Market at 11 PMBenchmark indices were trading near the day’s high level with Nifty inching towards 18000.The Sensex was up 244.50 points or 0.41% at 60273.56, and the Nifty was up 79.40 points or 0.44% at 17968.40. About 1721 shares have advanced, 1114 shares declined, and 121 shares are unchanged.

SJS Enterprises IPO subscribed 53% on final day of bidding

The initial public offering (IPO) of SJS Enterprises has been subscribed 53 percent on the final day of bidding, with investors putting bids for 56.25 lakh equity shares against the IPO size of 1.05 crore equity shares.

Retail investors portion has been subscribed by 1.04 times, while the portion set aside for non-institutional investors subscribed 6 percent.

However, qualified institutional buyers were yet to be bid for.

Broking house Hem Securities has put a subscribe rating on the issue.

Sigachi Industries IPO subscribed 25.28 times

The initial public offering (IPO) of the chemical-maker Sigachi Industries had been subscribed 25.28 times on November 3, the final day of bidding.

Investors have put in bids for 13.61 crore equity shares against the IPO size of 53.86 lakh equity shares.

Retail investors had bought 42.18 times the shares set aside for them.

The portion reserved for non-institutional investors has been subscribed 18.46 times, while Qualified Institutional Buyers (QIBs) had bid for 82 percent of their lot.

Sameet Chavan, Chief Analyst-Technical and Derivatives, Angel One:

For the coming session, we expect the range bound move to continue where 17950 – 18000 are likely to act as immediate hurdles and on the lower side, 17800 – 17700 are to be seen as key supports.

Traders are advised not to trade aggressively in index and in case of a recovery towards the mentioned resistance zone of 18000 – 18100, one should lighten up existing longs.

Also all eyes would be on Bank Nifty, because if Nifty has to reclaim these levels, it needs to continue its upwards trajectory with some intent. One needs to focus on individual stocks; but needs to be very selective because only few counters are likely to do well in such kind of lethargic mood.

Policybazaar IPO oversubscribed by 1.62 times on final day

The initial public offering (IPO) of PB Fintech that owns Policybazaar and Paisabazaar, has seen good demand from investors as it received bids for 5.58 crore equity shares against offer size of 3.45 crore equity shares, which resulted into a subscription of 1.62 times on November 3, the final day of bidding.

The qualified institutional investors, for whom the 75 percent of the offer is reserved, have put in bids 2.08 times the portion set aside for them. Non-institutional investors have bought 27 percent shares of their total reserved portion.

Retail investors’ response to the offer remained strong as their reserved portion was subscribed 2.18 times.

CLSA on Dabur India

Broking house CLSA has kept outperform call on the stock with a target at Rs 700. It has cut FY23 earnings by 3 percent to reflect higher tax guidance & near-term margin pressure.

The raw material inflation is intensified and thrust on sustaining operating margin.

Dabur India was quoting at Rs 610.10, up Rs 11.80, or 1.97 percent on the BSE.

India October PMI Data

India October Services PMI (purchasing managers’ index) stood at 58.4 versus 55.2, MoM, highest in last 10 years.

The October Composite PMI was at 58.7 versus 55.3, MoM.

Rupee Opens:

Indian rupee opened 12 paise higher at 74.56 per dollar on Wednesday against previous close of 74.68.

US dollar rose 0.28% as the US Federal Reserve started its two day policy meeting, where investors expect the central bank to announce tapering. However, sharp upside was capped on a rise in risk appetite in the global markets, said ICICI Direct.

Rupee future maturing on November 26 appreciated by 0.28% in yesterday’s trading session tracking weakness in the dollar and FII inflows. However, sharp gains were prevented on steady crude oil prices and muted domestic markets.

Gold Prices Today: Yellow Metal Likely To Remain Range-bound Ahead Of Fed Meet

Gold prices inched lower on November 3 as investors awaited the result of a US Federal Reserve policy meeting to assess how the central bank plans to combat rising inflation and ease worries about economic recovery. On the Multi-Commodity Exchange (MCX), the gold contracts were down 0.19 percent at Rs 47,533 for 10 grams at 9.32 am. Silver futures were marginally down 0.2 percent at Rs 63,208 a kilogram.

Gaurav Garg, Head of Research, Capitalvia Global Research:

The Indian Benchmarks started today on a positive note amid mixed global cues and ongoing earnings season. Investors remained cautious ahead of the Bank of England and Federal Reserve meetings. Traders will be taking encouragement as Niti Ayog Vice-Chairman said Indian economy is expected to grow by more than 10 percent in the current fiscal and 8 percent plus in the next fiscal year.

Sentiments will get a boost as Minister of State for Electronics and IT said India has an unprecedented opportunity to grow electronics manufacturing to USD 300 billion in the next 3-4 years.

Some support will come with a private report stating that hiring expanded by 43 percent Y-0-Y in October driven by strong demand for technology professionals.

Our research suggests that markets will make cautious movement and 17500 and 18200 may act as immediate support and resistance respectively. We can expect the market to trade in the range of 17500-18200. Technical indicators also support positivity in the market.

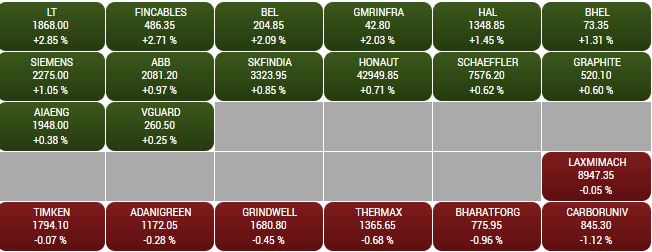

BSE Capital Goods index rose 1 percent supported by the L&T, Finolex Cables, Bharat Electronics

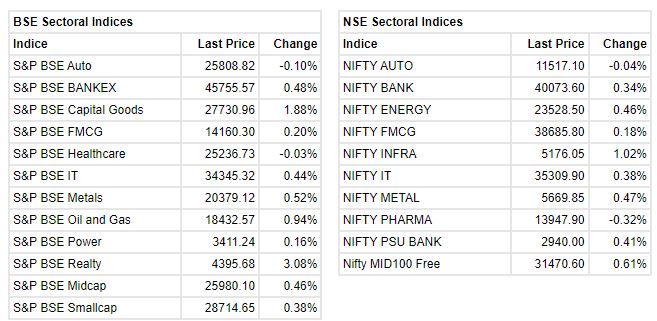

Market at 10 AMBenchmark indices were holding on the opening gains with Nifty trading around 18000 level.The Sensex was up 268.43 points or 0.45% at 60297.49, and the Nifty was up 82.50 points or 0.46% at 17971.50. About 1767 shares have advanced, 914 shares declined, and 116 shares are unchanged.