, Edited by Explained Desk | New Delhi |

Updated: August 2, 2020 1:22:08 pm

Reserve Bank of India Governor Shaktikanta Das interacts with the media at the RBI office, in New Delhi. File/Express Photo by Tashi Tobgyal

Dear Readers,

In the middle of the coming week — August 4 to 6 — the Reserve Bank of India’s Monetary Policy Committee will reconvene and evaluate RBI’s monetary policy stance. But this week’s meeting would test the RBI. Here’s why.

On paper, the RBI is required to target retail inflation. In other words, RBI is supposed to ensure that retail inflation — measured by Consumer Price Index — stays at 4% level. However, the RBI has a margin of 2 percentage points either way. So, retail inflation can swing between 2% and 6% and RBI is likely to be happy.

But, RBI doesn’t just look at retail inflation. It is also quite concerned with the country’s economic growth — although this is not its primary concern — and Governor Shaktikanta Das had said in March that the RBI will do whatever it takes to protect growth from the impact of Covid-19.

Under normal circumstances, when inflation rate spikes, it is because the economy is growing fast and so the Rbi only has to bother about containing inflation, and not about boosting growth.

On other occasions, like for most of 2019, when growth rate struggles, the inflation rate is well contained. Again, the RBI can focus on just one of these variables.

Today, the situation is fast turning into one of the most dreaded challenges any central bank can face: Inflation is spiking even though growth is faltering. GDP growth rate is likely to be negative this year— that is the GDP will contract (in comparison to the last financial year). Yet, retail inflation continues to stay above the 6% mark.

Efforts to boost growth — say by cutting interest rates in the economy — could further worsen the inflation rate. And curbing inflation would further damage India’s growth prospects.

📣 Express Explained is now on Telegram. Click here to join our channel (@ieexplained) and stay updated with the latest

That explains why different experts are expecting different decisions from the RBI in the coming week.

For instance, India’s largest public sector bank, the State Bank of India, expects that the RBI is likely to leave the repo rate unchanged in the upcoming policy review and instead possibly look for “unconventional policy measures” to ensure financial stability.

At the same time, Upasna Bhardwaj, Senior Economist at Kotak Mahindra Bank, continues to expect RBI cutting repo rate by 25 bps (basis points) in August, followed by a pause.

But, for the RBI, complications do not end here.

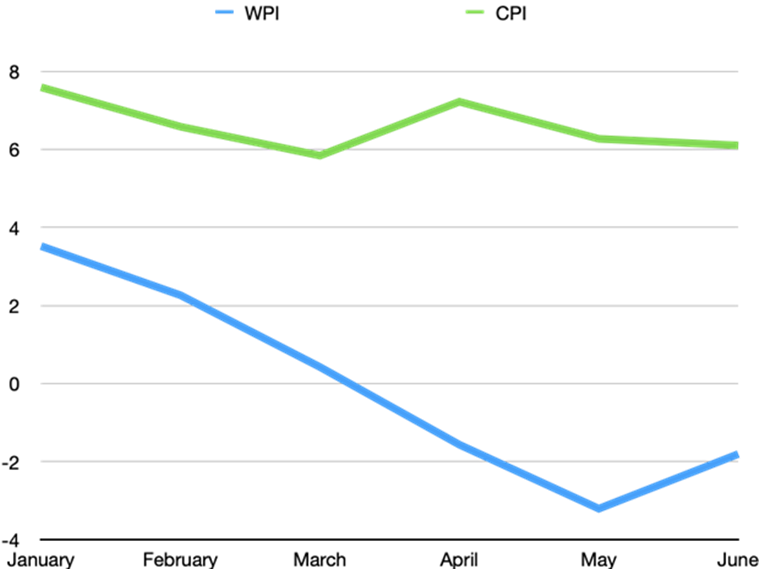

Within inflation, retail and wholesale inflation are charting fairly divergent paths (see Chart).

Retail and wholesale inflation since January this year

Retail and wholesale inflation since January this year

This creates an odd situation for monetary policymakers.

A high retail (CPI) inflation means that people expect prices to up further while a low or even negative (that is, prices are coming down) wholesale (WPI) inflation means the producers in the economy are losing out on pricing power.

If RBI only looks at CPI, it could keep the interest rate higher than what many wholesalers and business investors want. If it cuts interest rates to boost economic activity — by incentivising cheaper loans by firms — then it could fuel higher inflation expectations among consumers.

Of course, one could say, why should the RBI bother with wholesale inflation when it is mandated to contain only retail inflation. But, ignoring wholesale inflation (which provides a proxy for the pricing power of several businesses in the economy) may not be wise from the perspective of boosting growth.

This is still not the end of RBI’s worries.

Apart from these two conundrums, the RBI is also staring at a massive surge in non-performing assets in the banking system. According to the Financial Stability Report last week, gross NPAs could jump from 8.5% in March 2020 to 14.7% in March 2021.

As such, it is possible that the RBI may, outside the monetary policy purview, provide a one-time restructuring of loans (as against extending the moratorium period) for some of the most stressed sectors such as tourism, hospitality and real estate.

But extending moratoriums and loan restructurings are not steps that bankers enjoy. For one, they can be misused. Moreover, they do solve the issue causing stress; they just kick the can down the road.

Eventually, a lot of these decisions will depend on RBI’s outlook and impact of Covid-19. How many more months before things return to normal? Is the net effect of Covid disruption inflationary or disinflationary?

Watch out for the press conference on Thursday and stay safe!

Udit

📣 The Indian Express is now on Telegram. Click here to join our channel (@indianexpress) and stay updated with the latest headlines

For all the latest Explained News, download Indian Express App.