Follow our LIVE blog for the latest updates on the new Omicron variant of COVID-19 and its impact

Gaurav Garg, Head of Research, Capitalvia Global Research:

With gap-down openings tracking weak global cues, markets are likely to continue their sluggish trend.

Foreign institutional investors (FIIs) are likely to continue selling, according to provisional data available on the NSE.

Former RBI Governor Raghuram Rajan recently stated that the Indian economy has some bright spots and a number of extremely dark stains, and that the government should carefully target its spending to avoid large deficits. Rajan also stated that the government must do more to avoid the economy from recovering in a K-shaped pattern as a result of the coronavirus outbreak.

On Friday, US markets finished lower, with the Nasdaq reporting its largest weekly loss since March 2020, owing to concerns about inflation and expectations of monetary tightening.

On Monday, Asian markets are trading in the red, with the Federal Reserve anticipated to affirm that it would soon begin draining the vast liquidity that has fueled recent growth stock gains.

Our research suggests that the levels of 17500-17450 may act as important support levels in the market. If the market sustained above the levels of 17500, we can expect the market to trade in the range of 17450-17800.

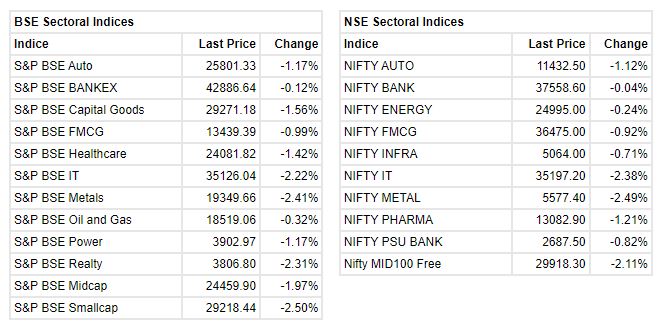

BSE Smallcap Index fell 3 percent dragged by the PNB Gilts, Cybertech Systems, Gokaldas Exports

Rupee Opens:

Indian rupee opened flat at 74.42 per dollar on Monday against Friday’s close of 74.42.

The US dollar declined 0.08% on Friday amid a decline in US treasury yields. However, further downside was cushioned as US stocks continued their slide amid worries over higher interest rates and escalating tension between the US and Russia, said ICICI Direct.

Rupee future maturing on January 27 appreciated by 0.11% amid soft dollar and retreat in crude oil prices. Meanwhile, weak global market sentiments and persistent FII outflows weighed on the Indian currency, it added.

India VIX spikes as risk aversion grips investors

The fear gauge India VIX soared 11 percent, biggest one-day jump since December 20, on January 24 as fear gripped investors ahead of a possible hike in interest rates by the US Federal Reserve and slowdown in the domestic rural economy.

The sell-off in global markets through the month has made investors dial back on their bullishness for the market and shift funds toward haven assets. The Nifty50 index has fallen for five consecutive days reflecting the weakness on global markets.

The US Federal Reserve is widely expected to raise interest rate in March with some traders speculating if the central bank will hike rates by as much as 50 basis points.

Market at 10 AMBenchmark indices were trading lower with Nifty below 17500 amid selling seen across the sectors.The Sensex was down 514.82 points or 0.87% at 58522.36, and the Nifty was down 173.00 points or 0.98% at 17444.20. About 664 shares have advanced, 2436 shares declined, and 119 shares are unchanged.

Trade Spotlight | What Should You Do With Shoppers Stop, Sharda Cropchem, SPARC, Hitachi Energy And Bajaj Auto?

Trade Spotlight | Here’s what Rajesh Palviya of Axis Securities recommends investors should do with these stocks when the market resumes trading today

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

The trend in global stock markets has turned distinctly bearish. Last week S&P 500 and Nasdaq closed 8% and 15% below their all-time highs. The sell-off in tech stocks has been brutal last week. European stocks too turned bearish.

The heightened tensions in the Russia-Ukraine border is a major geopolitical concern. FIIs again turning big sellers is a major headwind. Investors have to move cautiously.

An important feature of the tech sell-off is that bulk of the selling is happening in non-profitable tech stocks. This trend is impacting stocks like Zomato and Paytm in India too.

It is important to understand the fact that Indian IT stocks with high profits and good earnings visibility are in a totally different league. Results of RIL and ICICI Bank are very good, reinforcing the current trend of rising profitability of large Indian corporates.

Expect Indian market to go through a consolidation phase and do not own platform companies as lack of visibility on earnings front, said Atul Suri of Marathon Trends-PMS on CNBC-TV18.

The global markets jittery was ahead of US Fed interest rate action. As bond yields spike, the preference will move to value versus growth, he added.

BSE Information Technology index fell 1 pecent dragged by the Mastek, Subex, Happiest Minds Technologies

Buzzing:

Yes Bank share price gained more than 3 percent on January 24 after company announced its December quarter earnings.

Yes Bank on January 22 reported a 77% year on year growth in December quarter profit at Rs 266 crore as lower provisions and higher loan recoveries drove earnings at the lender.

Net interest income, a closely watched measure of how much money the bank makes from lending, was down 31% to Rs 1,764 crore and other income declined 32% to Rs 734 crore.

Provisions and contingencies fell 82% to Rs 375 crore. Sequentially they dipped 0.7%.

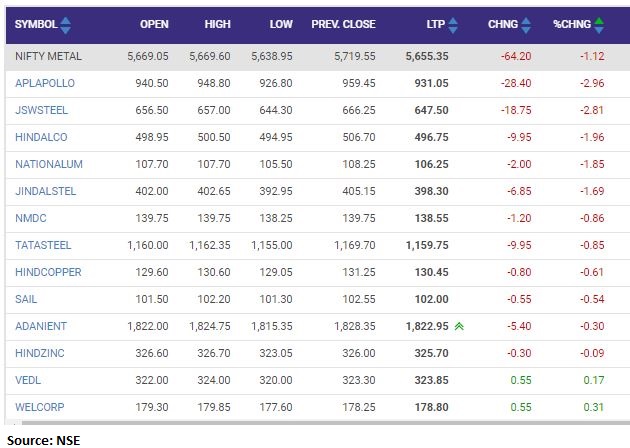

Nifty Metal index shed 1 percent dragged by the APL Apollo Tubes, JSW Steel, Hindalco Industries: