The tribe of women home-owners is growing in India. According to a consumer sentiment survey released by Anarock, 62 percent Indian women prefer investing in real estate. At least 82 percent women participants would buy a house for end-use, while 18 percent may consider it for investment. Over 70 percent women respondents consider this to be an ideal time to buy a property. The survey involved 3,900 participants of which 36 percent were women.

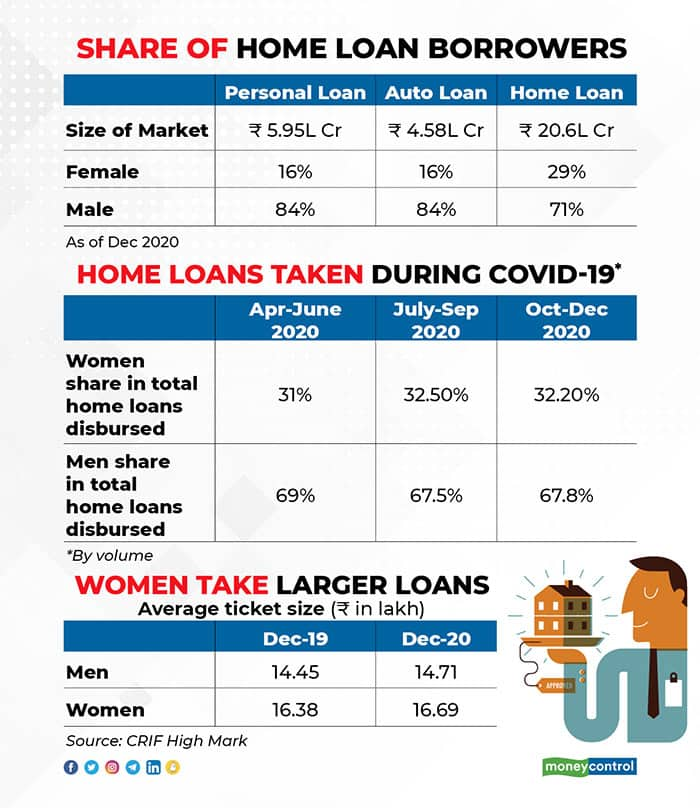

What’s more, Indian women borrowers are also taking larger home loans. As per data from credit information company CRIF High Mark, the average home loan ticket size borrowed by women is 13 percent higher than those taken by men. Both the segments have seen a growth of 2 percent over last year. During the pandemic, the volume of home loans disbursed in the three quarters of FY 2020-21 was in the range of 31-32 percent for women borrowers.

Navin Chandani, MD and CEO of CRIF High Mark says, “We are seeing a steady rise in credit consumption from women. It is encouraging to see more women taking charge and availing a loan independently to own a house. As more women opt for smart financial choices, the credit market must develop innovative offerings to boost this segment further.”

Why women should be primary applicants of a home loan

Many banks and housing finance companies (HFCs), including State Bank of India (SBI) and HDFC, offer a concession of 5 basis points (a basis point is one-hundredth of a percentage point) where women are the first applicants. “Women as a category get differentiated pricing where they have co-ownership of the property,” says Y. Viswanatha Gowd, the MD and CEO of LIC Housing Finance.

“Interest rates are at a multi-year low, developers have reduced residential property prices, there is an inventory of ready-to-move-in houses available as well as the benefit of lower stamp duty,” says Ambuj Chandna, President, Consumer Assets, Kotak Mahindra Bank.

Lenders give favourable treatment to women borrowers. Renu Sud Karnad, Managing Director of HDFC says, “Our data analytics indicates that loan default among women applicants is lower. Thus, a woman’s chances of being approved for a home loan are higher.” At HDFC, 40 percent home loan borrowers are women as of financial year 2019-20.

At LIC housing finance, the share is around 26 percent as of December 2020, while at State Bank of India (SBI), it’s 28 percent as of February 2021.

Lower interest rates on home loan

State Bank of India and Kotak Mahindra Bank have reduced home loan rates, effective March 1. Kotak Mahindra Bank reduced its home loan interest rates to 6.65 percent per annum – the lowest in the market, followed by SBI with home loan interest rate of 6.70 percent for loans up to Rs 75 lakh and 6.75 percent for loans above Rs 75 lakh to Rs 5 crore. For women borrowers, the deals could be even sweeter. ICICI Bank also reduced interest rate to 6.70 percent, effective March 5.

In order to encourage more women to become property owners, most of the financial institutions have differential pricing, which is lower for women home buyers. “The discount in interest rates is to make home loans more affordable for women home buyers,” says Anil Kaul, MD, Tata Capital housing finance.

“This concession might seem small, but a home loan is a long-term commitment, and even a small difference will add up to a huge sum over a 15-20-year loan tenure,” says Raj Khosla, MD at MyMoneyMantra.com.

Also read: SBI, Kotak cut home loan rates: Now is the best time to buy a house

Lower stamp duty charges

Stamp duty charges are lower if property registration is executed in the name of a woman, although these charges vary from state to state. “In Delhi, for instance, the stamp duty payable by men is 6 percent of the value of the property. But in the case of women, the stamp duty is only 4 percent. That’s a straight saving of Rs 4 lakh on a property worth Rs 2 crore,” says Khosla. Several other states, including Bihar, Haryana, Punjab, Maharashtra, Orissa and Uttar Pradesh offer similar concessions of 0.5 to 3 percent on stamp duty to women home buyers (either as a sole owner or as a joint owner).

Also read: Women emerge as key homebuyers after COVID-19; as many as 71% prefer to buy ready-to-move homes

Government policies that support women homebuyers

Various government policies support and promote women ownership in India. For instance, to avail homes under the government’s flagship scheme Pradhan Mantri Awas Yojna (PMAY) introduced in 2015, it has been made mandatory to include a woman in the ownership of the property. The credit subsidy under the PMAY scheme is available only if a woman is the co-owner of the property.

In case a woman is the sole applicant, then she can receive interest rate subsidy of 3-4 percent under the credit-linked subsidy scheme (CLSS). “With the mandatory sole or co-ownership clause in CLSS, which is applicable for availing subsidy, has enabled women’s participation in house purchase,” says Abhay Kataria, Business Head – Housing, Ujjivan Small Finance Bank.

“The scheme gives priority to women in the economically weaker section and low income group category. One can expect a subsidy under this scheme of between Rs 2.30 lakh and Rs 2.67 lakh,” says Karnad.

Also read: How taxation on housing transactions changed under the Modi government

Tax benefits

All loan takers enjoy a tax deduction on repayments with the maximum deduction allowed in principal Section 80 C as well as the interest under section 24 at Rs 1.5 lakh and Rs 2 lakh, respectively. The combined income of the couple means higher loan eligibility and more tax benefits for the couple.