The domestic aviation market has grown by leaps and bounds, but so have pricing pressures, which have gobbled up many in the past.

The two-plus year hiatus on price wars in the Indian skies has come to an end. As the government announced withdrawal of fare caps which have been in place since May 2020, airfares are nosediving in many sectors. This is likely to put an end to the regime of high air fares and squeeze profitability, putting financially weak airlines in a spot.

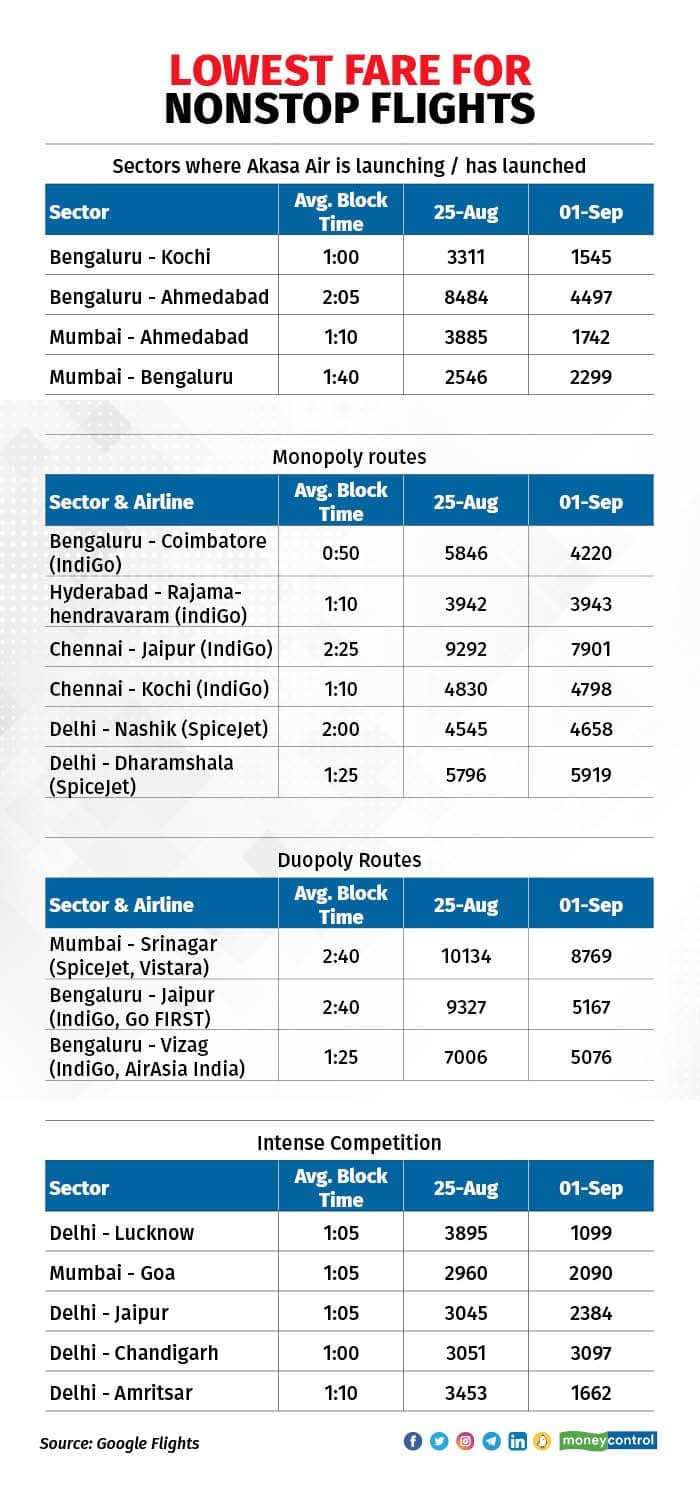

Airfares are now touching new lows. In fact, ticket prices are so low that on certain sectors like Delhi–Lucknow, they are lower than RCS-UDAN fares of similar duration. In this acronym happy country, RCS stands for Regional Connectivity Scheme, and UDAN for Ude Desh ka Aam Nagrik. The RCS-UDAN fares are subsidised and capped, while fares on all other routes are dynamic and largely driven by demand and capacity.

Soon as the circular was out, the undercutting started. An extreme fare war is in the offing on routes where Akasa Air is launching flights. With additional capacity on the same routes, the new entrant will face an intense fight for passengers.

New entrant

The capacity and fare war started when Akasa Air announced its inaugural routes. On many routes like Mumbai-Ahmedabad, Bengaluru-Kochi, and Bengaluru-Ahmedabad, fares for September 1 are less than half what they were a week prior.

The war is so intense on the Bengaluru-Kochi route that airlines seem to be competing with bus services, as the airfare is cheaper than AC sleeper bus fare on the same date.

Such severe competition could either push the weakest player out of the market, or, if everyone decides to hang around, delay their path to profitability.

In high volume, high frequency sectors like Delhi–Lucknow, seats are available for just Rs 1,099. Though a similar short flight to Chandigarh costs Rs 3,000, a slightly longer flight to Amritsar is available for just Rs 1,662.

Monopoly routes stand out

Per data shared by OAG aviation, IndiGo plans to operate 743 routes in India. Half of these are monopoly routes for the airline. SpiceJet has a monopoly in 42 percent of its routes. None of them have dropped fares on these routes. Other airlines have very few monopoly routes.

For example, Bengaluru-Coimbatore is a short 50-minute hop on an Airbus A320. The cheapest fare for September 1 is Rs 4,220, similar to the cheapest Bengaluru-Ahmedabad fare, which takes more than twice the time. Had it not been for monopoly routes, it may have been impossible for airlines to make ends meet.

On some duopoly routes, airlines have managed to hold on to their pricing, while on some they have not.

Pricing pressure down the decades

A lot of factors influence pricing. These include competition, demand, supply, costs, and potential cargo revenues. Monopoly routes help airlines shore up revenues while undercutting on other sectors. But monopoly routes are bad for those that fly these sectors as they have to subsidise the cut-throat competition on some of the other routes.

It is standard business practice to sell seats in advance cheaper to capture the market. But the airlines are in a quandary. Whether to drop fares and attract passengers, or arrest the slide and maybe even increase the average fare. If the last quarter is anything to go by, the fare wars do not bode well.

It is difficult to ascertain which was the first airline to drop fares. Every airline on the route is forced to drop fares and come closer to the lowest fare to attract passengers, as India is a highly price-sensitive market.

The domestic market has grown by leaps and bounds, but so have pricing pressures, which have gobbled up many in the past.

I recently came across a news article from 2006, when Air Sahara announced flights to Indore from Delhi at fares starting from Rs 1,975, plus taxes. Similar rates are available even today, though costs have increased manifold.