Bears Grip Hardens | Top 10 Trading Ideas For Next 3-4 Weeks

The Nifty50 has broken the crucial 18,000 mark last week and settled at 17,764.80 on Thursday. The index managed to defend the 17,700 levels, but experts feel, if the said levels get broken, then there could be a sharp correction in the coming days.

Buzzing:

Tractor-maker Escorts share price that has climbed more than 46 percent in the last three months is expected to gain 15 percent more, a report by research firm Sharekhan has said.

Japan’ Kubota Corporation will raise its stake in Escorts to 14.99 percent through a preferential issue aggregating to Rs 1,872 crore further cementing its place in India, the world’s largest tractor market. The joint entity intends to attain global leadership in the farm-equipment sector.

Brokerage firm Sharekhan has a positive outlook on Escorts and expects a 15 percent upside.

The partnership with Kubota would provide the company an opportunity to gain market share in the medium term, driven by product launches across brands and increase the addressable market, it added.

Go Fashion IPO issue subscribed 10.96 times on Day 3

The public issue of Go Fashion, which owns the brand Go Colors, had been subscribed 10.96 times by the morning of November 22, the third and final day of bidding. Investors put in bids for 8.85 crore equity shares against an offer size of 80.79 lakh units, as per the exchange data.

Retail investors have been active since day one of the bidding, buying shares 36.34 times their reserved portion, while the part set aside for non-institutional investors has been subscribed 9.19 times and that of qualified institutional buyers 3.39 times.

Go Fashion, which had a market share of around 8 percent in the branded women’s bottom-wear market in FY20, opened its Rs 1,013.61-crore public issue for subscription on November 17. The price band for the offer has been fixed at Rs 655-690 a share.

Motilal Oswal on Bharti Airtel: Bharti’s superior execution quality is reflected in its strong performance in the last 8-10 quarters; 25% YoY growth in consolidated EBITDA, despite no tariff hikes; and consistent subscriber and revenue market share gains. We see potential for a re-rating in both the India and Africa businesses on the back of steady earnings growth. We value Bharti on a Sep’22E basis, assigning an EV/EBITDA of 11x/5x to the India Mobile/Africa business, arriving at an SoTP based target of Rs 860. Our estimates do not factor in any upside from a tariff hike or steep market share gains from VIL’s financial stress. We maintain our buy rating.

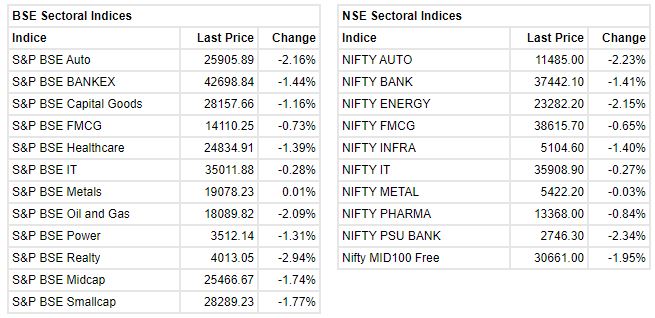

Market update at 11 AM: Sensex is down 679.53 points or 1.14% at 58956.48, and the Nifty tumbled 198.70 points or 1.12% at 17566.10.

Gaurav Garg, Head of Research, Capitalvia Global Research

The Indian benchmarks started today on a flat note amid mixed global cues. Traders will be taking encouragement with Icra report to upgrade its GDP growth estimate for the second quarter of FY2021-22 to 7.9 percent as government spending increases in the month of September.

Economic advisory council to the Prime Minister said the Indian economy is likely to grow by 7-7.5 percent in the next fiscal year. Traders may take note of report that the commerce ministry said exports of agriculture and processed food products rose by 14.7 percent to USD 11.65 billion during April-October period.

Some cautiousness may come as RBI data showed the country’s foreign exchange reserves declined by USD 763 million to USD 640.112 billion in the last week.

Our research suggests that the levels of 17600 may act as an important support level in the market. If the market sustained above the support of 17600, we can expect it to trade in the range of 17600-17850.

BSE Realty Index down 2.5 percent, all stocks in the red

HealthCare Global picks up majority stake in Suchirayu Healthcare Solutions

HealthCare Global Enterprises’ share price added 4 percent to Rs 263 after the company acquired a majority stake in Suchirayu Healthcare Solutions.

“HealthCare Global Enterprises (HCG) announced the acquisition of an additional 60.9 percent in Suchirayu Healthcare Solutions, Hubli, thereby becoming a majority stake owner from its existing 17.7 percent to 78.6 percent,” the company said in a press release.

Suchirayu owns a state-of-the-art multi-speciality hospital in Karnataka’s Hubli city with an operational capacity of 110 beds and a potential to scale up to 250 beds.

HCG has operated and maintained the hospital since August 2017 and had the right to increase its stake up to 80 percent by July 2022.

Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments:

Markets are in a precarious position. We are threatening the 17600 level and if we break this level on a closing basis, the Nifty could slide down to 17200.

The index has a resistance at 18100-18200 and unless we do not get past that, the trend of the markets will remain sideways to negative.

Rupee Opens:

Indian rupee opened 11 paise lower at 74.34 per dollar on against Thursday close of 74.23.

Despite a surging US dollar, rupee was seen some resilience on account of consistent IPO inflows and slide in crude oil prices. However, with domestic Indian equities declining by nearly 2% added some nervousness, as FII was seen back on a selling spree, said Amit Pabari, MD at CR Forex Advisors.

“Also once inflows get standstill and Fed’s tapering sword hanging, a depreciation pressure resides on rupee and can take it towards the first target of 74.75-75.00 levels and next target of 75.50 levels in the upcoming time,” he added.

Go Fashion IPO issue subscribed 7 times on final day

The public issue of Go Fashion, which owns the brand Go Colors, had been subscribed seven times by the morning of November 22, the third and final day of bidding. Investors put in bids for 5.65 crore equity shares against an offer size of 80.79 lakh units, as per the exchange data.

Retail investors have been active since day one of the bidding, buying shares 25.18 times their reserved portion, while the part set aside for non-institutional investors has been subscribed 2.42 times and that of qualified institutional buyers 3.24 times.

Go Fashion, which had a market share of around 8 percent in the branded women’s bottom-wear market in FY20, opened its Rs 1,013.61-crore public issue for subscription on November 17. The price band for the offer has been fixed at Rs 655-690 a share.

Gold Prices Today: Yellow Metal Likely To Remain Rangebound, Buy On Dips

On the Multi-Commodity Exchange (MCX), the gold contracts were up 0.14 percent to Rs 49,109 for 10 grams at 9.45am on November 22. Silver futures gained 0.28 percent to Rs 66,419 a kilogram.