According to the DRHP filed by Zomato, the food-delivery platform will offer equity shares aggregating up to Rs 8,250 crore. Of this, Rs 7,500 crore will be a fresh issue, while Rs 750 crore will be an offer for sale for its existing investor Info Edge.

Food delivery platform Zomato filed a Draft Red Herring Prospectus (DRHP) with the market regulator SEBI on April 28, 2021. According to the DRHP filed by Zomato, the company will offer equity shares aggregating up to Rs 8,250 crore. Of this, Rs 7,500 crore will be a fresh issue, while Rs 750 crore will be an offer for sale for its existing investor Info Edge. Here are the some of key financials and risk factors listed by the food delivery platform in its DRHP.

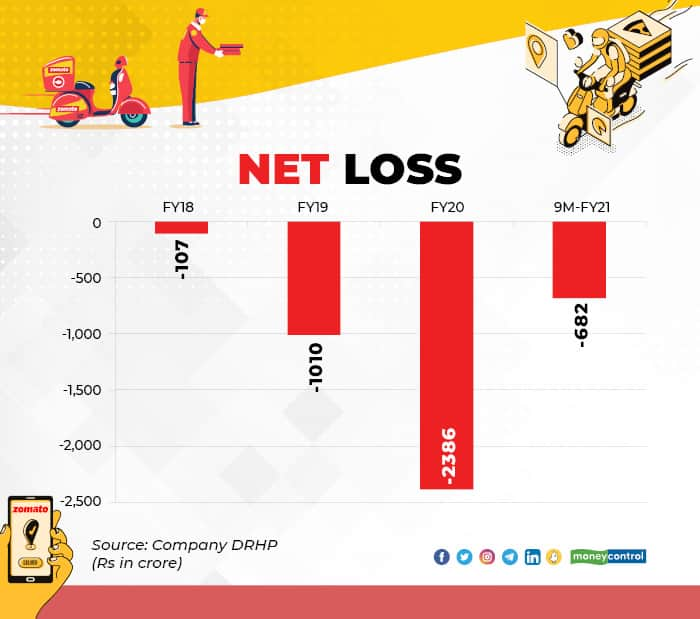

The food-delivery startup has a history of net losses from fiscal year FY18 to FY20 and even in the nine months ended December 31, 2020, it had a loss of Rs 682 crore. Risk Factor: The company said it has a history of net losses and anticipates increased expenses in the future.

The food-delivery platform saw a good revenue growth in FY19 and FY20. However, its nine-month data is a bit lower. In fact, the company said that its revenue may decrease and it may not be able to sustain historical growth rates and historical performance may not be indicative of future growth or financial results. Risk Factor: Zomato has said its revenue may decrease and the business may be adversely affected if it fails to retain existing restaurant partners, customers, or delivery partners or fails to add new restaurant partners, delivery partners, or customers to its portfolio in a cost-effective manner.

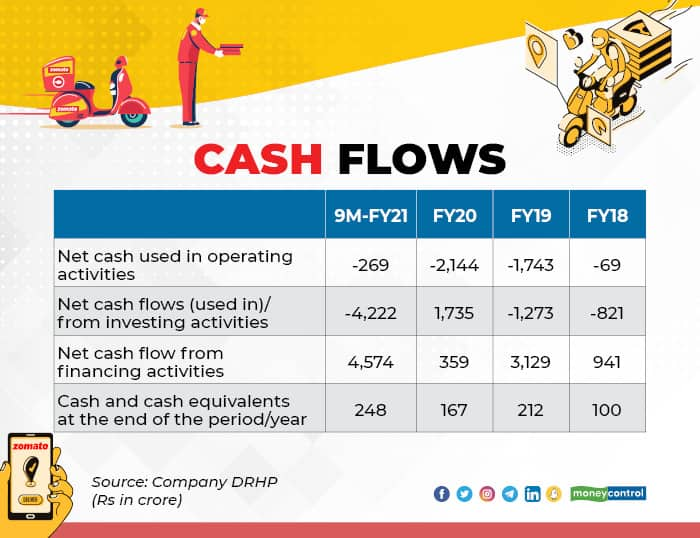

Net cash used in operating activities for the nine months ended December 31, 2020 was Rs 269 crore, cash flow in investing activities was Rs 4,222 crore, which included payment to acquire liquid mutual fund units, while cash flow from financing activities was Rs 4,574 crore.Risk Factor: The COVID-19 pandemic, or a similar public health threat, has had and could impact the business, cash flows, financial condition and results of operations. The company said its business, cash flows and prospects may be materially and adversely affected if it is unable to continue to provide services to its restaurant partners or to implement its strategy of enabling more restaurants with more solutions.”The unfavourable media coverage could harm its business, financial condition, cash flows and results of operations,” it said. It also noted that it faces “intense competition” in food delivery and other businesses and its business, financial condition, cash flows and results of operations could be adversely affected if the company is unable to compete effectively”.

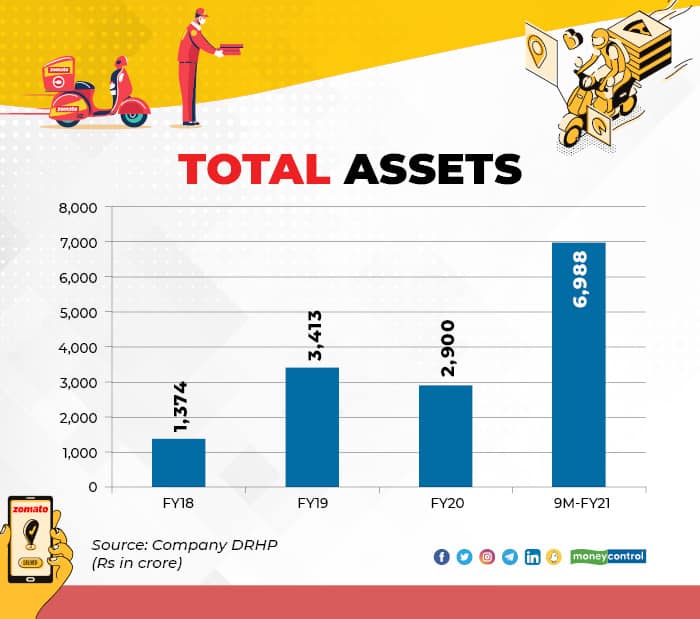

As of December 2020, the company had a total assets value of Rs 6,988 crore as against Rs Rs 2900 crore in FY20.

Ritesh Presswala Research Analyst at Moneycontrol