Gold Prices Today: Inflationary worries, slowdown concerns to support yellow metal despite impending interest rate hike

Gold prices may move towards Rs 52700 levels while it has support at Rs 51600. Silver has support at Rs 58000 and resistance at Rs 59800, said Nirpendra Yadav, Senior Commodity Research Analyst at…

Market at 10 AMBenchmark indices extended the opening gains and trading at day’s high with Nifty above 15900.The Sensex was up 447.93 points or 0.84% at 53682.70, and the Nifty was up 134.10 points or 0.85% at 15969.50. About 1988 shares have advanced, 709 shares declined, and 102 shares are unchanged.

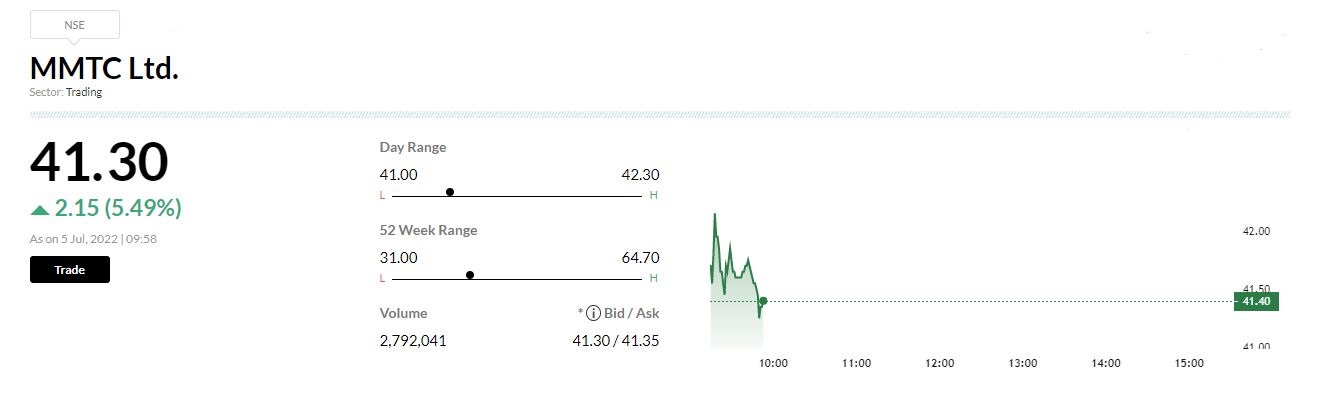

BuzzingMMTC share price jumped more than 5 percent on July 5 after company transferred around 50% stake in Neelachal Ispat Nigam to Tata Steel Long Products.MMTC has transferred its share of 49.78% of the issued and paid-up equity share capital of Neelachal Ispat Nigam Limited (NINL) to Tata Steel Long Products Limited (TSLP), MMTC said in its press release.MMTC has received consideration for the same, it added.

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

The market lacks clear direction and this trend can be expected to continue in the context of high uncertainty in the global economy. There are no clear indicators yet on whether the US economy will slip into recession and how serious the ongoing global growth slowdown will be. Elevated crude and high inflation will continue to drag on markets.

The recent correction has made valuations fair but not yet attractive enough for aggressive buying. Leading financials continue to be safe buys. Moderation in commodity prices and improvement in chip availability bode well for autos.

Market resilience in July indicates that a close above Nifty 16000 can lead to a near-term rally. Financials, autos and IT have the potential to drive such a probable rally.

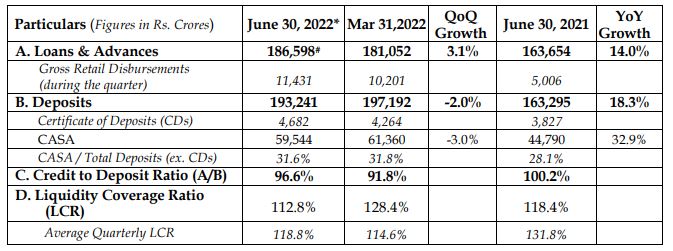

Yes Bank Q1 Business Update

Govt to stick to 6.4% fiscal deficit target

The Centre is committed to stick to the fiscal deficit target of 6.4 percent despite strong global headwinds, reports citing government sources said on July 4. The Ministry of Finance is confident of achieving the target set at the start of this fiscal, as the country’s macroeconomic fundamentals are strong, the sources told news agency PTI.

Officials who are privy to the development reiterated government’s commitment to the 6.4 percent fiscal deficit target while speaking to wire agency ANI, but added that the soaring crude oil prices will push India’s import bills. The current account deficit will be higher if the crude oil prices surge further, they underlined.

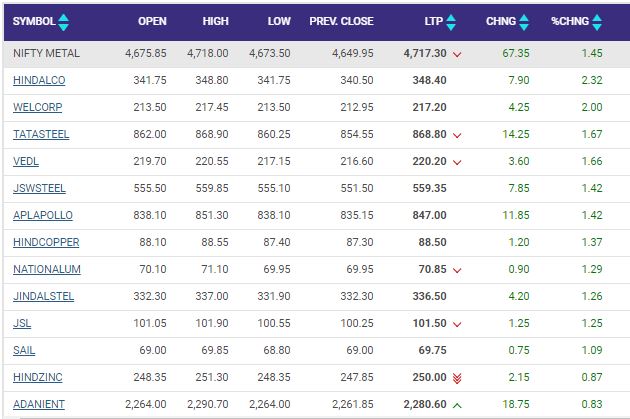

Nifty Metal index added 1 percent led by the Hindalco Industries, Welspun Corp, Tata Steel

Corrtech International gets Sebi’s go-ahead to float IPO

Corrtech International, a pipeline laying solutions provider, has received capital markets regulator Sebi’s go-ahead to raise funds through an Initial Public Offering (IPO). The public issue comprises fresh issuance of equity shares worth Rs 350 crore and an offer for sale of 40 lakh shares by promoters, according to the Draft Red Herring Prospectus (DRHP).

Equirus Capital is the sole book running lead manager to the issue.

Trade deficit shoots up 62% YoY to $25.6 billion in June

India’s merchandise trade deficit rose to $25.6 billion in June 2022, 62 percent higher than June 2021 as a continuing global commodity supercycle kept the prices of key energy and metal imports high.

Data released by the Commerce and Industry Ministry on Monday showed that while exports in June rose by 16.8 percent to $37.9 billion, imports shot up by 51 percent to $63.5 billion. The resultant $25.6 billion worth of trade deficit – the difference between total exports and imports – has given the Commerce Department a new headache, an official said.

The monthly trade deficit has been rising for the past few months. It had risen from $20.4 billion in April to $23.3 billion in May earlier.

Buzzing

Marksans Pharma share price rose more than 14 percent on July 5 as company board is going to consider the proposal for share buyback.

A meeting of the board of directors of Marksans Pharma is scheduled to be held on Friday, 8 th July, 2022 to consider the proposal for buyback of fully paid up equity shares of the company upto such amount of the aggregate of company’s paid up equity share capital and free reserves as the board may decide, company said in its press release.

Daily Voice | These financial entities qualify for a place in portfolio, says Devang Mehta of Centrum Wealth

Holding on to good companies in this market turmoil is the least one can do in one’s wealth creation journey. In life & investing, we are trained to see action as a sign of progress.

Gainers and Losers on the BSE Sensex in the early trade: