, Sunny Verma

| Mumbai, New Delhi |

Updated: August 7, 2020 7:29:24 am

RBI Governor Shaktikanta Das. (Express Photo/File)

The Reserve Bank of India kept interest rates on hold on Thursday, seeking to contain a rise in retail inflation even as growth remains a concern. The RBI has slashed policy rates by 115 basis points since February this year, and pumped close to Rs 10 lakh crore liquidity into the financial system. In its bi-monthly monetary policy review on Thursday, it has also given the green signal to a loan restructuring scheme to bail out stressed borrowers.

Why did the Monetary Policy Committee not slash interest rates?

While Governor Shaktikanta Das said the RBI’s accommodative stance continues, the holding of rates runs counter to broad market expectations of a slash in policy rates to enable banks to lend more. Retail inflation, measured by the Consumer Price Index, rose in June to 6.09% from 5.84% in March, breaching the RBI’s medium-term target range of 2-6%. That seems to have been a major red flag that prompted the MPC’s unanimous decision.

Moreover, Das flagged concerns over domestic food inflation remaining elevated. Given the uncertainty surrounding the inflation outlook and the weak state of the economy amid the pandemic, the policy panel decided to keep the policy rate on hold, while remaining watchful for a durable reduction in inflation to use the available space to support a revival of the economy.

[embedded content]

Why is RBI worried about inflation?

The RBI Governor made it clear that the headline retail inflation prints of April-May 2020 require more clarity. The inflation objective itself is further obscured by the spike in food prices because of floods in eastern India, lockdown-related disruptions and cost-push pressures in the form of high taxes on petroleum products, hikes in telecom charges, and rising raw material costs reflected in rise in steel prices and gold prices on safe haven demand.

Headline inflation in June after a gap of two months, and imputed prints of inflation for April-May, have added uncertainty to the inflation outlook. Supply chain disruptions on account of Covid-19 persist, with implications for both food and non-food prices. While price pressure in key vegetables is yet to abate, protein-based food items could also emerge as a pressure point, given the tight demand-supply balance in the case of pulses.

The RBI observes that the inflation outlook of non-food categories is fraught with uncertainty. Volatility in financial markets and rising asset prices also pose upside risks to the outlook. Headline inflation may remain elevated in the second quarter of 2020-21, but may moderate in the second half of 2020-21 aided by large favourable base effects.

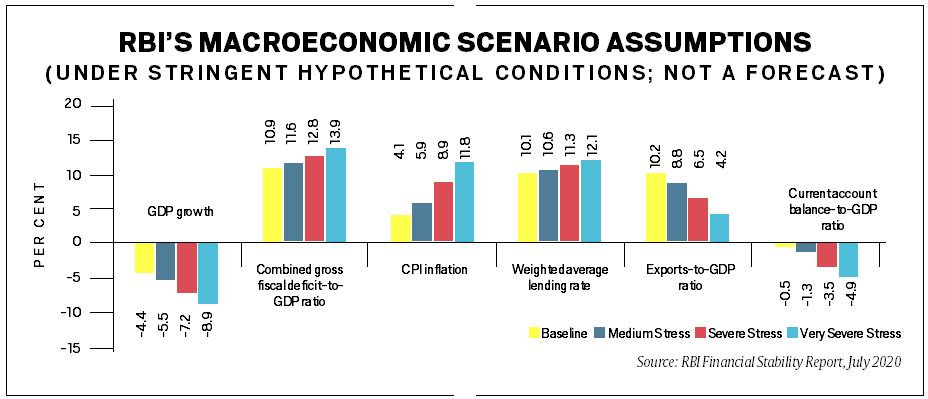

Source: RBI Financial Stability Report, July 2020

Source: RBI Financial Stability Report, July 2020

Is the previous interest rate cut working?

The RBI has claimed that cumulative reduction of 250 basis points in the repo rate since February 2019 is working its way through the economy, lowering interest rates in money, bond and credit markets, and narrowing down spreads. In May, the MPC had cut the repo rate by 40 bps to 4%, while maintaining its accommodative policy stance. In effect, over the last seven months, the MPC has already slashed the repo rate by 115 bps, although transmission by banks to customers is still to kick in fully. However, the RBI says transmission to bank lending rates has improved, with the weighted average lending rate on fresh rupee loans declining by 91 bps during March-June. On the other hand, deposit rates have also fallen, hitting savers.

What is the RBI assessment of the economy?

It says economic activity had started to recover from the lows of April-May following the uneven reopening of some parts of the country in June. However, fresh Covid-19 infections have forced renewed lockdowns in several cities and states, and several high-frequency indicators have levelled off. The RBI and many experts, including HDFC Chairman Deepak Parekh, have said the recovery in the rural economy is expected to be robust, buoyed by the progress in kharif sowing.

Manufacturing firms responding to the RBI’s industrial outlook survey expect domestic demand to recover gradually from Q2 and sustain through Q1 of 2021-22. For 2020-21 as a whole, real GDP growth is expected to be negative. Early containment of the pandemic may improve the outlook. A more protracted spread, deviations from the forecast of a normal monsoon, and global financial market volatility are the downside risks.

📣 Express Explained is now on Telegram. Click here to join our channel (@ieexplained) and stay updated with the latest

Is the RBI depending on the liquidity push to bring down rates and boost growth?

The liquidity measures announced by the RBI since February 2020 aggregated to about Rs 9.57 lakh crore — equivalent to about 4.7% of the 2019-20 nominal GDP. The RBI said the liquidity measures so far have helped in significant lowering of interest costs for corporate borrowers, resulting in effective transmission of lower policy rates and improvement in financial conditions. The situation for non-banking financial companies and mutual funds has stabilised since Covid-19 first jolted markets in March.

The RBI on Thursday announced an additional special liquidity facility of Rs 10,000 crore at the policy repo rate — Rs 5,000 crore each to the National Housing Bank and NABARD. This is expected to improve fund flow to the housing sector, NBFCs and microfinance institutions. Measures like loan restructuring are aimed at improving the liquidity position of companies and individuals.

Also in Explained | The two reasons why RBI did not cut interest rates, contrary to expectations

What is the new loan restructuring framework for stressed assets?

As the moratorium on loan repayments will end on August 31, banks and the RBI expect a spike in bad loans. Non-performing assets could rise to as high as 14.7% of total loans in the worst-case scenario by March 2021. In a big relief to stressed sectors hit by the pandemic, the RBI has opened an across-the-board, one-time restructuring window for those who are in default for not more than 30 days as on March 1, 2020. For restructuring of corporate and large loans, strict monitoring and adherence to norms have been specified to prevent ever-greening of bad loans. For corporate borrowers, banks can invoke a resolution plan until December 31, 2020 and implement it until June 30, 2021. In a major relaxation for the banks, the RBI said loan accounts should continue to be standard till the date of invocation.

Restructuring of large exposures will require independent credit evaluation by rating agencies and a process validation by an expert committee to be chaired by K V Kamath. To mitigate the impact of expected loan losses, banks need to make a 10% provision against such accounts under resolution. In the case of multiple lenders to a single borrower, banks need to sign an Inter-Creditor Agreement (ICA). The loan recast plan is expected to keep the bad loan level under check.

What about resolution of personal loans?

For these, the RBI has put in place a separate framework. Only those personal loan accounts which were classified as standard, but were not in default for more than 30 days as on March 1, 2020, are eligible for resolution. However, credit facilities provided by lenders to their own personnel/staff are not eligible. The resolution plan for personal loans can be invoked until December 31, 2020 and shall be implemented within 90 days thereafter. Unlike in the case of restructuring of larger corporate exposures, there will not be any requirement for third party validation by the expert committee, or by credit rating agencies, or need for ICA in case of personal loans. The term of the loans under resolution cannot be extended by more than two years. Resolution plans may include rescheduling of payments, conversion of any interest accrued, or to be accrued, into another credit facility.

Also read | What is the link between inflation rate and interest rate?

📣 The Indian Express is now on Telegram. Click here to join our channel (@indianexpress) and stay updated with the latest headlines

For all the latest Explained News, download Indian Express App.

© The Indian Express (P) Ltd