Follow our LIVE blog for the latest updates on the novel coronavirus pandemic and its impact

Stocks in the news | Satin Creditcare, Vedanta, Majesco, Bharti Airtel, APL Apollo, Urja Global, Indian Overseas Bank, Bharat Forge

Gainers and Losers on the BSE Sensex:

Market Opens: Indian indices opened higher on February 23 with Nifty above 14,700 amid mixed global cues.

At 09:16 IST, the Sensex was up 225.67 points or 0.45% at 49,969.99, and the Nifty was up 68.30 points or 0.47% at 14,744. About 1032 shares have advanced, 265 shares declined, and 53 shares are unchanged.

ICICI direct

Indian markets are likely to see a positive opening on the back of optimism over earnings and economic recovery despite weak global cues. However, global news flows and sector specific developments will be key monitorables. US markets ended mixed tracking losses in tech stocks and increase in treasury yields.

Trade Spotlight: What Should Investors Do With Happiest Minds, Vedanta & Hindalco?

Stocks like Happiest Minds which hit a fresh 52-week high rose by nearly 4 percent, Vedanta rose nearly 7 percent, and Hindalco closed with gains of over 2 percent in an overall weak market on Monday.

Market at pre-open: Benchmark indices are trading firm in the pre-opening session with Nifty above 14,700.

At 09:02 hrs IST, the Sensex was up 100.69 points or 0.20% at 49,845.01, and the Nifty was up 45.50 points or 0.31% at 14,721.20.

Heranba Industries IPO Opens For Subscription Today: Should You Subscribe?

Heranba Industries has reported strong 13.3 percent and 44.4 percent revenue and PAT CAGR respectively from FY18 to FY20.

Siddhartha Khemka, Head – Retail Research, Motilal Oswal Financial Services:

Going ahead the market may continue with its profit booking for some time till the concerns over rising bond yields and inflation recedes. Even spike in virus cases is worrying the market. Further Nifty valuations at ~21x FY22 EPS are not inexpensive anymore and demand consistent earnings delivery ahead. Rising bond yields may cap equity valuations as the RBI may have to do a balancing act to keep bond yields at lower levels while managing the government borrowing program. Thus the market would track rising inflation, increasing covid cases along with prospective US stimulus in the near term for further direction.

Further, investors will also keep an eye on Federal Reserve Chair Jerome Powell’s testimony to Congress this week, especially after the real rates on long bonds rose above zero for the first time since June.

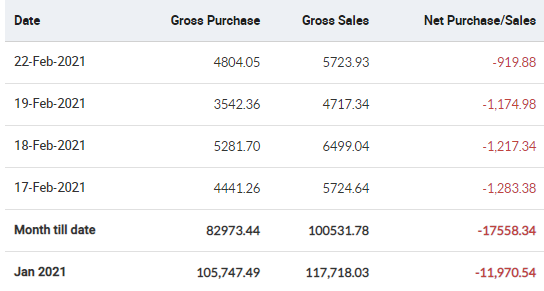

DII Trading Activity

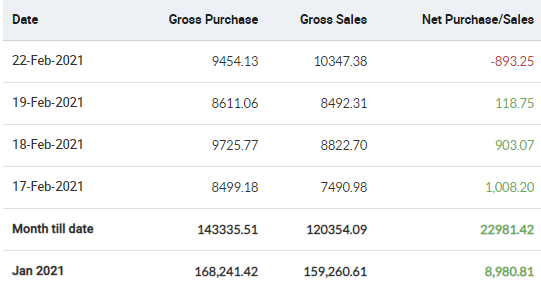

FII Trading Activity

Heranba Industries raises Rs 187.5 crore from anchor investors ahead of IPO

Crop protection chemical manufacturer Heranba Industries on February 22 garnered Rs 187.50 crore from 18 anchor investors ahead of its intial public offering (IPO). The company in consultation with merchant bankers finalised allocation of 29,90,520 equity shares to anchor investors at Rs 627 per share, the higher end of price band.