Alphalogic Techsys bags order to design and supply ‘Storage Systems’ to Scootsy Logistics:

Spandana Sphoorty board approves fund raise of Rs 100 crore via NCDs on private placement basis:

#OnCNBCTV18 | Currently looking at large caps, pain is more visible in mid & small cap segments. Very selective & cautious in overall internet space. Need to be cautious on financials in the very short-term, says Harsha Upadhyaya of Kotak Mutual Fund pic.twitter.com/U7RrHpsElz

— CNBC-TV18 (@CNBCTV18Live) December 2, 2022

Market update at 11 AM: Sensex is down 388.46 points or 0.61% at 62895.73, and the Nifty shed 111.50 points or 0.59% at 18701.

Gold Prices Today: Precious metals to remain range-bound as investors eye US employment data

Any correction in precious metals prices could be a good buying opportunity today. Gold has support at Rs 52000 and resistance at Rs 56000, said Nirpendra Yadav of Swastika Investmart.

NLC India inks MoU with Odisha government for renewable energy

NLC India and GRIDCO (Grid Corporation of Odisha) has signed MoU for setting up of ground mounted/floating solar power projects, pumped hydro storage projects, green hydrogen projects and any other renewable projects.

This MoU will enable both the parties towards National targets for renewable energy capacity and energy transition goal.

NLC India was quoting at Rs 85.00, up Rs 1.60, or 1.92 percent on the BSE.

Daily Voice | This chief investment officer likes banks as over 15% credit growth for FY24 looks sustainable

Daily Voice | This chief investment officer likes banks as over 15% credit growth for FY24 looks sustainable” title=”

Daily Voice | This chief investment officer likes banks as over 15% credit growth for FY24 looks sustainable” title=”Daily Voice | This chief investment officer likes banks as over 15% credit growth for FY24 looks sustainable

“>

Piyush Garg of ICICI Securities is bullish on the telecom space but cautious about mid-sized and product-based IT companies.

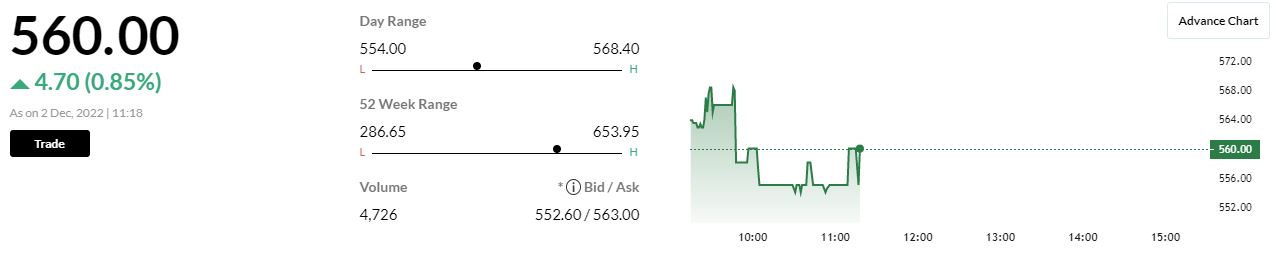

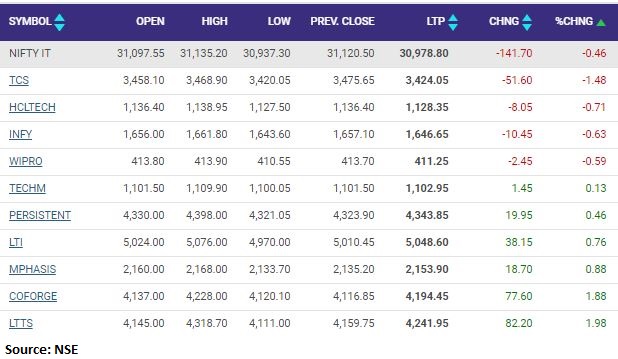

Nifty Information Technology index fell 0.4 percent dragged by the TCS, HCL Technologies, Infosys

United Spirits dissolves its Singapore wholly owned subsidiary:

United Spirits Singapore Pte, wholly owned subsidiary of Asian Opportunities and Investments Limited, wholly owned subsidiary of United Spirits, in Singapore stands dissolved.

For the financial year ended March 2021, USSPL was a non-operative company and consequently did not have any turnover or revenue or operating income. It had a negative net worth of approximately USD 0.02 million.

Since USSPL was a non-operative company, its voluntary winding up will not have any impact on the company’s business, United Spirits said in its release.

United Spirits was quoting at Rs 925.80, up Rs 0.25, or 0.03 percent.

Motilal Oswal maintains Neutral rating on Bandhan Bank

-Maintain Neutral rating with a Target Price of Rs 270

-Remain watchful of its asset quality, particularly in the Assam portfolio, which can keep credit cost elevated

-Management expects healthy recoveries over 2HFY23/1QFY24, slippages are likely to be higher during 3Q/4QFY23, thus keeping its overall performance under pressure

Bandhan Bank was quoting at Rs 239.85, up Rs 4.25, or 1.80 percent on the BSE.

BSE Power index shed 1 percent dragged by the Adani Transmisssion, Adani Green, Adani Power

Oil prices edge higher on easing COVID curbs in China, firm dollar limits gains

Oil prices inched higher in Asian trade on Friday on hopes for further relaxation of COVID curbs in China, which could help demand recover in world’s second biggest economy, though a firmer U.S. dollar capped gains.

Brent crude futures were up 20 cents or 0.23% at $87.08 per barrel by 0349 GMT, after earlier falling to $86.59.

U.S. West Texas Intermediate (WTI) crude futures gained 6 cents or 0.07% to $81.28 per barrel, after slipping to $80.88 earlier in the session.