Follow our LIVE blog for the latest updates on the novel coronavirus pandemic and its impact

Hexaware accepts delisting price:

HT Global Holding BV (acquirer) along with HT Global Holdings (promoter) of Hexaware Technologies, has accepted Rs 475 per share as the final price for the delisting offer.

All public shareholders who have tendered their equity shares at or below the exit price will be paid a consideration of Rs 475 per share.

The last date for payment to all public shareholders whose bid has been accepted is September 30, 2020.

Rupee closes: Indian rupee ended flat at 73.57 per dollar, amid volatile trade seen in the domestic equity market. It opened flat at 73.58 per dollar against previous close of 73.58 and remained in the range of 73.49-73.63.

Gold touches six-week low:

Gold prices touched a six-week low on Wednesday, as the dollar strengthened with the coronavirus crisis rattling sentiment in Europe, while investors grew wary of further stimulus from the U.S. Federal Reserve.

Spot gold fell 1% to $1,880.46 per ounce by 0641 GMT. Earlier in the session, bullion hit its lowest since Aug. 12 of $1,873.70.

Hareesh V, Geojit’s Head of commodity Research:

Gold may continue to be supported by renewed US-China tensions and hopes of fresh economic stimulus measures amid rising virus cases across the globe. However a robust US dollar and optimism over Covid vaccine continue to hit the safe haven demand of the commodity.

Technical Outlook (London spot): Prices continue to trade in a tight range of $1880-1975 an ounce initially and breaking any of the sides would suggest a fresh direction to the commodity.

Market Update: Sensex is down 274.52 points or 0.73 percent at 37459.56, and the Nifty shed 86.80 points or 0.78 percent at 11066.90. Nestle India, HDFC Bank and Infosys are the top gainers while Reliance Industries, Bharti Airtel and Voltas are the most active stocks.

Among the sectors, the PSU bank index along with power, metals and pharma dragged the most while the midcap index shed a percent.

Abhishek Bansal, Founder Chairman, Abans Group: Oil prices declined after the API report was released. As per this report, crude oil inventories rose by 691,000 barrels, against expectations of a drop of 2.256 million barrels, for a decline for the week ending September 18. Crude oil prices are likely to remain under pressure, following the potential resumption of oil supply from Libya.

We expect the crude oil prices to remain under pressure, on weakness in world energy demand, due to the coronavirus pandemic and increasing oil supplies from the US and OPEC+ members. WTI crude oil could trade towards the next support level of USD 38.90-37.50, and critical resistance level could be seen around USD 40.90 per barrel.

Mazagon Dock Shipbuilders to launch IPO on September 29: State-owned defence company Mazagon Dock Shipbuilders will launch its initial public offering on September 29, people familiar with development told Moneycontrol. The government company is likely to raise around Rs 700-800 crore via its maiden public offer, sources said, adding the issue will close on October 1, 2020.

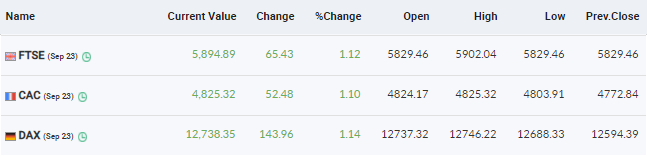

European markets trade higher:

Angel Broking IPO subscription updates:

The Rs 600-crore initial public offering of Angel Broking, so far, is subscribed 1.03 times on September 23, the second day of bidding.

The IPO has received bids for 1.42 crore equity shares against offer size of 1.37 crore equity shares, the subscription data available on the exchanges showed. The offer size excluded anchor investors’ book.

The company has already raised Rs 180 crore from anchor investors on September 21.