Buzzing Stocks: L&T, Cipla, Bharti Airtel and others that will be in focus today

Follow our LIVE blog for the latest updates on the novel coronavirus pandemic and its impact

Motilal Oswal on Larsen & Toubro: The company’s fundamentals are quite strong.s: L&T has rightly prioritized its balance sheet strength over growth during the second COVID wave. While COVID 2.0 has brought on similar challenges as last year, construction activity has been ongoing unlike last year and hence, the impact should be lower than last time. We broadly maintain our consolidated earnings estimate. We expect L&T to witness Core E&C revenue/EBITDA/adjusted PAT CAGR of 12%/11%/17% over FY21-23E. We maintain buy with target of Rs 1,700 per share.

Buzzing stock: Bharti Airtel share price was trading in the red in the morning session on May 17 ahead of its Q4 results. The telecom major is expected to declare its March quarter earnings later today. Bharti Airtel is expected to report a strong operating print and moderation in average revenue per user (ARPU) with interconnect usage charge (IUC) going to zero, according to media reports. Analysts will keep a keen eye on the management’s commentary on ARPU trajectory and non-wireless business.

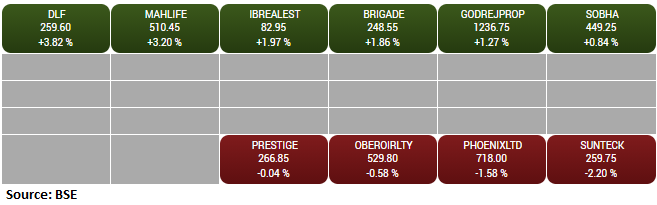

BSE Realty Index rose 1 percent led by the DLF, Mahindra Lifespace, Indiabulls Real Estate

Buzzing:

Cipla share price was trading lower by 3 percent on May 17 after the company declared its Q4 results.

The pharma company on May 14 clocked a healthy 72.2 percent year-on-year growth in consolidated profit at Rs 411.5 crore driven by operating performance. Earnings on all parameters missed analysts’ expectations.

Anil Kumar Bhansali, Head of Treasury – Finrex Treasury Advisors

The market is in a range whether equity, debt or currency. The rupee is opening on a flat note but with a string of IPOs announced and excess dollar liquidity have a feeling that rupee may not depreciate much from.

Any good uptick on the pair needs to be sold. Importers may buy near to 73.20 where RBI is buying dollars and exporters, may sell near 73.40 all for near term only. Range for the day is 73.10 to 73.40.

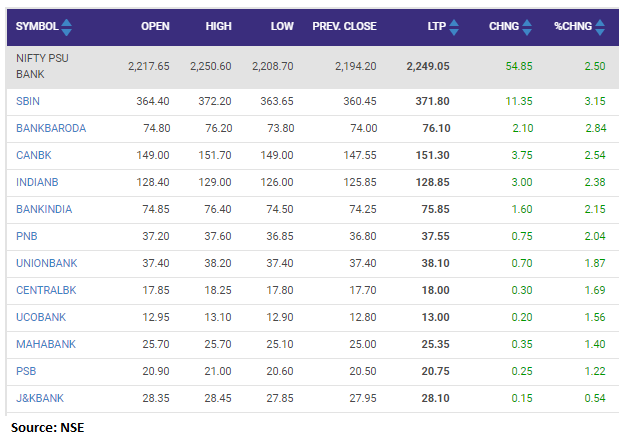

Nifty PSU Bank index added 2.5 percent supported by the SBI, Bank of Baroda, Canara Bank:

ICICI Direct:

Friday’s drop erases some of a two day rally in the US dollar after data on Wednesday showed US consumer prices increased after nearly 12 years. With the US dollar sustaining below 90.5, we feel the rupee is likely to appreciate towards 73 levels.

The dollar-rupee May contract on the NSE was at Rs 73.45 in the last session. The open interest rose almost 1.5% for the May series.

Crude Updates:

Oil prices edged lower on Monday as the recovery of a major US pipeline network eased concerns over supply and a new wave of COVID-19 restrictions in Asia fuelled fears of lower demand.

Nifty In Wait-and-watch Mode, 10 Technical Trading Ideas For Short Term

The level of 14,590 on the Nifty should act as strong support, below it, the correction is likely to continue to 14,500. A further downside till 14,390 is also possible, say experts.

Rupee Opens:

Indian rupee opened flat at 73.27 per dollar on Monday against Friday’s close of 73.29, amid buying seen in the domestic equity market. On May 14, rupee ended higher by 13 paise at 73.29 per dollar against Wednesday’s close of 73.42.