LIC policyholder’s funds have a well-diversified investment portfolioLIC is the largest asset manager in India as at 30th September 2021, with an AUM of Rs 39,55,892.9 crore on a standalone basis.Also, the investments of LIC are mostly into top graded equity/debt instruments which can be seen from the fact that as of September 30, 2021.95.9 percent of LIC’s debt AUM on a standalone basis was invested in sovereign and AAA rated securities.Over 90 percent of policyholders’ equity investments on a standalone basis are held in stocks that are a part of the Nifty 200 and BSE 200 indices.

LIC IPO Day 3: Total subscription at 1.24 times

The initial public offering of country’s largest life insurance company Life Insurance Corporation of India has subscribed 1.24 times, receiving bids for 20.02 crore equity shares against offer size of 16.2 crore equity shares.

The portion set aside for policyholders portion has been subscribed 3.66 times, employees 2.78 times, and retail investors subscribed 1.12 times, while QIBs bid for 50 percent shares of their allotted quota and NII lapped up 60 percent of their portion.

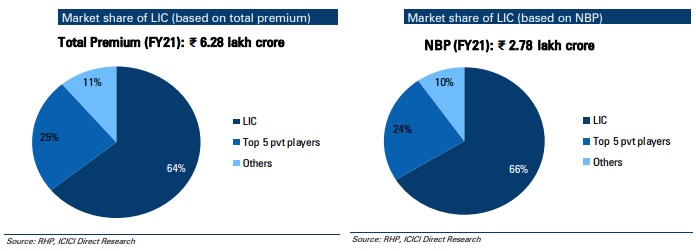

Market Share of LIC

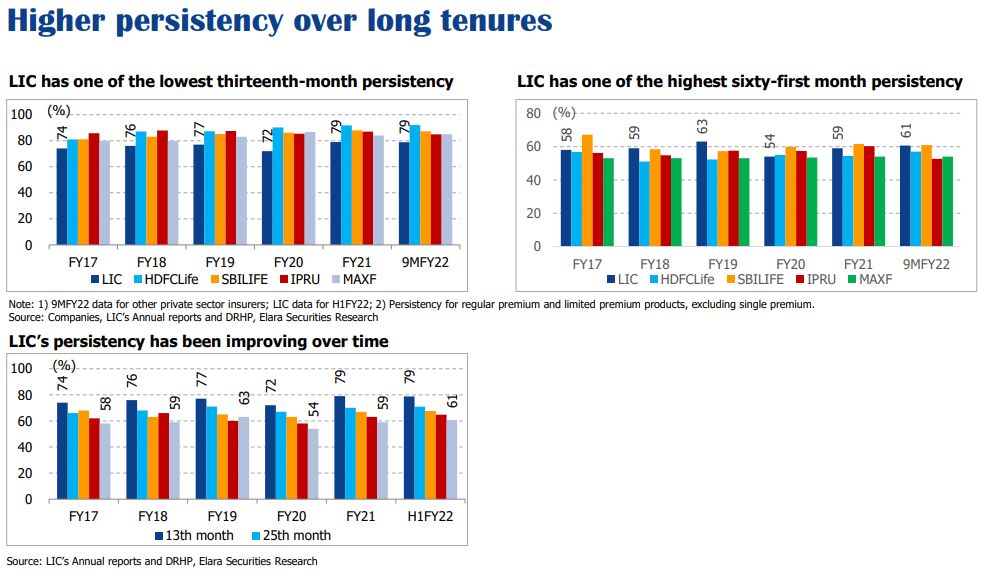

LIC Enjoys Higher Persistency Over Long TenuresPersistency ratio is calculated on the basis of number of policyholders who consistently pay their renewal premium or how the insurance company is able to retain its business in every financial year without policies being lapsed.

LIC IPO Day 3: Total subscription at 1.23 times

The initial public offering of country’s largest life insurance company Life Insurance Corporation of India has subscribed 1.23 times, receiving bids for 19.87 crore equity shares against offer size of 16.2 crore equity shares.

The portion set aside for policyholders portion has been subscribed 3.64 times, employees 2.76 times, and retail investors subscribed 1.11 times, while QIBs bid for 50 percent shares of their allotted quota and NII lapped up 59 percent of their portion.

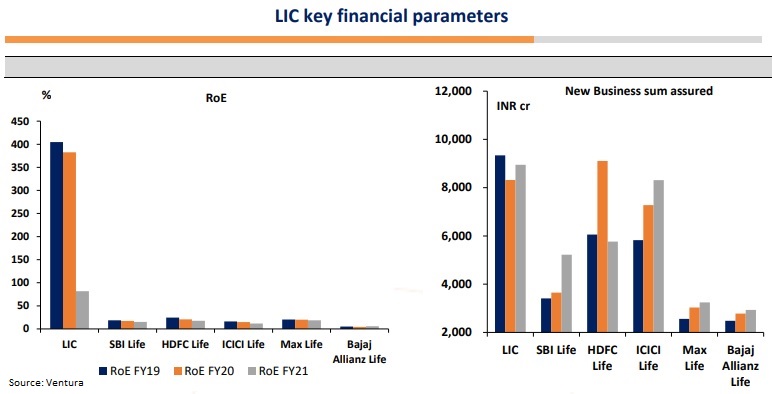

LIC Key Financial Parameters

LIC IPO Day 3: Total subscription at 1.20 times

The initial public offering of country’s largest life insurance company Life Insurance Corporation of India has subscribed 1.20 times, receiving bids for 19.37 crore equity shares against offer size of 16.2 crore equity shares.

The portion set aside for policyholders portion has been subscribed 3.61 times, employees 2.73 times, and retail investors subscribed 1.10 times, while QIBs bid for 41 percent shares of their allotted quota and NII lapped up 58 percent of their portion.

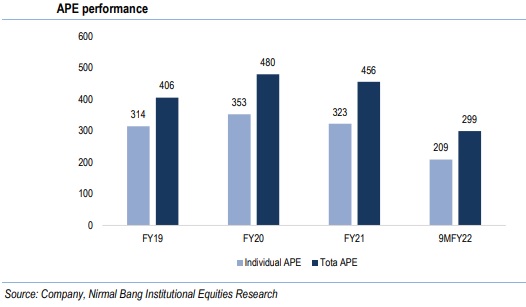

LIC’s Annual Premium Equivalent Performance

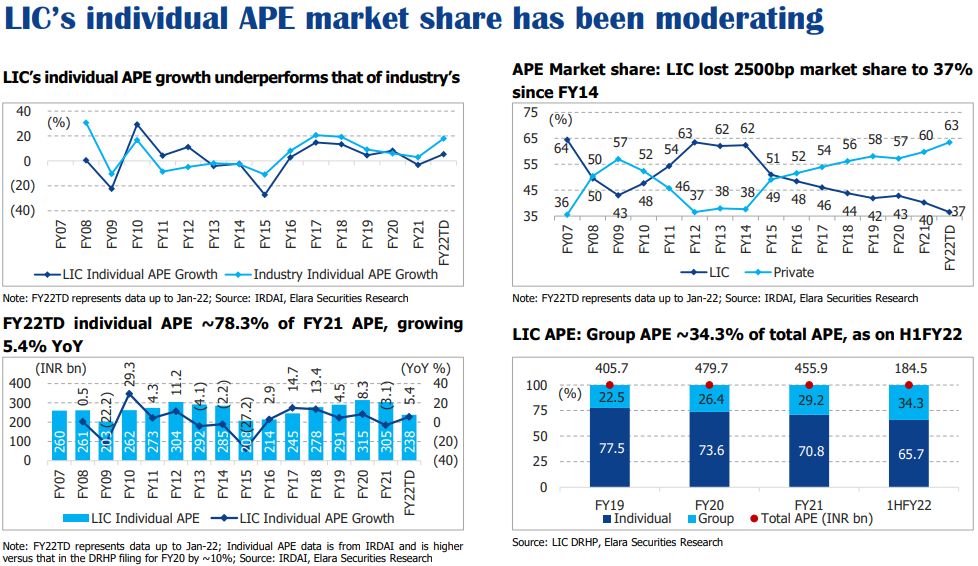

LIC’s individual APE market share has been moderating, says Elara

LIC IPO Day 3: Total subscription at 1.19 times

The initial public offering of country’s largest life insurance company Life Insurance Corporation of India has subscribed 1.19 times, receiving bids for 19.22 crore equity shares against offer size of 16.2 crore equity shares.

The portion set aside for policyholders portion has been subscribed 3.59 times, employees 2.7 times, and retail investors subscribed 1.09 times, while QIBs bid for 41 percent shares of their allotted quota and NII lapped up 58 percent of their portion.

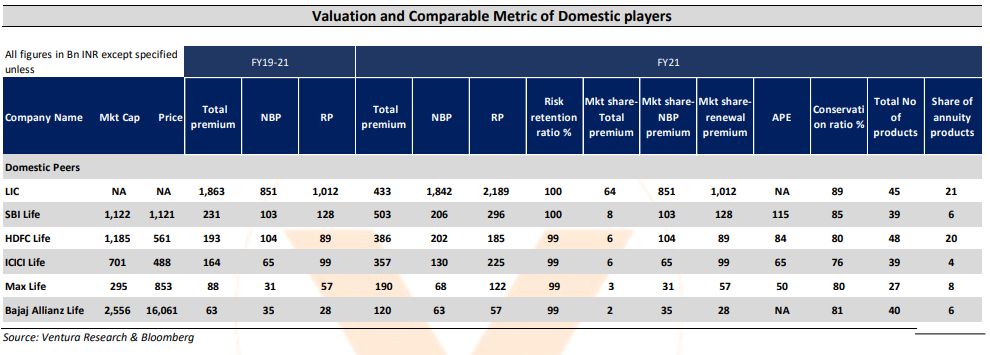

Valuation and Comparable Metric of Domestic players in Insurance Space

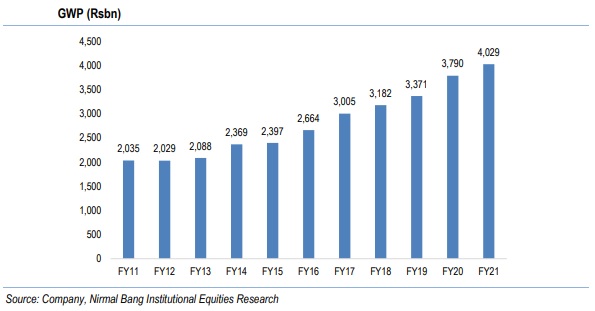

Growth in LIC’s Gross Written Premium