 7% — much above the RBI’s comfort level of 4% (±2%) — in the first two quarters of the current fiscal. RBI has projected inflation at 7.5% in the June quarter and 7.4% in the September quarter. International crude oil prices remain elevated, with risks of further pass-through to domestic pump prices. There are also upside risks from revisions in the prices of electricity. Edible oil prices remain under pressure from adverse global supply conditions, notwithstanding some recent correction due to the lifting of an export ban by a major supplier. Early results from manufacturing, services and infrastructure sector firms polled in RBI’s surveys sow they expect further pressures on input and output prices.

The RBI expects inflation at 6.2% in the December quarter and 5.8% in March 2023. The elevated level for calendar years 2022 is likely to force the RBI to hike rates further and withdraw liquidity from the system.

What will be the impact of withdrawing the accommodative policy?

Interestingly, the RBI removed the word “accommodative” from the policy stance. The RBI’s policy panel, chaired by the RBI Governor, has decided to remain focused on withdrawal of accommodation to ensure that inflation remains within the target. The RBI had pumped huge liquidity into the system in 2020 to counter the impact of the pandemic. While this did support econonic recovery, it has also been the main reason for the rise in inflation.

The RBI’s market operations had led to a decline in liquidity in May. Still, overall system liquidity remains in large surplus, with the average daily absorption under the liquidity adjustment facility (LAF) moderating to Rs 5.5 lakh crore during May 4-31, from Rs 7.4 lakh crore during April 8-May 3, in consonance with the policy of gradual withdrawal of accommodation. The withdrawal will also put upward pressure on interest rates.

Will consumer spending be impacted?

The policy withdrawal and the rate hike are expected to impact consumption and demand in the economy. The impact is likely to be more pronounced in non-discretionary spending by consumers. “Recently released GDP data showed a sliding year-on-year growth for private consumption expenditure, an indication that economic activity remains slow,” said Indranil Pan, Chief Economist, Yes Bank.

According to the RBI policy panel, the forecast of a normal monsoon should boost kharif sowing and agricultural output. This will support rural consumption. The rebound in contact-intensive services is expected to sustain urban consumption. RBI’s surveys suggest further improvement in consumer confidence and households’ optimism for the outlook a year ahead.

“The RBI’s optimism on growth is significant because the performance of the economy in the first two months is quite impressive. Interest rate hike will help to ensure that growth is not affected as unchecked inflation can affect discretionary consumption, which in turn will affect growth,” said Madan Sabnavis, Chief Economist, Bank of Baroda.

Newsletter | Click to get the day’s best explainers in your inbox