Some of Future Group companies to which banks have exposure include Future Consumer, Future Retail, and Future Enterprises. (Representative image. Source: Reuters)

Creditors of debt-laden Future Group are considering clubbing all group companies under the bankruptcy process after Reliance Industries Ltd called off a deal to acquire the Kishore Biyani-backed company’s retail, logistics, and warehouse assets.

Multiple bankers and legal experts told Moneycontrol on Monday that a group insolvency process could be the best way forward for banks to maximise debt recovery.

Group companies to which banks have exposure include Future Consumer Ltd, Future Retail Ltd and Future Enterprises Ltd.

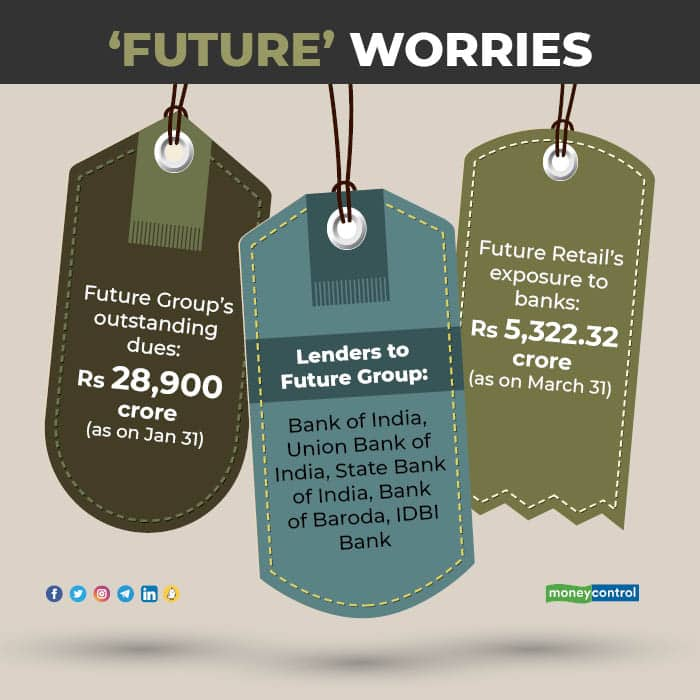

Lenders to the group include Bank of India, Union Bank of India, State Bank of India, Bank of Baroda, and IDBI Bank, among others. These lenders have, together, lent more than Rs 28,000 crore to the group as of January 31, according to the data sourced by Moneycontrol from banks.

Bank of India on April 14 filed insolvency proceedings against Future Retail for non-payment of dues. Future Retail owes banks Rs 5,322.32 crore as of March 31, according to Bank of India’s petition in the National Company Law Tribunal (NCLT).

Rapid expansion and acquisition of several retail assets have burdened Future Group with debt over the past few years. The company’s debt woes were exacerbated by the nationwide COVID-19 lockdown that strained its liquidity position and led to rating downgrades.

Future Retail alone made a loss of Rs 4,445 crore in the last four quarters, the company said in an exchange filing on February 26.

In a stock exchange filing on April 23, Reliance Industries said the $3.4 billion deal to take over the retail assets of Future Retail could not be implemented because the company’s secured creditors had “voted against the scheme.”

While over 75 percent of Future Group’s shareholders and unsecured creditors had voted in favour of the deal with Reliance, 69.29 percent of secured creditors rejected the deal and the remaining 30.71 percent voted in favour of it, Future Retail said in an exchange filing on April 22.

Wait-and-watch game

“The plan is now to start insolvency proceedings against all Future Group companies. Clearly, the majority of the lenders were not happy with what Reliance was offering in the deal, and were uncertain about some aspects of it,” said a banker with a leading state-run bank that has exposure to Future Group.

“Now, there is no option but to wait and watch. Once the formal insolvency process begins, let Reliance come and submit a fresh bid,” added the banker, who requested anonymity.

Another senior banker with a state-owned bank said: “Right now, banks are looking at how to get the best value out of Future Group’s assets, and the process of starting insolvency proceedings against all of Future Group companies will be initiated shortly.”

Ideally, when a bankruptcy process is initiated, the Committee of Creditors selects a resolution professional who takes care of the entire debt resolution process. The committee also calls for potential suitors to bid for assets of the company and votes for the highest bidder.

Uncertainty ahead for banks

To be fair, banks have already made provisions against Future Group accounts to shield their balance sheets from a potential default. Given the history of long-drawn-out insolvency proceedings, analysts said this could mean banks will take a long time to recover their loans.

According to Asutosh Mishra, head of research at Ashika Stock Broking, even if there are potential suitors, bids are likely to be close to the liquidation value of the group and that could mean “minimal recovery” for lenders.

“Apart from a few large cases, overall recovery from the IBC process has been very low for banks, and this time, given Future Group’s complex (legal) situation, it should be no different,” Mishra said. IBC is short for the Insolvency and Bankruptcy Code.

Mishra was referring to Future Group’s insolvency process, which faces legal hurdles from US online retail giant Amazon.com Inc.

In 2019, Amazon invested $200 million in Future Coupons Pvt Ltd, the group’s gift voucher unit, for a 49 percent stake, by virtue of which the US company secured a 7.3 percent foothold in Future Retail. Amazon tried to block Future Group’s deal with Reliance by obtaining a freeze order on it from a Singapore arbitration court. The dispute gradually snowballed into a slew of cases that are pending across multiple Indian courts.

New valuation methodology

Analysts also said prospective bidders may want to submit fresh bids to acquire the company, but its valuation methodology will have to consider the value erosion of Future Group’s assets and a fresh assessment of the company’s debt obligations.

“Now that the companies will most likely be dragged in the insolvency court, potential suitors, and that could also include Reliance, will have to re-work the asset size of the company and submit fresh bids. Depending on the size of the new bids, banks will reassess their haircuts and debt recovery potential,” said Sanjiv Bhasin, director at IIFL Securities Ltd.

Legal experts said banks can file an insolvency application under section 7 of the IBC and that it could be their best option of going ahead.

“For the Future Groups companies, a restructuring scheme is not a possible option,” said Anushkaa Arora, principal and founder, ABA Law Office.

“Under the IBC, Reliance Retail can participate in the bidding process for Future Group’s assets and bid afresh to take over the company’s assets,” Arora added.

According to Pooja Chakrabarti, a partner at Argus Partners (Solicitors & Advocates), as the businesses of the Future Group companies are dependent on each other, a complete resolution would make more sense.

“Banks could also move the Debt Recovery Tribunal seeking repayment of outstanding dues, injunction against alienation of assets and allied prayers against the defaulting entities,” Chakrabarti added.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Download your money calendar for 2022-23 here and keep your dates with your moneybox, investments, taxes