In the year after last Independence Day, the market hit a record high in October 2021 and since then it has not seen that level yet due to several events, largely on the global front, which brought lot of volatility, but in between 13 stocks and one index clocked multibagger returns.

The BSE Sensex and Nifty50 registered little more than 7 percent gains in last one year despite a lot of volatility. The BSE Midcap and Smallcap indices climbed nearly 8 percent and 6 percent respectively.

After a healthy returns since pandemic, the market has seen major correction of more than 18 percent during the last one year and hit a fresh 52-week low in June. In between, the two attempts made by the benchmark indices to scale record highs failed – first because of the third Covid wave and the second due to the Ukraine-Russia war. Now, once again the market seems to be ready and inching towards a historical level.

Whether that would be possible in this attempt or not is a big question now, but experts seem bullish given the gradually changing global environment and expect the indices to make a new high before the end of this calendar year itself if China-Taiwan maintain peace.

Also read – Rakesh Jhunjhunwala’s journey from Rs 5,000 to $ 5.5 billion and everything in between

High valuations, rising fear of policy tightening which came true in current financial year, third Covid wave in early parts of this calendar year, geopolitical tensions over Ukraine-Russia war which pushed inflation to multi-year highs, fears of growth slowdown in the US and Europe, and consistent FII selling of Indian equities hit the market sentiment during the year gone by.

With the return of foreign investors through the last few weeks amid hope that inflation concerns may be easing now and central banks may take soft approach towards policy tightening to avoid its impact on growth, the market has showed strong recovery in the last couple of months, rising more than 16 percent from the June lows.

“In all likelihood, 20,000 on the Nifty is coming sooner than next Independence Day, probably before the end of calendar year 2022. The only caveat is that China and Taiwan should not begin a war,” said Manish Sonthalia, Executive Director, CIO – PMS, Offshores & Alternates, at Motilal Oswal AMC.

Also read – Rakesh Jhunjhunwala | Of 32 stocks and a net worth of Rs 32,000 crore

Since the last Independence Day, the market has seen only 13 multibagger stocks in the BSE50 index, which was much less compared to 181 a year back, largely due to correction and volatility in the markets. Even the breadth was not very strong as one share advanced against one declining share in the index, against 9:1 advance-decline ratio in previous year.

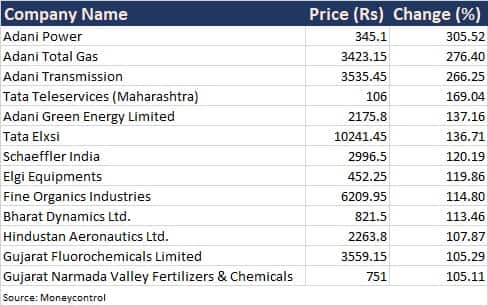

Among 13 stocks, four stocks out of top five were from Adani group including Adani Power (up 305 percent), Adani Total Gas (up 276 percent), Adani Transmission (up 276 percent), and Adani Green Energy (up 137 percent).

Tata Teleservices (Maharashtra), Tata Elxsi, Schaeffler India, Elgi Equipments, Fine Organics Industries, Bharat Dynamics, Hindustan Aeronautics, Gujarat Fluorochemicals, and Gujarat Narmada Valley Fertilizers & Chemicals surged 105-169 percent.

Moreover, Timken India, Adani Enterprises, Varun Beverages, Indian Hotels Company, Chalet Hotels, Deepak Fertilizers and Petrochemicals Coporation, Linde India, and Brightcom Group also had strong run-up in the same period, rising more than 90 percent each.

Apart from stocks, one index also joined the multibagger list in the last one year which was SME IPO index with a massive 155 percent rally.

Also read – A look at Rakesh Jhunjhunwala’s timeless mantras for retail investors

Among sectors, there was a mixed trend with defensives and cyclicals like metals underperformed. The BSE Power index was the biggest wealth creator that gained 79 percent, followed by Auto (up 30 percent), Energy (up 29 percent), Capital Goods (up 27 percent), and Oil & Gas (up 25 percent), whereas IT, Pharma and Metal indices were down 8-11 percent from last Independence Day.

The wealth of investors has increased by nearly Rs 35 lakh crore as the BSE market capitalisation jumped to Rs 275.07 lakh crore on last trading day before the 76th Independence Day, increasing from Rs 240.23 lakh crore on August 13, 2021.

Due to several reasons, the wealth creation was definitely lower if compared with the journey of almost last two months. The wealth recorded by investors since June 2022 lows was around Rs 40 lakh crore.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.