LIC IPO: Issue subscribed 2.95 times on final day

The initial public offering of Life Insurance Corporation of India has received healthy response from investors as the offer has subscribed 2.95 times, receiving bids for 47.83 crore equity shares against IPO size of 16.2 crore equity shares.

The portion set aside for policyholders has been subscribed 6.11 times, employees bid 4.39 times the allotted quota and retail investors 1.99 times, while the reserved portion of qualified institutional buyers has booked 2.83 times and that of non-institutional investors 2.91 times.

LIC’s Embedded Value TrendEmbedded value is a reflection of a company’s net present value of future business to shareholders. It is a widely used metric for valuing an insurance company. This measure considers future profits from existing policyholders only and ignores the possibility of the introduction of new policies. The embedded value is the discussion topic of the town as LIC IPO is here. It is complex to calculate, as it involves several assumptions and is calculated by professional actuaries.

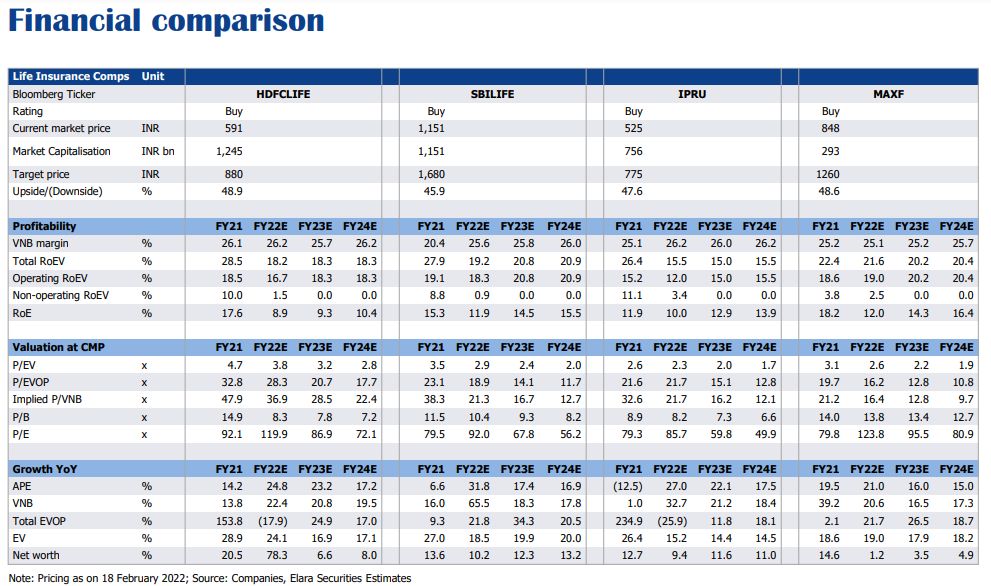

Comparison of LIC with other leading life insurance players on financial basis

LIC IPO: Issue subscribed 2.95 times on final day

The initial public offering of Life Insurance Corporation of India has received healthy response from investors as the offer has subscribed 2.95 times, receiving bids for 47.77 crore equity shares against IPO size of 16.2 crore equity shares.

The portion set aside for policyholders has been subscribed 6.10 times, employees bid 4.39 times the allotted quota and retail investors 1.99 times, while the reserved portion of qualified institutional buyers has booked 2.83 times and that of non-institutional investors 2.91 times.

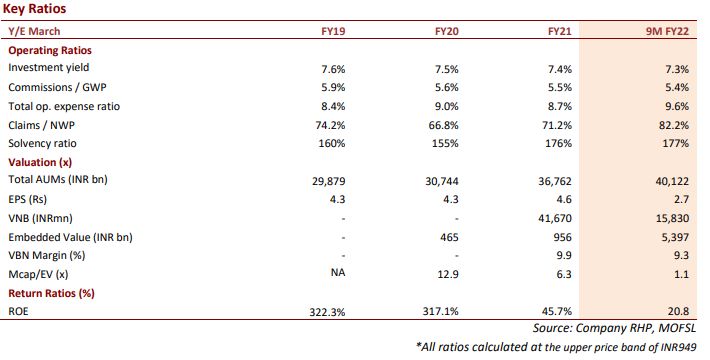

Look at these key ratios trend before investing in LIC IPO

Expert’s Take on LIC IPO

“Participation from tier 2-3 cities is high for LIC IPO, we can attribute this to the deeper agent and policy holder penetration of LIC. We have got a good amount of applications from the newly formed Union territories as well,” Girirajan Murugan, CEO at FundsIndia said.

He further said, “We are sure this will pave the way for larger retail participation in the Secondary markets as well as the accounts opened for applying to LIC IPO will be used for larger investments in the Equity markets.”

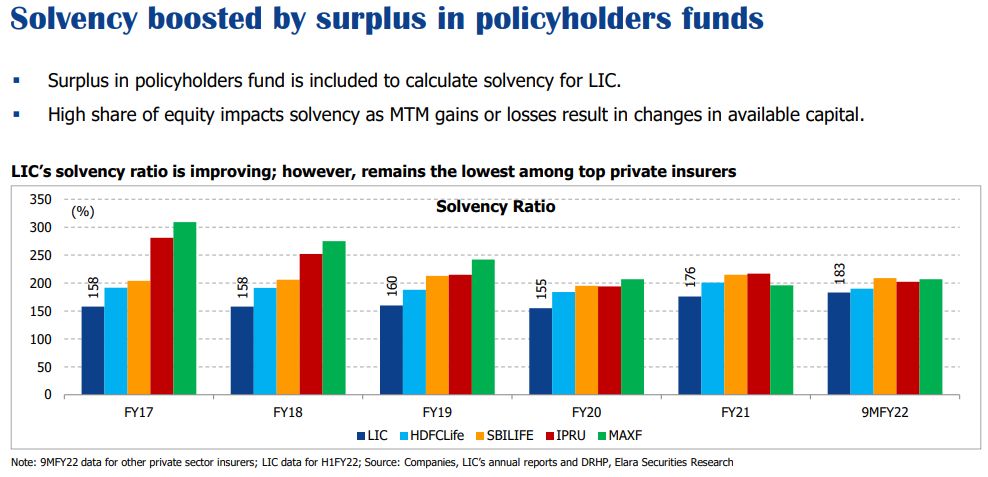

LIC Solvency Ratio boosted by surplus in policyholders funds

LIC IPO: Issue subscribed 2.94 times on final day

The initial public offering of Life Insurance Corporation of India has received healthy response from investors as the offer has subscribed 2.94 times, receiving bids for 47.57 crore equity shares against IPO size of 16.2 crore equity shares.

The portion set aside for policyholders has been subscribed 6.06 times, employees bid 4.36 times the allotted quota and retail investors 1.97 times, while the reserved portion of qualified institutional buyers has booked 2.83 times and that of non-institutional investors 2.91 times.

LIC IPO: Issue subscribed 2.91 times on final day

The initial public offering of Life Insurance Corporation of India has received healthy response from investors as the offer has subscribed 2.91 times, receiving bids for 47.17 crore equity shares against IPO size of 16.2 crore equity shares.

The portion set aside for policyholders has been subscribed 5.99 times, employees bid 4.32 times the allotted quota and retail investors 1.95 times, while the reserved portion of qualified institutional buyers has booked 2.83 times and that of non-institutional investors 2.88 times.

LIC has robust risk management framework, says Asit C Mehta

LIC has a risk management framework where risk identification, risk measurement and risk mitigation are undertaken through structured procedures and various Board-approved policies and controls. Their enterprise risk management (“ERM”) cell provides a framework for evaluating and managing risks inherent in LIC through risk and control self-assessment, incident management and top risk-key risk indicator analysis.

The ERM cell is working on the implementation of the IT solution package for monitoring various risks LIC encounters in its business processes.

LIC IPO: Issue subscribed 2.89 times on final day

The initial public offering of Life Insurance Corporation of India has received healthy response from investors as the offer has subscribed 2.89 times, receiving bids for 46.77 crore equity shares against IPO size of 16.2 crore equity shares.

The portion set aside for policyholders has been subscribed 5.97 times, employees bid 4.31 times the allotted quota and retail investors 1.94 times, while the reserved portion of qualified institutional buyers has booked 2.83 times and that of non-institutional investors 2.8 times.

Continued dominant position of LIC in group insurance driving NBP growth

In terms of business parameters LIC’s new business premium (NBP) has grown at a CAGR of 13.5 percent between FY2019-FY2021 while total premium has grown at a CAGR of 9.2 percent during the same period.

Total premium in India has grown at a CAGR of 9.3 percent while annualized premium equivalent (APE) has grown at a CAGR of 6.0 percent CAGR during the same period. (Source: Angel One)