LIC IPO receives record applications from retail investor

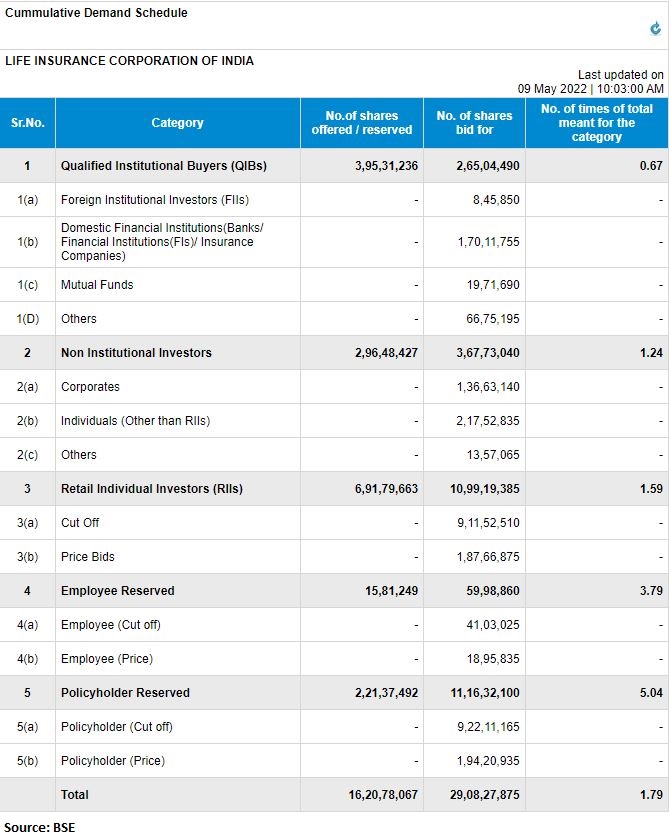

The initial public offering (IPO) of Life Insurance Corporation (LIC) continued to receive strong interest from employees, policyholders and retail investors as the issue got subscribed 1.78 times till May 8, the fifth day of bidding. The country’s biggest public issue received 29.07 crore bids against 16.02 crore shares on the offer.

The portion reserved for retail investors was fully subscribed on third day and 1.59 times by the end of the fifth day of subscription. The issue received 10.9 crore bids from retail individual investors, against 6.9 crore shares set aside for them.

It may be recalled, the initial share sale of Reliance Power in 2008 had received 4.8 million applications. Fourteen years later, LIC smashed this record as it received nearly 6 million applications from retail equity investors.

LIC’s financials & valuations

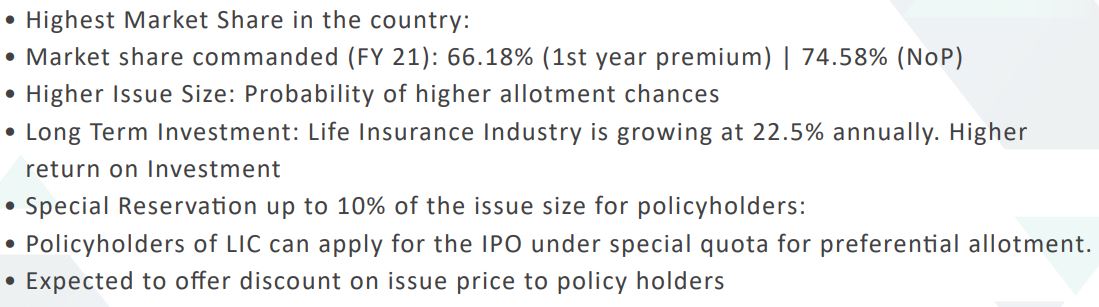

LKP Research on LIC IPO: India’s life insurance industry is expected to grow rapidly, owing to a relatively underpenetrated market and expanding awareness, which presents a multi-year growth opportunity. LIC has been providing life insurance in India for over 65 years and is the country’s biggest life insurer, with a significant brand value advantage. There are concerns about losing market share to private players and having lower profitability and revenue growth when compared to private players. However, we believe that LIC’s distribution advantage, increasing sales mix of direct and corporate channels, and a gradual shift to high margin Non- participating products could be possible drivers for LIC’s future growth, negating lower than industry growth rates.

At the upper price band, the stock is priced at 1.1x of its 2QFY22 Indian Embedded value (Market capitalization/Embedded value: Rs 6 trillion/Rs 5.39 trillion), which is at a significant discount to its listed peers. Currently listed insurance companies trade at Market capitalization/EV multiple of ~2.8x. LIC has a marquee anchor list of investors and we recommend SUBSCRIBE to the LIC IPO.

LIC IPO Updates:

Life Insurance Corporation of India’s (LIC) initial public offering received 1.93 times subscription on the final day of bidding, with the portion reserved for qualified institutional buyers (QIBs) fully booked. The bids received so far are 31.21 crore against offer size of 16.20 crore.

Policyholders have bid 5.14 times the allotted quota and retail investors 1.63 times, while employees bought shares 3.84 times the portion set aside for them. The reserved portion for non-institutional investors was subscribed 1.29 times while QIBs have bid for 1.07 times of the reserved portion so far.

LIC IPO final day bidding begins, here’s a snapshot of the bids so far

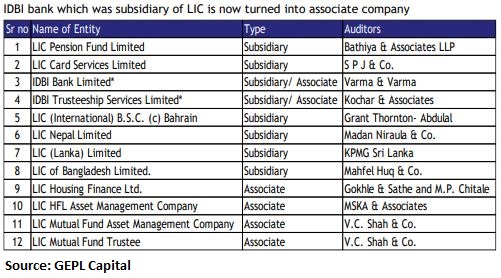

LIC subsidiary companies

IIFL Securities on LIC IPO: At the upper price band of Rs 949, Life Insurance Corporation of India is demanding a PE multiple of ~201.91X based on FY21 earning which is much higher than the industry average PE multiple of 79.77X of FY21. This might look expensive, but if we look at the company’s Indian Embedded Value of Rs 5,39,686 crore as on September 30, 2021, the Market Cap to Embedded Value (EV) Ratio comes in at just 1.11X. It’s peers like HDFC Life Insurance and SBI Life Insurance are trading at an EV multiple of 4.05x and 3.10x, while ICICI Prudential Life trades at 2.5x EV multiple.

Looking at the strong brand value, market leadership, extensive distribution networks, robust risk management and plans of diversifying the product mix we recommend subscribe to the issue with a long-term perspective.

LIC IPO: How to maximise your allocation and listing gains

With retail category highly likely to be oversubscribed, how can an investor improve her chances of taking a lot home

Edelweiss on why one should apply for LIC IPO

How to evaluate LIC IPO and other insurance companies?

An aggressive growth focus like private insurers could also increase value of LIC’s future business

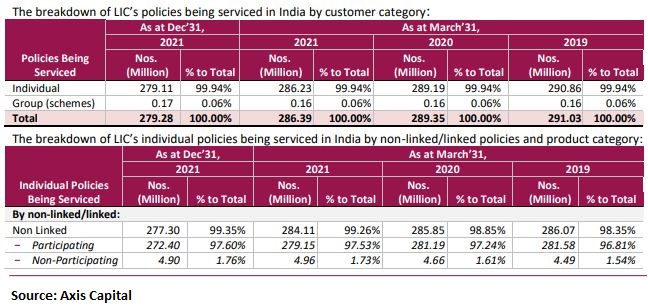

Breakdown of LIC’s policies being serviced in India by customer category:

If LIC IPO lists below issue price, investors should accumulate more: GEPL Capital MD Vivek Gupta

There will be some pressure on LIC’s market share in the near term it is unlikely to go below 50 percent as it has strong brand recall, says Gupta