Foreign institutional investors (FIIs) remained net sellers for the fourth consecutive month in April offloading equities worth Rs 5,208.50 crore from the cash segment in Indian markets.

April, which saw a 23 percent relief rally from March lows, failed to inspire overseas interest in emerging markets, such as India, as investors preferred to park their money in local markets. The outflow was driven by the fall in INR/USD exchange rate, which dropped to its lowest levels on April 16 at Rs 76.87/dollar, a 5.7 percent drop from March 2 levels.

Overall, April saw a 14 percent surge in both Nifty and Sensex, primarily driven by positive global cues and attractive valuations following the carnage in March. The rally was broad-based as Nifty Midcap 100 and Nifty Smallcap 100 also logged double-digit gains, rising 13.02 percent and 16.93 percent, respectively. During the month, investor wealth increased by Rs 15.92 lakh crore, halving the March losses – the worst month since the 2008 global financial crisis – which wiped out Rs 33.38 lakh crore.

Of the 35 sectors classified by the BSE, foreign investors were net sellers in 24. Meanwhile, eight sectors saw positive flows and three witnessed no action from FIIs in April, data provided by National Securities Depository Ltd (NSDL) shows.

related news

Also Read: How foreign money travelled in times of COVID-19

The biggest carnage was seen in Other Financial Services, which saw an outflow of Rs 1,991 crore but was supported by Banks which were among the top gainers of overseas money at Rs 1,238 crore during April. The BSE identifies both sectors under one category – Total Financial Services – hence, the overall tailwind in the sector stood at Rs 753 crore.

The sharp sell-off from Other Financial Services segment can be attributed to the elevated risk of non-performing assets (NPAs) in the sector. In April, various experts warned of liquidity crunch and deteriorating asset quality, especially for the NBFCs due to the extended nationwide economic shutdown.

“For NBFCs, it looks more difficult (than banks) as only a few large corporate-backed NBFCs are able to raise capital. A smooth flow of liquidity is of utmost importance for NBFCs in the current scenario. NBFC will also struggle for growth and pressure on asset quality would increase,” Jaikishan Parmar, Senior Equity Research Analyst, Angel Broking told Moneycontrol.

As per BSE, Other Financial Services include financial institutions, holding companies, housing finance companies, investment companies, NBFCs, asset management companies and any other issuer dealing in financial services not categorised as banks or the aforementioned sub-categories.

Pharmaceuticals & Biotechnology was another sector which saw massive withdrawals of foreign funds at Rs 1,942 crore during April. Interestingly, it has been the top-performing sector in 2020 so far.

The sector which was already showing signs of recovery after a prolonged downtrend over the last few years, saw major inflows coming in March as pharma companies took centre stage in the battle against COVID-19.

The BSE Healthcare index has risen 14.17 percent on a year-to-date basis till April. Meanwhile, benchmark Sensex fell over 18 percent in the first four months of 2020.

Other sectors that foreign investors exited in April include Automobiles & Auto Components (Rs 1,923 crore), Software & Services (Rs 1,278 crore), Textiles, Apparels & Accessories (Rs 1,073 crore), Utilities (Rs 1,005 crore) among others.

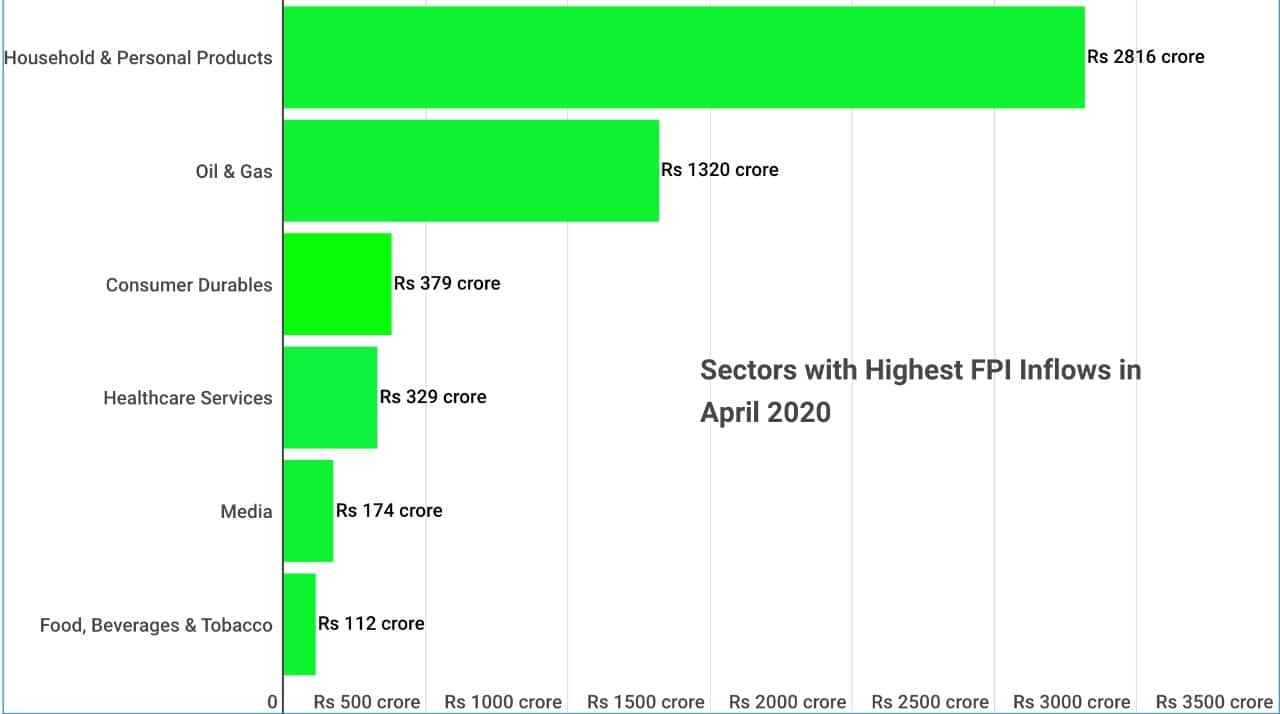

The Household & Personal Products sector was on the top of FIIs’ shopping list, raking in Rs 2,816 crore during the month.

Oil & Gas was another sector where foreign investors pumped money, as it garnered Rs 1,320 crore during the month. The sector was the second-biggest losers last month witnessing a withdrawal of Rs 9,764 crore in foreign funds.

Also Read: Despite highest-ever sell-off in March, FIIs bought into these 6 sectors

Other sectors that FPIs bought into include Consumer Durables (Rs 379 crore), Healthcare Services (Rs 329 crore), Media (Rs 174 crore), Food, Beverages & Tobacco (Rs 112 crore).

The three sectors which saw no action in April from FIIs were Food & Drugs Retailing, Real Estate Investment, Sovereign.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Moneycontrol Ready Reckoner

Now that payment deadlines have been relaxed due to COVID-19, the Moneycontrol Ready Reckoner will help keep your date with insurance premiums, tax-saving investments and EMIs, among others.