Information technology (IT) services bellwether Infosys on Wednesday posted a 17.47 per cent year-on-year (YoY) growth in net profit at Rs 5,076 crore for the March quarter of financial year 2020-21 (Q4FY21) as against Rs 4,321 crore posted in the same period last fiscal.

Sequentially, however, the figure dipped by 2.32 per cent from Rs 5,197 crore posted in the December quarter of FY21.

The revenue for the quarter under review, meanwhile, stood at Rs 26,311 crore, up 13.08 per cent YoY and 1.5 per cent quartet-on-quarter. The same figure stood at Rs 23,267 crore in Q4FY20 and Rs 25,927 crore in Q3FY21.

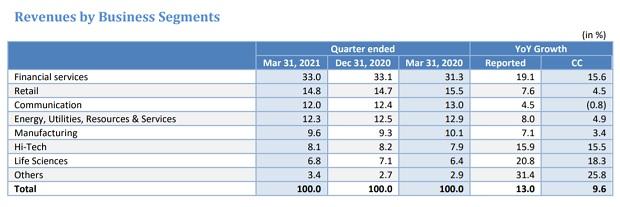

The revenues in CC (constant currency) terms grew by 9.6 per cent YoY and 2.0 per cent QoQ. In dollar terms, the company reported revenue at $3,613 million, a growth of 13 per cent YoY. The digital revenues for the quarter under review stood at 51.5 per cent of the total revenues, a CC growth of 34.4 per cent YoY.

Source: Infosys’ financial statement

“We have crossed a milestone of Rs 100,000 crore in revenue in FY21. Our intense focus on client relevance, growing our digital portfolio with differentiated capabilities like Infosys CobaltTM, and empowering employees have helped us emerge as a preferred ‘partner-of-choice’ for our global clients. Our record large deal wins stand testimony to the effectiveness of this approach,” Salil Parekh, CEO and MD, said in a statement.

The firm met analysts’ expectations of a 14-23 per cent YoY rise in the March quarter net profit and 13-14.5 per cent growth in the revenue (in rupee terms). READ HERE

Further, the IT bellwether’s operating profit in the March quarter rose 30.7 per cent YoY to Rs 6,440 crore as against Rs 4,927 crore in the same period last fiscal. Meanwhile, on a quarterly basis, it slipped by 2.3 per cent from Rs 6,589 crore posted in the December 2020 quarter.The operating margin for the March quarter came in at 24.5 per cent an increase of 3.4 per cent YoY and a decline of 0.9 per cent QoQ.For the full financial year, Infosys delivered a 5 per cent CC growth. Large deal TCV (total contract value) for FY21 peaked to an all-time high of $14.1 billion with 66 per cent being net new. Operating margin for the year expanded by 3.2 per cent.It also recommended a final dividend of Rs 15 per share for FY21. Together with the interim dividend of Rs 12 per share already paid, the total dividend paid by the company for FY21 will amount to Rs 27 per share.Guidance

For FY22, Infosys forecasts revenue growth of 12-14 per cent in CC terms while it posted operating margin guidance of 22-24 per cent for the next fiscal year, along expected lines.“A strong momentum exiting FY21, alongside a focused strategy to accelerate client digital journeys, gives us confidence for a stronger FY22”, Parekh added. Buyback programme

The company board approved share buyback programme worth up to Rs 9,200 crore priced at Rs 1,750 per share, a premium of 25.12 per cent over the stock’s closing price on the BSE, of Rs 1,398.60 per share, as on Tuesday.

The shares of the firm closed at Rs 1,398.60 on the BSE, down 1.91 per cent. The stock market was close for a holiday on Wednesday on account of Dr. Baba Saheb Ambedkar Jayanti.