Glenmark & Sanotize announce Phase 3 clinical trial result of NONSGlenmark Pharmaceuticals and SaNOtize Research and Development Corp, today announced that The Lancet Regional Health Southeast Asia (TLRHSEA) – peer reviewed, high impact journal published the successful phase 3 clinical trial results of SaNOtize’s Nitric Oxide Nasal Spray (NONS) study titled: “SARS-CoV-2 accelerated clearance using a novel nitric oxide nasal spray (NONS) treatment: A randomized trial.“We are excited to publish the study of the novel Nitric Oxide Nasal Spray, which positively impacts the lives of people, in The Lancet group of journals. The robust double-blind trial demonstrated significant efficacy and remarkable safety of NONS. This therapy has the potential to make a crucial contribution to COVID-19 management, with its ease of use in the current highly transmissible phase of pandemic”, said Dr. Monika Tandon, Senior VP & Head – Clinical Development, Glenmark Pharmaceuticals Ltd.

Equitas Small Finance Bank increases NRE interest rate:

Equitas Small Finance Bank Limited, one of the leading SFBs, has announced the revision of interest rates for Fixed and Recurring Deposits of Non Resident External (NRE) Account with effect from 13th July 2022.

NRE customers can now avail upto 7.40% interest p.a. on 888 days Fixed Deposit, offering an annualized yield of 7.61%. The Recurring Deposits (RD) interest is also increased to 7.30% for 30 & 36 months NRE RDs.

Equitas Small Finance Bank was quoting at Rs 41.20, up Rs 0.15, or 0.37 percent on the BSE.

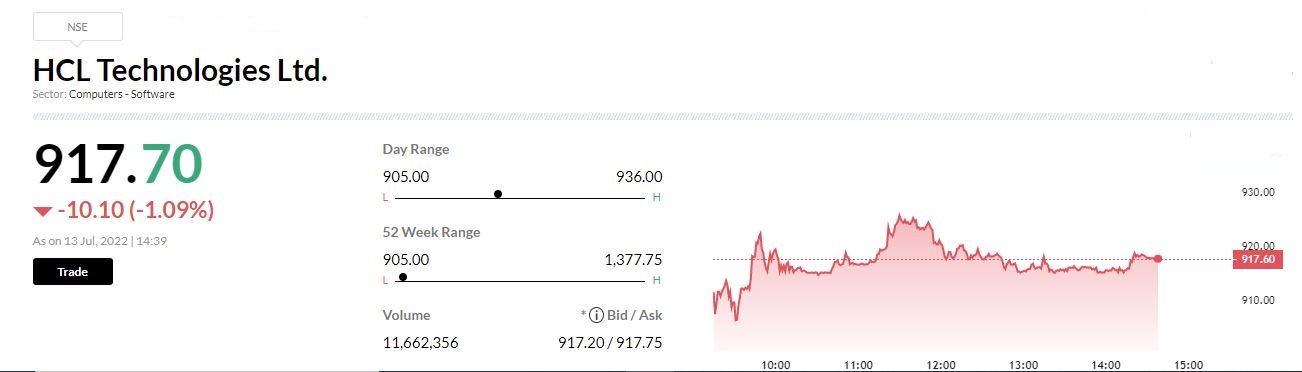

Credit Suisse View on HCL TechnologiesCredit Suisse has maintained the ‘outperform’ rating on the stock and cut target to Rs 1,110 from Rs 1,450 per share.The FY23 margin expected to stay muted at 18% and expect demand delays led by macro headwinds.The stock is more than pricing growth & margin headwinds.Credit Suisse cut FY23-25 EPS estimates by 8-14%, reported CNBC-TV18.

BSE Metal index added 1 percent led by the JSW Steel, NMDC, APL Apollo Tubes:

Tirthankar Das, Head of Technical Research, Ashika Group:

Share price of Tata Steel is seen rebounding from the extreme oversold territory from the key support zone of Rs 870-890, being the 50% retracement (High: Rs 1535; Low: Rs 250) of the entire rally since April 20. Past few months corrective phase hauled weekly stochastic oscillator in extreme oversold territory (currently placed at 25), indicating impending pullback.

RSI has also bounced from its oversold zone and is positively placed which could fuel the up move. The ADX (currently placed at 40) shows bullish strength, though the negative directional indicator -DMI is still above the +DMI.

Presence of Harmonic ‘White Swan Sea Pony’ since the start of FY22 also indicates the same, a 261.8% retracement of B-C measures around 828. Hence, considering the overall chart structure it can be expected that stock is in a base building mode around the key support zone of Rs 870-890. Hence investors can accumulate the stock at dip to ride the next leg of up move towards Rs 970-990

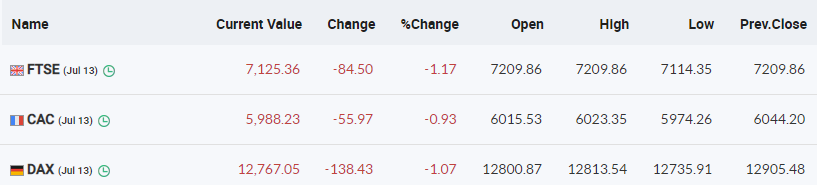

European Markets Updates

Adani Ports expects 60% growth in cargo volumes to 500 MT by 2025:

Adani Ports and Special Economic Zone Ltd on July 13 said that it expects its cargo handling volumes to grow by 60 percent in 2022-23 and 2023-24 to cater to 500 million tonnes (MT) by 2024-2025.

The company’s chief executive officer Karan Adani said that his company handled a cargo throughput of 100 MT in the first 99 days of 2022-23 and is poised to become the world’s largest port operator by 2030.

The company witnessed a 12 percent on-year jump in cargo handling volumes in June 2022 at 31.88 MT.

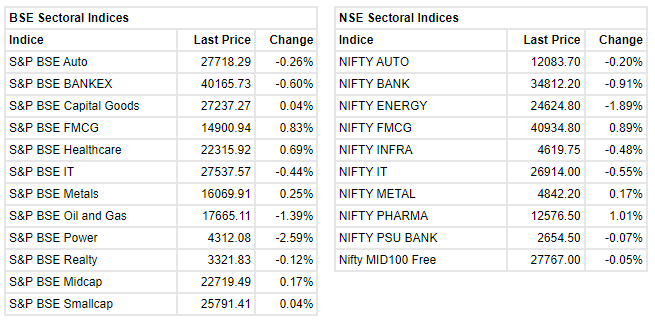

Market update at 2 PM: Sensex is down 309.55 points or 0.57% at 53577.06, and the Nifty shed 79.90 points or 0.50% at 15978.40.

Tanvee Gupta Jain, UBS India Economist on CPI inflation:

We expect India’s CPI inflation to start easing from October onwards but to continue to remain above RBI’s upper tolerance band of 6%. The government’s recently announced various supply-side measures to help control the rising prices .

The monsoons have been progressing well with the cumulative rainfall being 9% above long-term average up to 12th July. The global commodity prices have also moderated considering the increased recession risks in the US and Eurozone. Notably, our hard data model for recession probabilities for the US has now risen further to 96%, after spiking from 11% in April to 89% in May.

For Europe it’s the soft data model that is starting to flash red (30% probability of a recession) (link). We believe India being a net global commodity importer will benefit from recent correction in global commodity prices but INR depreciation risks (weakened by 7.1% CYTD against USD) needs to be monitored closely (at a time when dollar index has been strengthening). We expect these factors to help limit the upside risks to our full year FY23 CPI inflation forecast of 7%YoY. In our base case, we expect MPC to hike repo rate by another 25-35 bps in the August policy.

Nitric Oxide Nasal Spray (NONS) trial shows significant efficacy in #COVID treatment. #Glenmark & Sanotize announce phase 3 clinical trial result of #NONS

Patients receiving NONS had significant reduction in viral load within 24 hrs.

Here’s more#COVID19 pic.twitter.com/1u7N2xxbgx

— CNBC-TV18 (@CNBCTV18Live) July 13, 2022

LIC’s IPO anchor investors haven’t given up on insurer despite heavy losses

Shares of the insurance giant have seen their value shrink 24 percent since their listing on the stock exchanges on May 17

Market update at 1 PM: Sensex is down 189.87 points or 0.35% at 53696.74, and the Nifty shed 46.10 points or 0.29% at 16012.20.