Shrikant chouhan, Head of Equity Research (Retail), Kotak Securities

Markets were extremely range-bound with a negative bias with most of the Asian indices too closing on a sluggish note. Investors are keeping a low profile ahead of RBI’s credit policy meeting this week, while lack of fresh triggers from global markets too have been a dampener.

Another factor could be the recent rally was too fast paced and hence nobody wants to risk taking long only bets.

Technically, after the early morning selloff the Nifty took support near 18,600 and reversed sharply. However, the short term texture of the market is still non directional.

We are of the view that 18,600 could act as a sacrosanct support zone for the market. If the index trades above the same it could retest 18,800-18,850 in the near future. On the flip side, below 18,600, the index could slip till 18,500-18,450.

Rupee Close:

Indian rupee closed 48 paise lower at 81.79 per dollar on Monday against Friday’s close of 81.31.

Market Close: Indian benchmark indices ended on flat note in the volatile session on December 5.

At Close, the Sensex was down 33.90 points or 0.05% at 62,834.60, and the Nifty up 4.90 points or 0.03% at 18,701. About 2080 shares have advanced, 1401 shares declined, and 191 shares are unchanged.

Apollo Hospitals, Tata Motors, Reliance Industries, Tech Mahindra and SBI Life Insurance were among the top Nifty losers. The gainers were Hindalco Industries, Tata Steel, UPL, ONGC and Coal India.

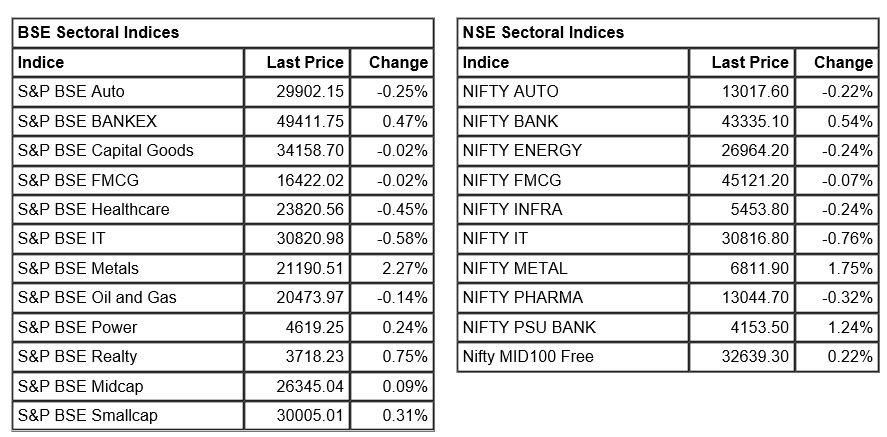

Among sectors selling was seen in the auto, IT, pharma, while buying is seen in the PSU bank, realty, and metal stocks.

The BSE midcap and smallcap indices ended on flat note.

Morgan Stanley ‘Overweight’ rating on ICICI Bank, target Rs 1,250 per share

-Overweight call, target Rs 1,250 per share

-Showcased various digital assets where they have made further progress

-Will drive better productivity/cross-sell & higher customer retention

ICICI Bank was quoting at Rs 933.60, up Rs 2.80, or 0.30 percent on the BSE.

BSE realty index rose 0.8 percent led by the Sobha, Mactotech Developers, Indiabulls Real Estate

Rahul Chander, MD & CEO of LivFin (Fintech NBFC):

Since inflation continues to slowly ease off across the world, interest rate hikes have also started to ease off. We are now hopefully in the last possible 75-100 bps hike of the cycle. The MPC will have to keep in mind the impact of rate increases on GDP growth, the expectation for which for FY2023 has moderated sharply.

While part of this could be attributed to unforeseen events like the Russia- Ukraine conflict which has played havoc with the commodity markets, the previous rate hikes have also partially contributed to the falling GDP growth.

The INR exchange rate vis-à-vis the USD especially has also been a matter of concern, though the trend seems to have been reversed over the last few weeks. However, with the MPC meeting in December coming a few weeks before the next US Fed meeting, the MPC will have its task cut out, as a significant increase in US Fed rate will have its bearing on the exchange rate.

Hence a delicate balance is now needed in determining additional rate increases. The US Fed eased off the interest rate hike from about 75 bps to 50 bps and has indicated a further reduction. Similarly, the Reserve Bank of India is also expected to ease it off from a 50 bps hike to 25-35 basis points (possibly towards the lower end of that band).

ALERT | UK November Services PMI at 48.8 versus estimates of 48.8

Market at 3 PMBenchmark indices were trading flat with negative bias with Nifty around 18,700.The Sensex was down 63.17 points or 0.10% at 62805.33, and the Nifty was down 3.30 points or 0.02% at 18692.80. About 1958 shares have advanced, 1362 shares declined, and 161 shares are unchanged.

CLSA maintains Buy on Mahindra & Mahindra Financial Services, target Rs 260

-Buy call, target Rs 260 per share

-Disbursement traction remained healthy & collections were strong

-Stage-2 assets declined whereas stage-3 was largely stable

-Management expects both to improve in December due to seasonality

-Company has made many on-ground changes & is witnessing impact of that in its numbers

-Only negative surprises that could come in forthcoming results are NIMs or Opex

Mahindra & Mahindra Financial Services was quoting at Rs 241.75, up Rs 12.75, or 5.57 percent and touched 52-week high of Rs 243.60.

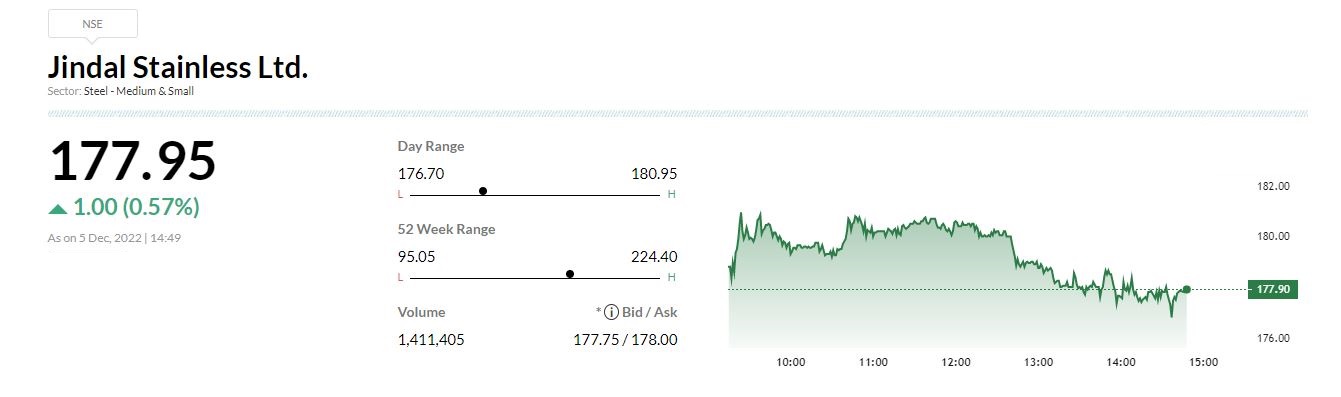

Jindal Stainless signs contract with ReNew PowerJindal Stainless today signed a contract with the country’s largest renewable energy company, ReNew Power, to develop a utility scale captive renewable energy project for the supply of power to its facility in Jajpur, Odisha.

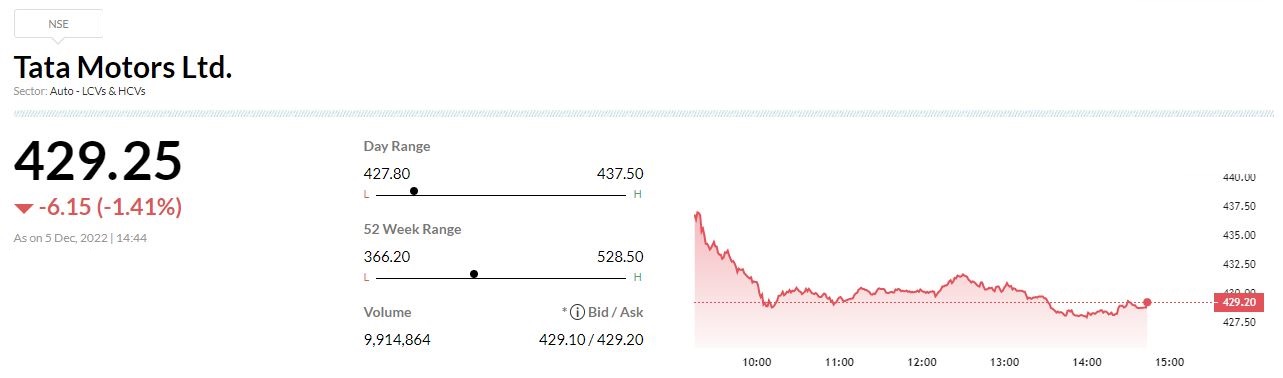

November Auto Sales | Tata Motors JLR UK sales up 2.6% at 4,204 units versus 4,097 units, YoY and up 15.2% MoM