Follow our LIVE blog for the latest updates on the new Omicron variant of COVID-19 and its impact

Gaurav Garg, Head of Research, Capitalvia Global Research:

The Indian Benchmarks made a cautious start, owing to mixed global cues and an increase in Corona virus infections around the world. Traders may focus on data that the country’s export shipments are expected to exceed USD 400 billion this fiscal year, according to reports.

Textile industry stocks will be in focus as The Union Minister said the government is making efforts towards gaining access to new markets and getting concessional duties on textile products through free- trade agreements.

Some respite may come in the market as Foreign Institutional Investors (FIIs) net bought shares worth Rs 1,273,86 crore, while domestic institutional investors (DIIs) net purchase shares worth Rs 532.97 crore in the Indian equity market.

Our research suggests that sustaining above the level of 17600-17700 is important levels to stay positive in the market. If the market sustained the level of 17600-17700, we can expect it to trade till the level of 18000. If market unable to sustain the levels of 17600-17700, it may trade till the lower range of 17300-17500.

Buzzing:

Macrotech Developers’ UK projects clocked record sales of £191 million (Rs 1,900 crore) in the quarter (Q3FY22). “We believe that MDL’s investment in the UK will be significantly repatriated back to India in FY 23,” Macrotech Developers said in a release.

In the previous quarter (Q2FY22), Grosvenor Square, London (GSQ) development had £110 million (Rs 1,100 crore) of pre-sales following the relaxation of restriction on international travel.

Macrotech Developers was quoting at Rs 1,263.45, up Rs 29.85, or 2.42 percent.

Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments:

17800-17950 is a resistance patch for the Nifty. One should not add fresh positions here, in fact traders holding long positions on the index can lighten up a bit and buy lower if there is a dip or intraday correction.

If we get past this zone, the next target for the Nifty would be 18200.

Market at 10 AMBenchmark indices were trading higher in the volatile session with Nifty holding above 17800.The Sensex was up 116.59 points or 0.19% at 59972.52, and the Nifty was up 32.70 points or 0.18% at 17838. About 1550 shares have advanced, 1358 shares declined, and 81 shares are unchanged.

BSE Bankex index rose 1 percent led by the AU Small Finance Bank, ICICI Bank, HDFC Bank

Crude Updates:

Oil prices fell on Wednesday as rising fuel stockpiles in the United States raised concerns of declining demand in the world’s biggest oil consumer amid a massive spike in COVID-19 cases caused by the Omicron variant.

U.S. gasoline stockpiles rose by 7.1 million barrels in the week to December 31, the American Petroleum Institute (API) reported late on Tuesday. Distillate stockpiles climbed by 4.4 million barrels in the week.

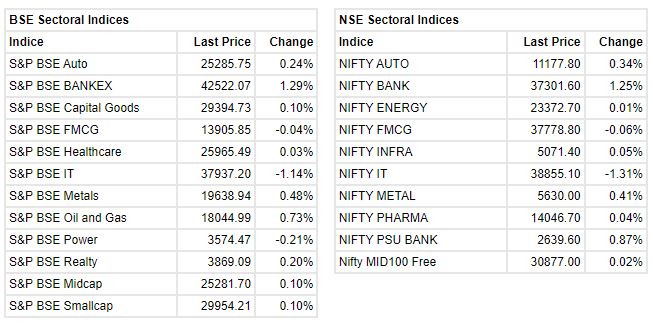

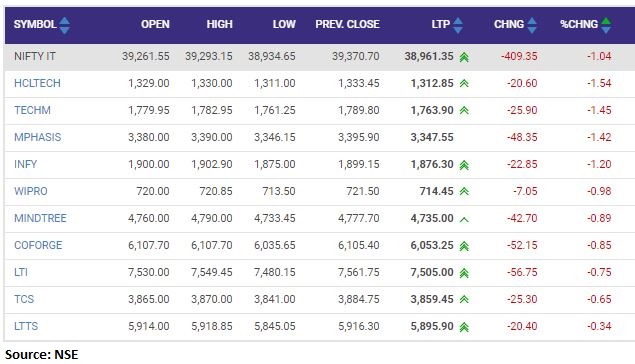

Nifty IT index fell 1 percent dragged by the HCL Technologies, Tech Mahindra, Mphasis

Bharti Airtel enters in JV with Hughes

Hughes Communications India Pvt Ltd, (HCIPL) and Bharti Airtel announced the formation of a joint venture to provide satellite broadband services in India.

The agreement, announced in May 2019, has received all statutory approvals, including those from the National Company Law Tribunal (NCLT) and Department of Telecom (Government of India) and the joint venture has been formed.

Bharti Airtel was quoting at Rs 694.60, down Rs 2.60, or 0.37 percent on the BSE.

Gainers and Losers on the BSE Sensex in the early trade:

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

The Dow setting a new all time new high when the number of daily Omicron cases crossed 1 million in the US might appear as a paradox, but, this is a clear message from the market that the fast spreading less virulent variant of the virus marks the beginning of the end of the pandemic. Also, most countries are not imposing fresh restrictions impacting economic activity.

In India there are clear trends from the market: FIIs are back as buyers having bought for 3 days consecutively and the buy amount is rising (Rs 1274 crore yesterday). This will be fodder for the bulls.

More importantly, news on bank credit growth is promising. So, bulls tightening their grip on banking stocks and bears running for cover may lead to smart rebound in leading banks, particularly private sector banks in which FIIs were large sellers.

Market Opens: Indian indices opened on flat note on January 5 amid mixed global cues.

The Sensex was down 24.28 points or 0.04% at 59831.65, and the Nifty was down 7.00 points or 0.04% at 17798.30. About 1374 shares have advanced, 843 shares declined, and 96 shares are unchanged.

Bajaj Finance, Dr Reddy’s Labs, Maruti Suzuki, M&M and Axis Bank were among major gainers on the Nifty, while losers were HCL Technologies, Infosys, TCS, Tech Mahindra and Wipro.