Banca channel gaining traction; agency still remains dominant

Life insurance players have significantly leveraged banking channels to market their products from FY18 onwards. This gradually led to an increase in share of bancassurance channel and a decline in the share of individual agents in distribution of individual life insurance products. Share of bancassurance channel rose from 23.8% of NBP in FY16 to 29% of NBP in FY21, in the individual business, driven mostly by private players, which either have major holdings from the banks or have empanelled banks as their corporate agents.

Individual agents, however, continue to account for as much as 58% of the individual life insurance premium for FY21 due to the personal connect they can establish with customers. They can provide hand holding to these customers, make them understand the various advantages of the policies and differences among various products as well as provide advice on suitability of the product basis the customer’s needs, premium reminders and help with cheque collection, etc (Source: ICICI Direct)

LIC IPO Day 3: Total subscription at 1.29 times

The initial public offering of country’s largest life insurance company Life Insurance Corporation of India has subscribed 1.29 times, receiving bids for 20.85 crore equity shares against offer size of 16.2 crore equity shares.

The portion set aside for policyholders portion has been subscribed 3.77 times, employees 2.89 times, and retail investors subscribed 1.15 times, while QIBs bid for 54 percent shares of their allotted quota and NII lapped up 65 percent of their portion.

Expert’s Take on LIC IPO

The valuation of the IPO is attractive to keep the issue stable. The EV (Embeded Value) seems to be in favour of LIC compared to the existing listing players on the insurance space. Life insurance has been one of the fastest growing segments in India’s insurance market and we advise people to invest in India’s largest and World’s third strongest brand Life Insurance Corporation (LIC).

For those investors who are worried that LIC may lose market share to private players, we think LIC has distribution advantage, increasing sales mix of direct and corporate channels, and steady swing to high margin that could be growth drivers for LIC going ahead. We recommend subscribe to the investors, says Girirajan Murugan, CEO of FundsIndia.

LIC IPO Day 3: Total subscription at 1.28 times

The initial public offering of country’s largest life insurance company Life Insurance Corporation of India has subscribed 1.28 times, receiving bids for 20.68 crore equity shares against offer size of 16.2 crore equity shares.

The portion set aside for policyholders portion has been subscribed 3.75 times, employees 2.86 times, and retail investors subscribed 1.15 times, while QIBs bid for 54 percent shares of their allotted quota and NII lapped up 63 percent of their portion.

Competition with private players is a risk factor

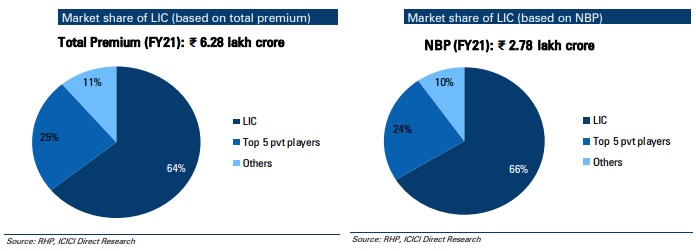

LIC is the sole public sector life insurer in India’s market. However, as on FY21 there are 23 other private insurance companies. LIC’s main competitors are SBI Life Insurance Company Limited, HDFC Standard Life Insurance Company Limited and ICICI Prudential Life Insurance Company Limited. However, given LIC’s scale, there is no other life insurer in India that is directly comparable to LIC, says Ventura Securities.

LIC IPO Day 3: Total subscription at 1.26 times

The initial public offering of country’s largest life insurance company Life Insurance Corporation of India has subscribed 1.26 times, receiving bids for 20.50 crore equity shares against offer size of 16.2 crore equity shares.

The portion set aside for policyholders portion has been subscribed 3.72 times, employees 2.83 times, and retail investors subscribed 1.14 times, while QIBs bid for 53 percent shares of their allotted quota and NII lapped up 62 percent of their portion.

Premium Comparison Across Life Insurance Players

LIC IPO Day 3: Total subscription at 1.25 times:

The initial public offering of country’s largest life insurance company Life Insurance Corporation of India has subscribed 1.25 times, receiving bids for 20.27 crore equity shares against offer size of 16.2 crore equity shares.

The portion set aside for policyholders portion has been subscribed 3.7 times, employees 2.79 times, and retail investors subscribed 1.12 times, while QIBs bid for 53 percent shares of their allotted quota and NII lapped up 60 percent of their portion.

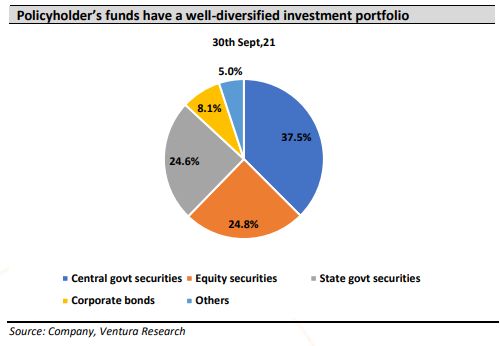

LIC policyholder’s funds have a well-diversified investment portfolioLIC is the largest asset manager in India as at 30th September 2021, with an AUM of Rs 39,55,892.9 crore on a standalone basis.Also, the investments of LIC are mostly into top graded equity/debt instruments which can be seen from the fact that as of September 30, 2021.95.9 percent of LIC’s debt AUM on a standalone basis was invested in sovereign and AAA rated securities.Over 90 percent of policyholders’ equity investments on a standalone basis are held in stocks that are a part of the Nifty 200 and BSE 200 indices.

LIC IPO Day 3: Total subscription at 1.24 times

The initial public offering of country’s largest life insurance company Life Insurance Corporation of India has subscribed 1.24 times, receiving bids for 20.02 crore equity shares against offer size of 16.2 crore equity shares.

The portion set aside for policyholders portion has been subscribed 3.66 times, employees 2.78 times, and retail investors subscribed 1.12 times, while QIBs bid for 50 percent shares of their allotted quota and NII lapped up 60 percent of their portion.

Market Share of LIC

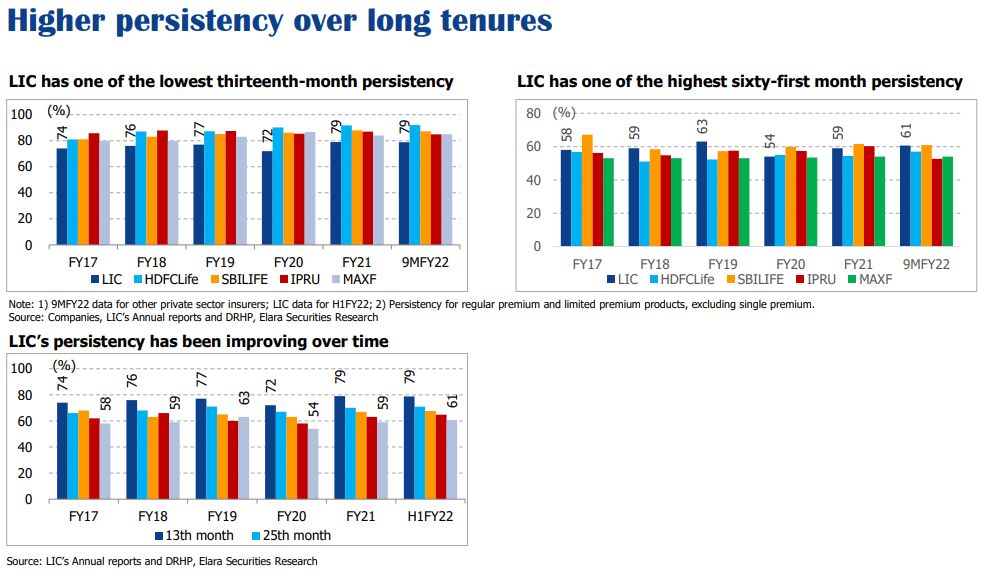

LIC Enjoys Higher Persistency Over Long TenuresPersistency ratio is calculated on the basis of number of policyholders who consistently pay their renewal premium or how the insurance company is able to retain its business in every financial year without policies being lapsed.