Nifty Smallcap 100 index fell 4 percent dragged by Indiabulls Housing Finance, Welspun India, Gujarat Narmada Valley Fertilizers And Chemicals

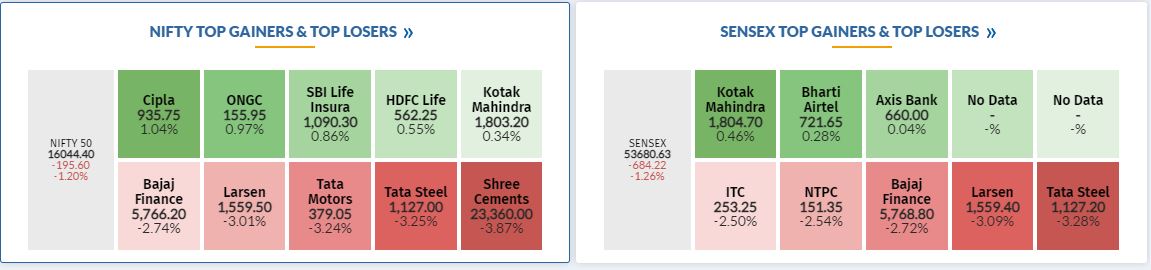

Market at 1 PMBenchmark indices extended the losses with Sensex and Nifty trading at day’s low.The Sensex was down 678.65 points or 1.25% at 53686.20, and the Nifty was down 197.20 points or 1.21% at 16042.80. About 448 shares have advanced, 2679 shares declined, and 86 shares are unchanged.

Adani Ports board meeting rescheduled on May 24Adani Ports and Special Economic Zone has informed that the board meeting is rescheduled to 24th May, 2022 to consider and approve the Audited Financial Results for the quarter and year ended 31st March, 2022 and to recommend divided on Equity Shares, if any.Adani Ports and Special Economic Zone was quoting at Rs 752.20, down Rs 19.10, or 2.48 percent on the BSE.

Adani Ports board meeting rescheduled on May 24

Adani Ports and Special Economic Zone has informed that the board meeting is rescheduled to 24th May, 2022 to consider and approve the Audited Financial Results for the quarter and year ended 31st March, 2022 and to recommend divided on Equity Shares, if any.

Adani Ports and Special Economic Zone was quoting at Rs 752.20, down Rs 19.10, or 2.48 percent on the BSE.

Jefferies view on Cipla

The broking firm Jefferies has maintained a buy rating on Cipla but cut the target price to Rs 1,165 from Rs 1,205 per share.

The revenue/adjusted EBITDA was 5/6% above estimates.

FY23 US outlook is healthy with Revlimid, Abraxane and Advair generics in pipeline, CNBC-TV18 reported.

Tata Motors unveils subcompact sport utility vehicle Nexon EV Max in India

Tata Motors has launched a long-range version of the Nexon EV in the Indian market on May 11 called the Nexon EV Max which is top of the line among subcompact sport utility vehicles (SUVs). Click To Read More

Tata Motors was quoting at Rs 380.70, down Rs 11.00, or 2.81 percent

BSE Capital Goods index fell 1 percent dragged by the Elgi Equipments, Graphite India, BHEL

Results on May 11: Adani Ports, Punjab National Bank, Indian Bank, Petronet LNG, Balaji Amines, Birla Corporation, HSIL, JSW Ispat Special Products, Kalyan Jewellers India, Kennametal India, KSB, Lakshmi Machine Works, Lloyds Steels Industries, NCC, Skipper, Prism Johnson, Relaxo Footwears, Sagar Cements, SKF India, Butterfly Gandhimathi Appliances, Century Enka, Cholamandalam Financial Holdings, and DIC India will release quarterly earnings on May 11.

Electrosteel Castings reports 67.2% growth in consolidated profit at Rs 113 crore

Electrosteel Castings share price fell 1.5 percent despite company clocked a 67.2 percent year-on-year growth in consolidated profit at Rs 113 crore in March 2022 quarter on healthy growth in topline and operating income.

Revenue increased by 28.2 percent to Rs 1,577 crore and EBITDA grew by 30.6 percent to Rs 217.33 crore during the same period.

Electrosteel Castings was quoting at Rs 35.65, down Rs 0.55, or 1.52 percent on the BSE.

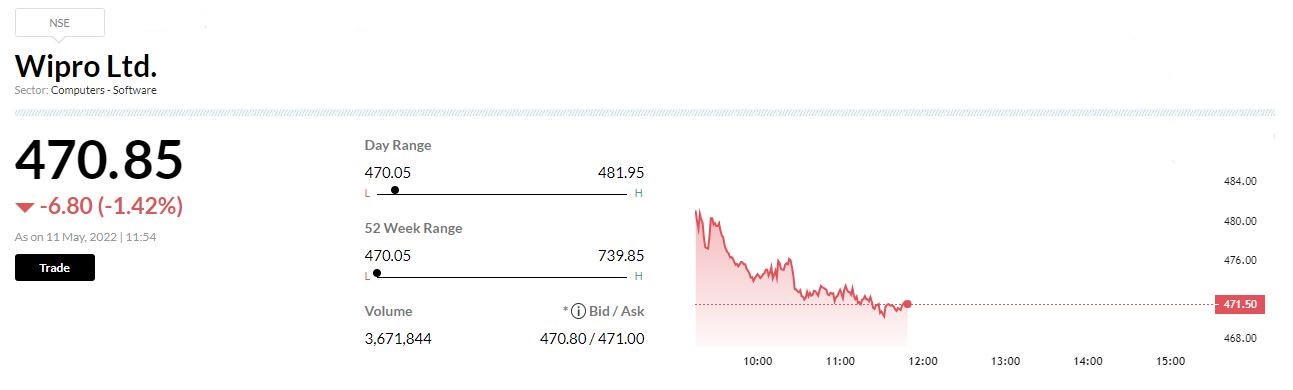

Market at 12 PMBenchmark indices extended the losses and trading near the day’s low point with selling seen in the auto, capital goods, FMCG and IT names.The Sensex was down 350.03 points or 0.64% at 54014.82, and the Nifty was down 98 points or 0.60% at 16142. About 618 shares have advanced, 2440 shares declined, and 95 shares are unchanged.

Wipro extends its strategic agreement with Crédit Agricole CIBWipro has extended its strategic agreement with Crédit Agricole CIB, the corporate and investment bank division of Crédit Agricole Group, to fuel Crédit Agricole CIB’snext stage of growth.

KRChoksey on Infibeam Avenues:

We expect Infibeam Avenues’ revenue and EBITDA to grow at 36.1% CAGR, each, over FY22-FY24E (vs. 62.4% CAGR expected in revenue during FY21-FY24E, before). Infibeam is trading at 3.0x/2.3x/1.6x its FY22/FY23E/FY24E Price/Revenue multiples, respectively.

It is similarly trading at 48.3x/38.7x/22.8x its FY22/FY23E/FY24E PE multiples vs. industry peer trading at an average FY24E PE of 30.0x, indicating attractiveness for Infibeam’s shares at current levels.

The company has had a 1:1 bonus issued in March 22. Given the tighter monetary conditions prevailing in the economy, we value the company on a lower price to sales multiple (P/S) of 3.0x than before (earlier 3.9x FY24E sales). As such, we lower the target price (from post bonus implied target price of Rs 43.0 or Rs 86.0 before bonus) to Rs 28.0 and maintain “BUY” on the shares as it indicates an upside potential of 83.0% over the CMP of Rs 15.