Moneycontrol launches Analysts’ Call Tracker. A monthly special page that tells you which way analysts are leaning; the stock they are most bullish or bearish on, what they are upgrading or downgrades, and where they are betting against the market. Ignore this at your own risk!

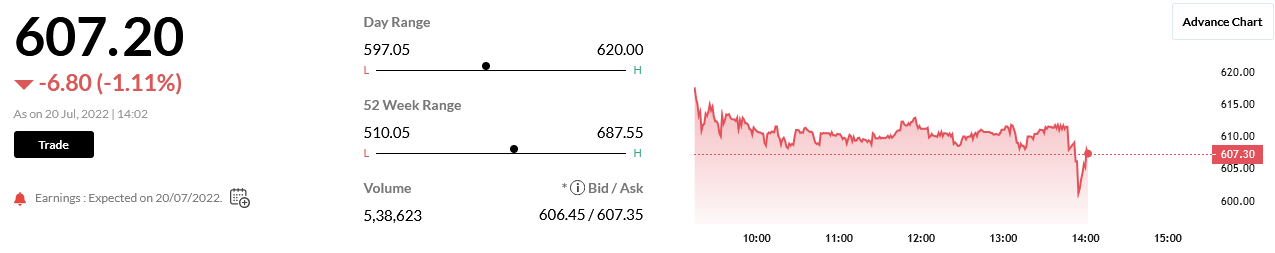

#1QWithCNBCTV18 | Century Plyboards reports Q1 earnings.

▶️Cons net profit at ₹92.3 cr vs ₹31.4 cr (YoY)

▶️Cons revenue up 94.3% at ₹889 cr vs ₹457.5 cr (YoY)

▶️Cons EBITDA at ₹143.1 cr vs ₹60.2 cr (YoY)

▶️EBITDA margin at 16.1% vs 13.2% (YoY) pic.twitter.com/Z9phbKb7SZ

— CNBC-TV18 (@CNBCTV18Live) July 20, 2022

Tapan Patel, Senior Analyst (Commodities), HDFC Securities

Crude Oil prices traded lower with benchmark NYMEX WTI crude oil prices fell by more than 1% to 99.33 per barrel on Wednesday. Crude oil prices declined, pressured by global central bank efforts to tame inflation and ahead of expected builds in U.S. crude inventories as product demand weakens. Crude oil prices whipsawed in the previous session, caught in a tug-of-war between supply fears due to Western sanctions on Russia and pressures on indications from central bankers that they will raise interest rates to combat inflation. We expect crude oil prices to trade sideways to down with resistance at $102 per barrel with support at $96 per barrel. MCX Crude oil July contract has important support at Rs. 7810 and resistance at Rs. 8070 per barrel.

Anuj Choudhary – Research Analyst at Sharekhan by BNP Paribas:

Indian rupee traded on a flat note today. rupee opened in the green on weak dollar and surge in domestic equity markets. However, concerns over twin deficits capped sharp gains. Dollar fell on decline in safe haven appeal amid positive global risk sentiments and weak housing data from US. US housing starts declined by 2% to 1.559 million in June from 1.591 million in May.

We expect rupee to trade with a negative bias as rising current account deficit and trade deficit may put pressure on rupee. Dollar may also strengthen again on expectations of an aggressive rate hike by Fed later this month. Traders may also take cues from existing home sales data from US later today which is expected to remain weak. USD-INR spot price is expected to trade in a range of Rs 79.20 to Rs 80.80 in next couple of sessions.

Century Plyboards Q1: Consolidated net profit at Rs 92.3 crore against Rs 31.4 crore (YoY). Consolidated revenue jumped 94.3% at Rs 889 crore against Rs 457.5 crore (YoY). EBITDA at Rs 143.1 crore against Rs 60.2 crore (YoY). Margin at 16.1% against 13.2% (YoY).

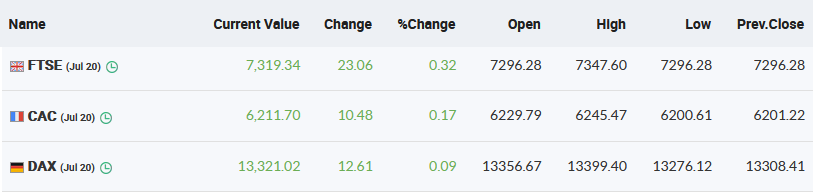

European Markets Updates

Russia likely to restart gas exports from Nord Stream 1 on schedule: Russian sources

Russian gas flows via the Nord Stream 1 pipeline are likely to restart on time on Thursday after the completion of scheduled maintenance but at lower than its full capacity, two Russian sources familiar with the export plans told Reuters.

The pipeline, which accounts for more than a third of Russian natural gas exports to the European Union, was halted for ten days of annual maintenance on July 11.

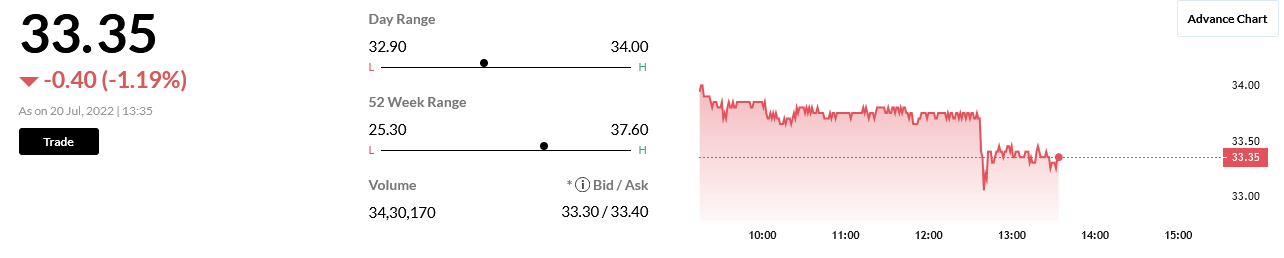

Syngene International Q1: Consolidated net profit went down 4.4% at Rs 73.9 crore against Rs 77.3 crore (YoY). Consolidated revenue was up 8.4% at Rs 644.5 crore against Rs 594.5 crore (YoY). Consolidated EBITDA rose 4.7% at Rs 172.8 crore against Rs 165 crore (YoY). Margin at 26.8% against 27.7% (YoY).

Market update at 2 PM: Sensex is up 779.90 points or 1.42% at 55547.52, and the Nifty jumped 221.80 points or 1.36% at 16562.30.

Naveen Kulkarni, Chief Investment Officer, Axis Securities

The Indian markets opened higher on positive global cues, with overnight US markets up more than 2% on the back of strong corporate earnings. Weakness in the dollar index is also helping generate a risk-on environment. Domestically, the move by the Indian government to reduce tax on windfall gains for Oil and Gas companies is helping heavyweights like RIL and ONGC to outperform. We believe that there is a definite reduction in market volatility in the last couple of weeks, but one needs to be wary of risk emanating from Europe, especially with issues relating to the resumption of gas supplies to Europe from Russia and the corresponding effect on growth rates if the gas supply is not restored. We advise investors to gradually increase allocation to equity, especially since FII selling pressure has significantly ebbed in recent times. Some sectors we like are Banks, Auto, and Capital Goods.

NHPC signs MoU with Damoder Valley Corporation to explore formation of JV for hydropower:

#OnCNBCTV18 | Operating return on embedded value is in line with company’s target. Merger with Exide Life was consummated in terms of share issue on January 1. The merger involved a cash component of ₹700 crore, says Vibha Padalkar of @HDFCLIFE pic.twitter.com/9ZUiHtmiQV

— CNBC-TV18 (@CNBCTV18Live) July 20, 2022