Follow our LIVE blog for the latest updates on the new Omicron variant of COVID-19 and its impact

Jefferies on Thermax

Foreign broking house Jefferies has upgraded Thermax to a buy rating with target at Rs 2,575 per share.

The management focussed on taking a step ahead in improving capital allocation and margin improvement.

Jefferies upgrades FY23-24 EPS by 11-36% to reflect revenue recovery.

Thermax touched a 52-week high of Rs 1,948.55 and was quoting at Rs 1,894, up Rs 54.90, or 2.99 percent.

Manappuram Finance to consider various options for raising funds

Manappuram Finance is considering various options for raising funds through borrowings including by the way of issuance of various debt securities in onshore / offshore securities market by Public Issue, on Private Placement Basis or through issuing Commercial Papers, company said in its press release.

Based on the prevailing market conditions, the Board of Directors / Financial Resources and Management Committee / Debenture Committee of the Board of Directors of the Company may consider and approve issuances of Debt Securities during the month of January, 2022, subject to such terms and conditions including the issue price of debt securities, as the Board / respective Committee may deem fit, it added.

Manappuram Finance was quoting at Rs 166.95, up Rs 0.15, or 0.09 percent.

Market at 3 PMBenchmark indices erased some of the intraday losses but still trading lower with Nifty below 17800.The Sensex was down 576.70 points or 0.96% at 59646.45, and the Nifty was down 167.80 points or 0.94% at 17757.50. About 1834 shares have advanced, 1291 shares declined, and 76 shares are unchanged.

BSE Metal index fell 0.5 percent dragged by the JSW Steel, Tata Steel, APL Apollo

Bajaj Finserv December Business Update

Bajaj Finserv’s subsidiary Bajaj Allianz General Insurance’s gross direct premium for the month of December 2021 was at Rs 1,123.6 crore.

The Bajaj Allianz Life Insurance’s individual single premium was at Rs 22.9 crore and individual non-single premium was at Rs 459.1 crore.

Bajaj Finserv was quoting at Rs 18,046.50, up Rs 63.50, or 0.35 percent on the BSE.

IRB Infrastructure subsidiary executes concession agreement with Uttar Pradesh Expressways Industrial Development Authority: IRB Infra informed that Meerut Budaun Expressway Private Limited, wholly-owned subsidiary of the Company, has executed Concession Agrecment with Uttar Pradesh Ex pressways Industrial Development Authority(U llEIDA) for development of Access Controlled Six Lane (Expandable to Eight Lane) Greenfield ‘Ganga Expressway’ spread over 129.7 km. IRB Infra was trading at Rs 225.80, up Rs 2.60, or 1.16 percent. It has touched an intraday high of Rs 230.00 and an intraday low of Rs 219.30.

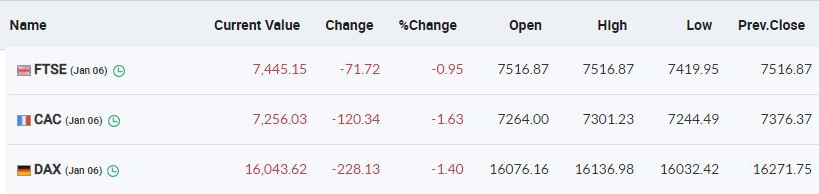

European Markets Updates

ICICI Direct on telecom sector: We expect subscriber addition momentum to moderate for the industry amid recent tariff hike. Reliance Jio (Jio) is likely to lead the subscriber addition with ~8 mn net adds mainly led by JioPhone Next launch. Bharti Airtel, which is likely to add ~0.3 mn subscribers, with modest addition amid tariff hike led consolidation. On the other hand, Vodafone Idea is expected to continue experiencing churn (albeit in a controlled level vis-à-vis earlier quarter) with subscriber loss of ~2 mn. ARPU growth will be seen for all telcos, led by partial benefit of tariff hike.

We expect Jio, Airtel and VIL to report ARPU to be up 6%, 4%, 6% QoQ at ~Rs 149, Rs 163, Rs 116, respectively. The lower ARPU growth for Jio is owing to lag between tariff hike vs. peers and larger share of long duration renewals. For Jio, revenues are expected at Rs 19,387 crore, up 3.5% QoQ. Airtel’s India wireless revenue is expected at Rs 16,111 crore, up 6.1% QoQ. For Vodafone Idea, we expect overall revenues to grow 4.6% QoQ at Rs 9835 crore.

Market update at 2 PM: Sensex is down 725.67 points or 1.20% at 59497.48, and the Nifty fell 205.80 points or 1.15% at 17719.50.

Alembic Pharma gets USFDA nod for Entacapone Tablet

Alembic Pharmaceuticals has received final approval from the US Food & Drug Administration (USFDA) for its Abbreviated New Drug Application (ANDA) for Entacapone Tablets USP, 200 mg.

The approved ANDA is therapeutically equivalent to the reference listed drug product (RLD) Comtan Tablets, 200 mg, of Orion Corporation. Entacapone Tablets are indicated as an adjunct to levodopa and carbidopa to treat end-of-dose “wearing-off” in patients with Parkinson’s disease.

Alembic Pharmaceuticals was quoting at Rs 819.05, up Rs 2.85, or 0.35 percent.

Kotak Mahindra Mutual Fund launches Midcap 50 ETF Scheme

Kotak Mahindra Asset Management Company announced the launch of an Exchange Traded Fund – Kotak Midcap 50 ETF – an open ended scheme that will track the Nifty Midcap 50 Index.

The new fund offering (NFO) is benchmarked against the Nifty Midcap 50 Index (TRI), which captures the movement of the mid-cap segment of the market.

The Kotak Midcap 50 ETF will replicate the Nifty Midcap 50 Index, which includes the top 50 companies based on full market capitalisation from Nifty Midcap 150 Index with preference given to those stocks on which derivative contracts are available on the National Stock Exchange. In case 50 midcap stocks do not have derivatives contract available on them then it could have less than 50 stocks in the index.