Buzzing Stocks: Wipro, Maruti Suzuki India, IDFC First Bank and other stocks in news today

Market at 10 AMBenchmark indices continues to trade flat with negative bias.The Sensex was down 91.55 points or 0.16% at 55857.55, and the Nifty was down 12.10 points or 0.07% at 16624.80. About 1441 shares have advanced, 1124 shares declined, and 105 shares are unchanged.

Anil Kumar Bhansali, Head of Treasury, Finrex Treasury Advisors:

All is quiet before the major event of Jackson Hole Symposium. Rupee to open 74.20 and remain in a range of 74 to 74.40. Expecting Powell to be neutral keeping the markets in good humor. Meanwhile, equities are down all over Asia, while Asian currencies are slightly weak.

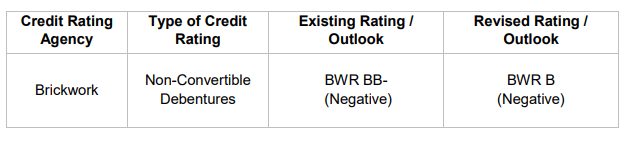

Brickwork Ratings downgrades rating of Vodafone Idea:

Buzzing:

SpiceJet share price surged over 4 percent on August 27 after DGCA has lifted the ban on Boeing 737 MAX aircraft.

The Directorate General of Civil Aviation (DGCA) has lifted the ban on Boeing 737 MAX aircraft, over two years after it was grounded, as per a statement issued by the aviation sector regulator on August 26.

The rescission of ban “enables operation of Boeing company model 737-8 and Boeing company model 737-9 airplanes only upon satisfaction of applicable requirements for return to service”, the DGCA order stated.

SpiceJet has 13 Boeing Max aircraft in its fleet.

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

Markets appear tantalizingly poised with the possibility of a swing in September. This can be on the downside if the trigger comes from a hawkish Fed speak from the Jackson Hole symposium. Covid cases rising, though slowly, too can turn out to be a dampener. The elephant in the room is the sustained FII selling which touched Rs 1974 crore in the cash market yesterday. It would be difficult for retail and DIIs to absorb the selling from FIIs, which might aggravate if the message from the Fed chief tonight is hawkish. Risk-reward appear to be not on the side of bulls.

The Nifty is held up by sector rotation. In recent days FMCG has emerged as a pillar of support to Nifty with HUL, Nestle, Britannia and Tata Consumer emerging strong. While this sector rotation is keeping the Nifty strong, the pain in the broader market continues with mid-and small-caps bleeding this month. This removal of froth is desirable and will make the broader market healthy.

It would be good to lighten positions ahead of the Fed message. Investors may remain invested in large-cap IT which is the strongest pillar of this market, the top names in FMCG, high-quality financials, pharma, chemicals and construction-related segments. Extreme care should be exercised in committing additional money at this stage in this richly valued market.

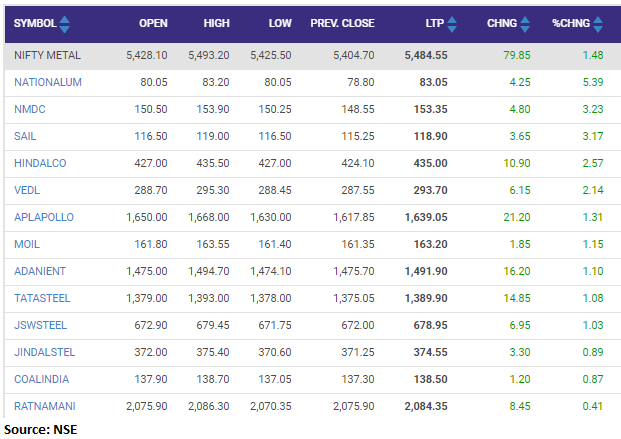

Nifty Metal index added over 1 percent supported by the NALCO, NMDC, SAIL:

MEIL hands over second oil rig to ONGC:

Infrastructure company MEIL said it has delivered the second oil rig to ONGC, and another 21 rigs will be supplied to the state-owned firm by 2022.

The delivery is a part of the Rs 6,000 crore order Megha Engineering and Infrastructures Ltd (MEIL) had won from ONGC for the supply of 47 rigs. MIEL is the first private company in India to manufacture oil and gas extraction rigs with indigenous technology, a company statement said.

Oil and Natural Gas Corporation was quoting at Rs 116.05, up Rs 0.60, or 0.52 percent on the BSE.

Ami Organics IPO price band fixed at Rs 603-610:

Specialty chemicals firm Ami Organics on August 27 fixed the price band for its initial public offering at Rs 603-610 per equity share. The offer will open for subscription on September 1.

The IPO consists of a fresh issue of Rs 200 crore and an offer for sale (OFS) of 60,59,600 equity shares by 20 shareholders including Kiranben Girishbhai Chovatia, Parul Chetankumar Vaghasia, Girishkumar Limbabhai Chovatia, and Aruna Jayantkumar Pandya.

The company plans to raise Rs 569.63 crore at the higher end of the price band. The minimum bid lot size is 24 equity shares and in multiples of 24 equity shares.

Retail investors can subscribe for a minimum of Rs 14,640 worth of shares in a single lot, and the maximum investment would be Rs 1,90,320 for 13 lots.

Gainers and Losers on the BSE Sensex:

Market Opens: Benchmark indices started the September F&O series on the flat note on August 27 amid mixed global cues.

At 09:16 IST, the Sensex was down 32.95 points or 0.06% at 55916.15, and the Nifty was down 6.80 points or 0.04% at 16630.10. About 1042 shares have advanced, 526 shares declined, and 73 shares are unchanged.

Trade Spotlight: What Should Investors Do With JSW Energy, UTI AMC & Balaji Amines?

JSW Energy rose nearly 5%, Balaji Amines rose more than 8% and UTI AMC closed with gains of over 2% to hit a fresh 52-week high on Thursday. Here’s what Shrikant Chouhan of Kotak Securities suggests…