Road engineering, procurement and construction (EPC) company GR Infraprojects opens its initial public offering for subscription on July 7, the 25th such public offering of 2021 that is likely to see a record number of businesses hitting the market.

Shares are proposed to be listed on the BSE as well as National Stock Exchange. HDFC Bank, ICICI Securities, Kotak Mahindra Capital Company, Motilal Oswal Investment Advisors, SBI Capital Markets and Equirus Capital are the book running lead managers to the issue.

Here are 10 key things to know about the issue:

1) Public issue

The public issue will be a complete offer for sale of up to 1,15,08,704 equity shares, including an employee reservation portion.

The offer for sale comprises 11,42,400 equity shares by Lokesh Builders, 1,27,000 equity shares by Jasamrit Premises, 80,000 by Jasamrit Fashions, 56,000 by Jasamrit Creations, 44,000 by Jasamrit Construction, 64,14,029 by India Business Excellence Fund 1, 31,59,149 by India Business Excellence Fund and 4,86,126 equity shares by Pradeep Kumar Agarwal.

Around 2.25 lakh equity shares will be set aside for eligible employees who will get them at a discount of Rs 42 a piece to the final price.

2) Dates

The public issue will open for subscription on July 7 and close on July 9. The anchor book, if any, will open for a day on July 6.

To Know All IPO Related News, Click Here

3) Price Band

The price band for the offer has been fixed at Rs 828-837 per equity share.

4) Lot size and reserved portion

Investors can bid for a minimum of 17 equity shares and in multiples of 17 thereafter. At a higher price band, retail investors can invest a minimum of Rs 14,229 and a maximum of Rs 1,99,206 as they are allowed to invest up to Rs 2 lakh in the IPO.

Up to 50 percent of the net offer is reserved for qualified institutional buyers, 15 percent for non-institutional bidders and 35 percent for retail investors.

5) Objects of the issue

Being an offer for sale, the company will not receive any proceeds from the IPO. All the money (excluding issue expenses) will go to selling shareholders.

Also read: GR Infraprojects IPO: Shares available at 26-38% premium in grey market ahead of the issue

6) Company profile

Incorporated in 1995, GR Infraprojects is an integrated EPC company with experience in design and construction of road and highway projects across 15 states. It recently diversified into projects in the railway sector.

Its principal business operations are broadly divided into three categories. Civil construction activities under which it provides EPC services; development of roads, highways on a build operate transfer (BOT) basis, including under annuity and hybrid annuity model (HAM); and manufacturing activities.

Under the manufacturing activities, the company processes bitumen, manufactures thermoplastic road-marking paint, electric poles and road signage and fabricates and galvanizes metal crash barriers.

Since 2006, the company has executed over 100 road construction projects. Out of its BOT projects, it has one operational road project which has been constructed and developed on a BOT (annuity) basis and 14 road projects under the HAM, out of which five projects are operational, four are under construction and the work is yet to commence on five of these projects. The company also has experience in constructing state and national highways, bridges, culverts, flyovers, airport runways, tunnels and rail over-bridges.

Also read: Clean Science IPO versus GR Infraprojects: Which one should you choose?

7) Competitive strengths, business strategy

a) It is a EPC player with focus on road projects.

b) It has an established track record of timely execution.

c) It has an in-house integrated model.

d) It has a strong credit rating and financial track record.

e) It has experienced promoters with a strong management team.

Business strategy

a) The company intends to continue to focus on road EPC business.

b) It plans to pursue other segments within the EPC space.

c) It intends to leverage core competencies with enhanced in-house integration.

d) It intends to strengthen internal systems and continue to focus on technology and operational efficiency.

e) It intends to maintain financial discipline coupled with the strategy to monetise assets.

8) Financials and peer comparison

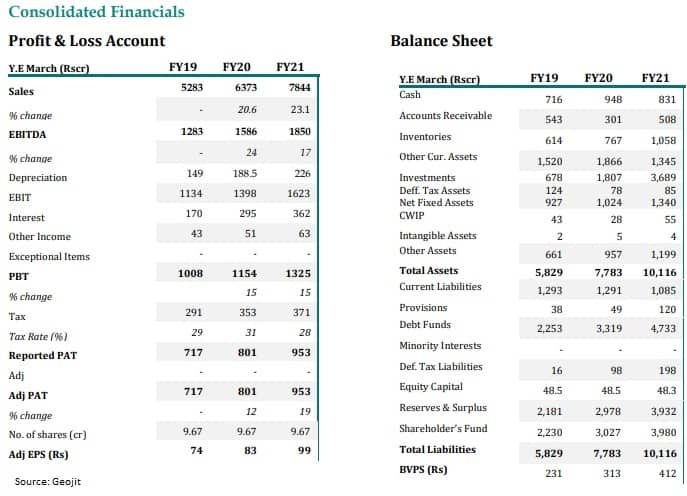

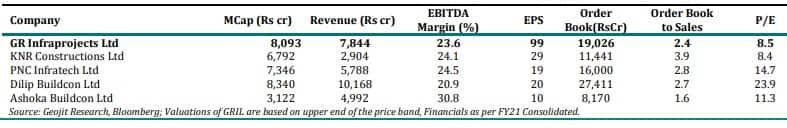

The significant growth in business over the last three fiscal years has contributed significantly to financial strength. Its revenue from operations, during FY19-FY21, increased at a CAGR of 21.86 percent to Rs 7,844.13 crore, while profit at Rs 953.22 crore in FY21 increased at a CAGR of 15.33 percent in the same period. Earnings before interest, tax, depreciation and amortisation (EBITDA), on a consolidated basis, grew at a CAGR of 20.08 percent during the same period.

9) Promoters and management

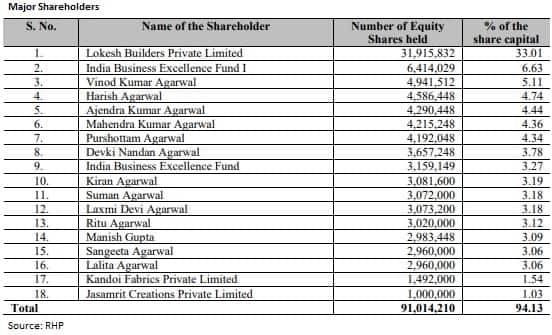

Promoters of the company are Vinod Kumar Agarwal, Ajendra Kumar Agarwal, Purshottam Agarwal and Lokesh Builders. The promoters hold a 46.89 percent stake in the company.

Vinod Kumar Agarwal is the chairman and also a whole time director. He has over 25 years of experience in the road-construction industry. He looks after the strategy and policy formulation and liaises with

various departments of the government. He also oversees bidding, tendering and planning.

Ajendra Kumar Agarwal is the managing director. He has a bachelor’s degree in civil engineering from Jodhpur University and has experience of over 25 years in the road construction industry. He is responsible for overseeing the overall functioning of the company, especially the operational and technical aspects. He heads the in-house design team and is also the head of budgeting, planning and monitoring processes.

Vikas Agarwal and Ramesh Chandra Jain are whole time directors, while Chander Khamesra, Kalpana Gupta, and Rajendra Kumar Jain are non-executive independent directors. Desh Raj Dogra is an additional director (non-executive independent director).

10) Allotment, refunds and listing dates

The company will finalise the basis for the allotment of shares July 14. Refunds and unblocked of funds from ASBA account will be done the next day.

Shares will be credited to the demat accounts of eligible investors on July 16, and the trading will commence from July 19, as per the schedule available in the red herring prospectus.